Summary:

Many economists argue that the key challenge is that of insufficient aggregate demand. That is why world growth is slow. Hobbled with debt, households have pulled back. Business investment is weak. Government dissavings has been offset by household and business savings. The solution offered by some economists is a large public investment program. The G20 encouraged members not to rely on monetary policy, which even some central bankers are concerned, has reached a point of diminishing returns. China has already indicated intentions on providing some fiscal stimulus. Japan, whose debt to GDP is the largest in the world, also sees scope for more spending. A supplemental budget for the current fiscal year has been approved, and there is talk, in the face of weak growth impulses, that the Abe government is considering another supplemental spending program. It would be front-loaded at the start of the new fiscal year (April 1). Japan's budget deficit is around 6% of GDP. We wonder if the problem is being misdiagnosed. To be sure, consumer demand is soft. Earlier today, Japan reported overall household spending contracted 3.3% in the 12-months through January. It is the fifth year-over-year contraction, and this is ahead of the planned sales tax hike in April 2017. The eurozone will report retail sales Thursday. Sales are expected to have slowed to a 1.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, Great Graphic, newsletter

This could be interesting, too:

Many economists argue that the key challenge is that of insufficient aggregate demand. That is why world growth is slow. Hobbled with debt, households have pulled back. Business investment is weak. Government dissavings has been offset by household and business savings. The solution offered by some economists is a large public investment program. The G20 encouraged members not to rely on monetary policy, which even some central bankers are concerned, has reached a point of diminishing returns. China has already indicated intentions on providing some fiscal stimulus. Japan, whose debt to GDP is the largest in the world, also sees scope for more spending. A supplemental budget for the current fiscal year has been approved, and there is talk, in the face of weak growth impulses, that the Abe government is considering another supplemental spending program. It would be front-loaded at the start of the new fiscal year (April 1). Japan's budget deficit is around 6% of GDP. We wonder if the problem is being misdiagnosed. To be sure, consumer demand is soft. Earlier today, Japan reported overall household spending contracted 3.3% in the 12-months through January. It is the fifth year-over-year contraction, and this is ahead of the planned sales tax hike in April 2017. The eurozone will report retail sales Thursday. Sales are expected to have slowed to a 1.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, Great Graphic, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Many economists argue that the key challenge is that of insufficient aggregate demand. That is why world growth is slow. Hobbled with debt, households have pulled back. Business investment is weak. Government dissavings has been offset by household and business savings. The solution offered by some economists is a large public investment program.

The G20 encouraged members not to rely on monetary policy, which even some central bankers are concerned, has reached a point of diminishing returns. China has already indicated intentions on providing some fiscal stimulus.

Japan, whose debt to GDP is the largest in the world, also sees scope for more spending. A supplemental budget for the current fiscal year has been approved, and there is talk, in the face of weak growth impulses, that the Abe government is considering another supplemental spending program. It would be front-loaded at the start of the new fiscal year (April 1). Japan's budget deficit is around 6% of GDP.

We wonder if the problem is being misdiagnosed. To be sure, consumer demand is soft. Earlier today, Japan reported overall household spending contracted 3.3% in the 12-months through January. It is the fifth year-over-year contraction, and this is ahead of the planned sales tax hike in April 2017. The eurozone will report retail sales Thursday. Sales are expected to have slowed to a 1.3% year-over-year rate. That would be the lowest since November 2014. It would be the fourth month that the year-over-year pace has slowed. This appears to be the longest declining streak since the aggregate data began in 2001.

While weak demand is part of the problem, excess investment seems to be more intractable. Business investment is weak because there is still excess capacity in many, if not most, sectors. Summers has argued that new businesses are less capital intensive than older industries, but capex in the older industries is poor too.

The bankruptcy of GM and Chrysler was partly a way to reduce the excess capacity in the US-based auto sector. Horizontal acquisitions also remove excess capacity. Bankruptcies may do the same, but not always. For example, the failure of some energy producers may see the assets move to stronger, better-capitalized hands.

Despite the various sectors in the US, Europe and Japan suffering from excess capacity, the focus is on China. The investment thrust not only racked up large corporate (and local government) debt, but it also led to significant excess capacity. This excess capacity is one of the sources of downward pressure on producer prices, which have been falling since early 2012.

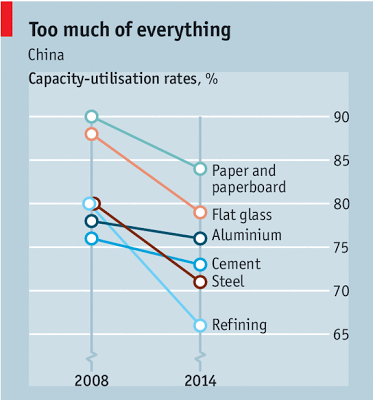

This Great Graphic from the Economist shows the capacity utilization rates of several industries. Those industries that China has excess capacity become vulnerable globally. Take steel as an example. China's spare capacity alone outstrips US, German, and Japanese annual steel output. This is not just slow growth, but the world can produce more steel than it can consume. Lower capacity usage is linked to lower profit margins. An industry group cited by the Economist found that steel capacity rose by 57% in the decade through 2014. China alone accounted for more than 90% of the added capacity.

There is a lag between the time a decision is made to build a plant and the time the factory comes online. That means that some of the investment decisions that were made 3-5 years ago are only now coming to fruition. This warns that peak capacity may not have been reached in some sectors, even though China's State Council recognizes excess capacity as a "national priority." This year, several large aluminum smelters are expected to be completed that will boost capacity by 10%.

How China deals with its excess capacity will help shape the investment climate going forward. A depreciation of the yuan fuels fears that China will reduce its surplus by exporting it. Some fear this is one of the reasons China wants to be regarded as a market economy for WTO purposes. It would make it harder for China's trading partners to impose anti-dumping duties. Even without a sharp depreciation of the yuan, trade frictions with China appear to be growing.

China may try to boost domestic demand, but it is unlikely to be sufficient to absorb the scale of excesses. Chinese officials are also committed to closing down some capacity, but this runs into conflict with other policy goals.

Of course, demand can increase, but it is unlikely to be sufficient to absorb the excess capacity. The scale of the challenge does not appear to be fully appreciated by those who propose a public investment push. Building new highways and bridges, for example, will absorb some of the slack, but what happens when the projects are over?

The excess capacity is not so much in consumer goods but producer goods. Fashion and built-in obsolescence can help conceal excess capacity in consumer goods. And think about all those things that businesses do to keep the ecosystem of their products growing, like different USB connections.

The underlying challenge is that market economies produce wealth in mind-boggling proportions. The power relationships have led to a greater share of productivity gains are being captured by profits rather than wages. Profits under conditions of excess capacity do not foster investment, and the track record of cutting corporate taxes does not show it spurs investment. Numerous industries, not just in China, suffer from redundant investment. The record levels of cash on corporate balance sheets is funneled back into the capital markets, often with numerous intermediaries gaining leverage along the way.

Even if labor got a larger share of productivity gains, it is unlikely to absorb the huge excess capacity in various capital goods sectors. In recent expansions cycles US, consumption was fueled by debt rather than income. During the current cycle, revolving credit has grown slowly as have home equity loans. Higher income might not change consumption very much but would change how it is financed.