Overview: Equity markets in Asia Pacific and Europe are weaker. The main exception in Asia Pacific was India, where the market rose by about 0.75%. Europe's Stoxx 600 is lower for the third consecutive session and is now down on the week. US futures are up around 0.3%-0.4%. The 10-year Treasury yield is hovering a little above 3%. European peripheral yields are softer ahead of the ECB meeting. New Zealand’s 10-year yield jumped eight basis points in response...

Read More »Are Today’s Homeownership Rates Sustainable?

There is scattered evidence that home prices are finally starting to slow down. But, if the phenomenon is system-wide, we’re still waiting to see the evidence in numbers. Last week, the most recent Case-Shiller national data, for example, showed that home prices in March rose an eye-popping 20 percent, year over year. That’s well in excess of what we saw during the height of the housing bubble leading up to the 2008 financial crisis. That makes nine months in a row...

Read More »There’s No Stopping a Recessionary Reckoning

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession. Severe, long-lasting recessions occur when multiple conditions arise at the same time. 1. The business cycle....

Read More »What If the U.S. Had Invaded Ukraine?

Let’s engage in a thought experiment. Suppose that Ukraine was headed by a pro-Russia regime. After repeated failed attempts at assassination by the CIA, the Pentagon finally decides to invade Ukraine for the purpose of bringing about regime change — i.e., ousting the pro-Russia regime from power and replacing it with a pro-U.S. regime. What then would be the response of American statists, especially those within the U.S. mainstream press? There is no doubt about...

Read More »The Greenback Bounces Back

Overview: After modest US equity gains yesterday, the weaker yen and Beijing’s approval of 60 new video games helped lift most of the large markets in the Asia Pacific region. South Korea and India were notable exceptions. Europe's Stoxx 600 is off for the second day as Monday's 0.9% advance continues to be pared. US futures are trading lower. The 10-year Treasury yield continues to hover around 3%, and European yields are up 3-5 bp today. The euro is little changed...

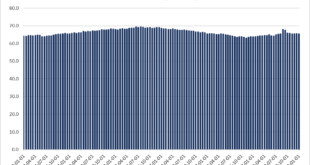

Read More »54.0 percent increase in overnight stays in the Swiss hotel sector during the 2021/2022 winter season

7.6.2022 – The Swiss hotel sector registered 14.6 million overnight stays during the winter tourist season (November 2021 to April 2022). Compared with the same period last year, overnight stays increased by 54.0% (+5.1 million overnight stays). With a total of 5.6 million overnight stays, foreign demand increased by 196.7% (+ 3.7 million). Domestic visitors registered an 18.9% increase (+1.4 million) with 9.0 million units. These are the provisional results from the...

Read More »The Fed, and No One Else, Is Responsible for Inflation

According to commentators in the mainstream press and various federal officials, inflation is like the coronavirus. It spreads around the world, hitting different countries in different ways. Sometimes a country will experience only mild symptoms and sometimes more severe symptoms, like what happens with Covid. Now that the inflation virus has hit America, the mainstream media, along with public officials, are coming up with all sorts of remedies to address the...

Read More »Let’s Boycott Them!

Tom Woods’ bestseller Meltdown placed the blame for the financial debacle of 2008–09 on the government’s counterfeiter, the Federal Reserve. It was the Fed’s policies that created the problems, although most economists and economic talking heads didn’t see it that way. The Fed’s loose monetary policies funded the meltdown and became the “elephant in the living room” most pundits couldn’t see. Woods was right, of course; putting a monopoly counterfeiter in charge of...

Read More »Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger. Social Security calculates cost-of-living increases based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from September to September each year. According to the Bureau of Labor Statistics, the CPI-W has increased 9.4% from March 2021 to March 2022. So,...

Read More »A Look at Switzerland’s Booming Digital Asset Ecosystem

In recent years, Switzerland’s blockchain and digital asset ecosystem has matured rapidly and grown into one of the world’s leading blockchain hubs, a position that’s asserted by its expanding workforce and a rising number of foreign companies setting up operations locally. A report by Home of Blockchain.swiss, a new public-private promotion initiative for the Swiss blockchain industry, looks at the state of the Swiss digital asset market, sharing findings from a...

Read More » SNB & CHF

SNB & CHF