Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!” “Yes, but housing is the collateral.” OK, so it’s not a...

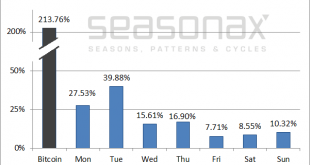

Read More »A Gain of 1,080 percent Annualized – One of the Strongest Seasonal Rallies is Starting Right Now

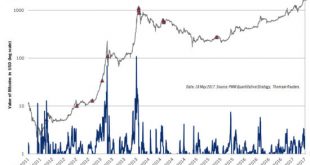

Bitcoin – An Exceptional Asset When I first heard about Bitcoin (BTC) in May 2011, it was trading at 8 US dollars. Today, more than eight years later, BTC trades at around 8,000 dollars. A thousandfold increase! An investment of 1,000 dollars at the time would have resulted in a gain of more than a million – a dream result. However, even an exceptional asset such as Bitcoin has its ups and downs – inter alia in terms of its seasonal patterns. And an exceptional...

Read More »Bitcoin: What is the Best Day of the Week to Buy?

Shifting Patterns In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week. It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the...

Read More »Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges. This 60 minute chart of Bitcoin shows (represented by the yellow candlestick wicks) how the...

Read More »Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

Looking for Opportunities The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for...

Read More »Crying Wolf – Precious Metals Supply and Demand

Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents last week. Perspective: if you are waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the market price of gold is at a 7.2% discount to the fundamental price vs. 4.6% last week). If you wanted to sell, this wasn’t a good week to wait. Which is your...

Read More »Cryptocurrency Technicals – Navigating the Bear Market

A Purely Technical Market Long time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money. The process of achieving more widespread...

Read More »Claudio Grass on Cryptocurrencies and Gold – An X22 Report Interview

The Global Community is Unhappy With the Monetary System, Change is Coming Our friend Claudio Grass of Precious Metal Advisory Switzerland was recently interviewed by the X22 Report on cryptocurrencies and gold. He offers interesting perspectives on cryptocurrencies, bringing them into context with Hayek’s idea of the denationalization of money. The connection is that they have originated in the market and exist in a...

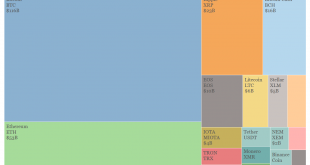

Read More »Incrementum’s New Cryptocurrency Research Report

Another Highly Useful Report As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link). BTC Hourly, 16 - 23 March 2018(see more...

Read More »Crypto-currencies in a bubble

Crypto-currencies like Bitcoin and Ripple are caught in a “bubble regime”, oscillating between extreme peaks and troughs. A new peak is close….Pictet’s inhouse quantitative analysis can provide ways of spotting certain kinds of bubble and predicting when they will burst (see article ‘Forecasting Financial Extremes’).One aspect of this analysis is focused on investor herding behaviour, as measured by the combination of super-exponential cycles and ever faster oscillations around those cycles....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org