The pandemic has created major challenges at ports delivering goods around the world. Copyright 2021 The Associated Press. All Rights Reserved Swiss economic experts expect a significant economic slowdown as supply chain bottlenecks, inflation and pandemic restrictions persist in many parts of the world. On Thursday, the State Secretariat for Economic Affairs (SECO) announcedExternal link that the economic expert group has lowered the growth forecast for Switzerland...

Read More »Natural and Neutral Rates of Interest in Theory and Policy Formulation

Interest has a title role in many pre-Keynesian writings as it does in Keynes’s own General Theory of Employment, Interest, and Money (1936). Eugen Böhm-Bawerk’s Capital and Interest (1889), Knut Wicksell’s Interest and Prices (1898), and Gustav Cassel’s The Nature and Necessity of Interest (1903) readily come to mind. The essays in F.A. Hayek’s Profits, Interest, and Investment (1939), which both predate and postdate Keynes’s book, focus on the critical role that...

Read More »Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS). The recently completed Project Jura explored settling foreign exchange (FX) transactions in euro and Swiss franc wholesale CBDCs as well as issuing, transferring and redeeming...

Read More »A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million. It wasn’t a record high, though, as that was set back in July. Yes, the number remains upward in the stratosphere, but it has been in the same general area of it...

Read More »Is Jeff Snider Wrong? Update

Emergence of the Eurodollar System | The Snider Series | Episode 2 (WiM088)

Jeff Snider joins me for a multi-episode conversation exploring the evolution of money and central banking throughout the 20th and 21st centuries. Be sure to check out NYDIG, one of the most important companies in Bitcoin: https://nydig.com/ GUEST Jeff's twitter: https://twitter.com/JeffSnider_AIP Jeff's writing: https://alhambrapartners.com/author/jsnider/ PODCAST Podcast Website: https://whatismoneypodcast.com/ Apple Podcast:...

Read More »Jeff Snider on why yield curves are not showing any monetary inflation in US or Europe

Paul Buitink talks with Jeff Snider of Alhambra Investments about the financial system. They first address what the eurodollar system is, and how it works in practice. Then they talk about the bond market and yield curves and what they tell us about what markets think about the future and inflation. Paul and Jeff also talk about the impact central banks have or have not on bond prices. Jeff thinks they have little impact and points to research. This applies to both the Fed and the ECB....

Read More »“Digitales Notenbankgeld – und nun? (CBDC—What Next?),” FuW, 2021

Finanz und Wirtschaft, December 8, 2021. PDF. I draw some conclusions from the CEPR eBook on CBDC, namely: Banks will change, whatever happens to CBDC. The main risk of retail CBDC is not bank disintermediation. CBDC may not be the best option even if it has net benefits. It should be for parliaments and voters, not central banks, to decide about the introduction of CBDC. [embedded content] You Might Also Like...

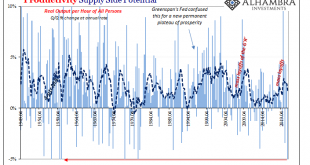

Read More »The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market. This topic deserves a much deeper dive than I am going to give it (for now). What...

Read More »Underwater archaeology reveals buried secrets of a Swiss lake

The prehistoric past of the city of Lucerne is still largely unknown. However, the lake that surrounds it could yet harbour some clues. Archaeologists have long suspected that pile dwelling settlements existed around the lake by the city, but it was only during construction work in March 2020 that remains of a settlement were dug up from the bottom for the first time. This autumn, in view of the possible construction of an underground railway station in Lucerne, the cantonal archaeology...

Read More » SNB & CHF

SNB & CHF