Interview with Patrick Barron – Part II of II Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about? Patrick Barron (PB): Banks are financial intermediaries. They take deposits and make loans. That has been going on for millennia. What we...

Read More »Dollar Bid as Markets Steady Ahead of ECB Decision

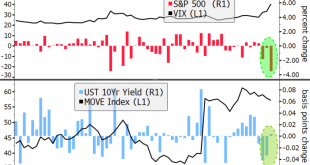

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported BOC delivered a dovish hold yesterday; Canada Finance Minister Freeland defended the government’s aggressive fiscal stimulus plans; Brazil left rates unchanged, as expected ECB is expected to deliver a...

Read More »No, the American Republic Was Not Founded on Slavery

The fact that some Americans supported slavery in the eighteenth century is not at all remarkable. Most of the world agreed with them. What is remarkable is that many of them sought to abolish slavery in the new republic. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “No, the American Republic Was Not Founded on Slavery“. You Might Also Like...

Read More »FX Daily, October 30: Investors Scared Before Halloween

Swiss Franc The Euro has risen by 0.07% to 1.0691 EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean...

Read More »What About China? Keith Weiner Returns, Dr Yu, Jeff Deist on Election Day

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »2020-10-30 – Swiss Financial Accounts: quarterly data published for first time

The Swiss National Bank is expanding its data offering with respect to Switzerland’s financial accounts. It will now publish quarterly as well as annual data, and the time to publication will be shortened from ten to four months. Today the SNB is releasing quarterly data for the period from Q4 2014 to Q2 2020. Annual data are available for the period 1999 to 2013. The data can be accessed in the form of charts and configurable tables on the SNB’s data portal...

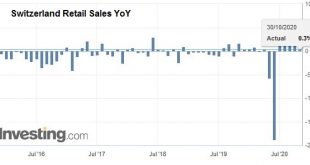

Read More »Swiss Retail Sales, September 2020: 0.3 percent Nominal and 0.3 percent Real

30.10.2020 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.3% in nominal terms in September 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 3.6% compared with the previous month. These are some of the findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.3% in September 2020 compared with the previous year. Real growth...

Read More »ALICE Doesn’t Work Here Anymore

What the political class and the Financial Nobility don’t yet grasp is that ALICE will never go back to her insecure, low-wage job, ever. Meet ALICE: Asset Limited, Income Constrained, Employed, at least she was employed until the pandemic presented impossible choices between taking care of her children and their education, and her aging parents, and keeping her demanding, low-wage job. Though it doesn’t fit in with the cute mythology of “capitalism” that...

Read More »Swiss select ex-central banker for OECD top post

Hildebrand Keystone/Peter Klaunzer The Swiss government has nominated Philipp Hildebrand, a former head of the country’s central bank, to lead the Organisation for Economic Co-operation and Development (OECD). “His experience in the highest levels of the private and public sectors, both in Switzerland and internationally, make him the ideal candidate for this prestigious position,” Economics Minister Guy Parmelin told a news conference on Wednesday. “This candidacy...

Read More »No, the American Republic Was Not Founded on Slavery

Journalistic propaganda is a powerful instrument of indoctrination. Without evidence, foul ideas can easily penetrate mainstream discourse. For instance, recently it has become fashionable to posit that slavery is America’s original sin. To sensible people, this is a risible claim, because there is nothing particularly American about slavery. But revisiting the history of slavery in non-Western societies in Asia and Africa would do little to change the minds of...

Read More » SNB & CHF

SNB & CHF