Market reforms in Africa can be thwarted because of propaganda asserting that markets are a Western import. Notwithstanding the currency of this belief, it is patently absurd. Markets flourished in Africa prior to colonialism, and wherever they are repressed, the result is social immiseration, as economist William Hutt points out in his pathbreaking study, The Economics of the Colour Bar. Merchants in precolonial Africa organized large-scale trading networks that...

Read More »Binance Review 2021: The best in Switzerland?

At Investing Hero, I aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Investing Hero is for informational purposes only. Please read the disclaimer. In this blog post I’m going to be reviewing the cryptocurrency trading platform,...

Read More »How Governments Seized Control of Money

In discussions surrounding of the world’s monetary systems today there is usually one thing almost everyone can agree on: that money should be controlled by the organizations we call “states” or “sovereign states.” Nowadays when we say “the US dollar” we mean the currency issued by the US government. When we say “the British pound” we mean the money issued by the regime of the United Kingdom. This assumed need to have state-issued money has not always been the...

Read More »Two Swiss cities remain in top 10 most expensive globally

© Giuseppe De Filippo | Dreamstime.com The latest Economist Intelligence Unit (EIU) survey of the prices of 200 goods and services in 173 cities placed both Geneva and Zurich in the top 10 most expensive cities in 2021. Overall, the cost of living across these 173 cities has risen by an average of 3.5%, the highest inflation seen in the last 5 years. This compares with inflation of just 1.9% in 2020 and 2.8% in 2019. Supply-chain problems, as well as exchange-rate...

Read More »U.S. Treasury Refuses to Answer Questions about Disposition of Its Own Gold

Recent correspondence between U.S. Rep. Alex X. Mooney, R-West Virginia, and the U.S. Treasury Department suggests that the department has given the Federal Reserve and International Monetary Fund unfettered control of a portion of U.S. gold reserves. In a letter to Treasury Secretary Janet Yellen on June 9 this year, Mooney posed many questions about the U.S. gold reserves, which are owned by the Treasury. A reply from the Treasury Department’s deputy assistant...

Read More »Swiss commodity traders control 2.7 million hectares of land worldwide

The preference is for “flex crops” like sugarcane that have multiple uses, as well as the potential for mechanisation of cultivation. Keystone / Andre Penner Research by investigative non-profit Public Eye has revealed that trading companies with a Swiss presence – or their subsidiaries – own over 550 plantations covering over 2.7 million hectares. These companies buy and sell commodities like sugar, soy and palm oil from trading offices in Geneva or Zug and include...

Read More »Jeff Snider: This Global Economic Indicator Is Signaling CODE RED!!

Jeff Snider on live to answer YOUR questions and discuss the recent inversion of the Eurodollar yield curve, one of the most powerful predictive tools in history. Check out the Rebel Capitalist Live event Jan 7th - 9th!! https://rebelcapitalistlive.com

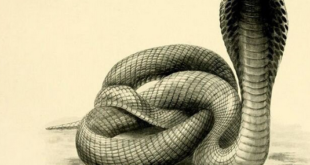

Read More »Government interventions and the Cobra effect – Part II

Part II of II Unsound money, unsound society Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime. Ever since the gold standard was officially...

Read More »Swiss banks implicated in trading cartel investigation

The EU Commissioner for competition policy, Margrethe Vestager. Keystone / Olivier Hoslet The European Commission has ended an investigation of five banks, including UBS and Credit Suisse, who colluded in a foreign exchange spot trading cartel. The total fines announced on Thursday came to €344 million (CHF359 million), with British bank HSBC taking the biggest hit of €174 million. UBS, Switzerland’s biggest bank, escaped a potential fine of €94 million since it...

Read More »Facebook erlaubt wieder Werbung für Cryptocoins

Die letzten zwei Jahre gab es immer wieder Kontroversen, wenn es um Werbung in den sozialen Medien für Cryptocoins ging. Unter anderem Facebook sorgte für ein Verbot von Crypto-Werbung auf seiner Plattform. Doch nun hat man sich offenbar dort umentschieden. Crypto News: Facebook erlaubt wieder Werbung für Cryptocoins Das Unternehmen hinter der Plattform Facebook hat sich erst kürzlich in „Meta“ umbenannt. Unter neuem Namen hat man nun seine vorherige Entscheidung...

Read More » SNB & CHF

SNB & CHF