After a meltdown in Asia, the global capital markets are stabilizing in Europe. The US S&P managed to recoup about half of its losses before the close yesterday, but this gave not comfort to Japanese investors. The yen's strength and ongoing concerns about banks' exposure to energy companies took the down 5.4% and pushed the 10-year JGB yield into negative territory for the first time. The Dow Jones Stoxx 600 is off 0.25% near midday in London. Telecoms and consumer staples are...

Read More »Europe Stabilizes After Asia Melts

After a meltdown in Asia, the global capital markets are stabilizing in Europe. The US S&P managed to recoup about half of its losses before the close yesterday, but this gave not comfort to Japanese investors. The yen's strength and ongoing concerns about banks' exposure to energy companies took the down 5.4% and pushed the 10-year JGB yield into negative territory for the first time. The Dow Jones Stoxx 600 is off 0.25% near midday in London. Telecoms and consumer staples are...

Read More »They Broke the Silver Fix (Part I)

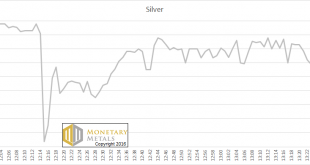

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action. The Price of Silver, Jan 28 (All times GMT) If you read more about it, you will see that there was an irregularity around the silver fix. At the time, the spot price was around $14.40. The fix was set at $13.58. This is a major deviation. Many silver bugs are up in arms about how unfair the new silver fix is. That’s nothing new. They were up in arms about the old one. The...

Read More »They Broke the Silver Fix (Part I)

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action. The Price of Silver, Jan 28 (All times GMT) If you read more about it, you will see that there was an irregularity around the silver fix. At the time, the spot price was around $14.40. The fix was set at $13.58. This is a major deviation. Many silver bugs are up in arms about how unfair the new silver fix is. That’s nothing new. They were up in arms about the old one. The...

Read More »Bizarro World of Negative Interest Rates and Central Banks Pushing for Wage Increases

In many ways, the world has turned upside down. It is not just central banks that have set policy rates below zero, but the entire German curve out through eight years have negative yields. Japan, which has the largest debt burden relative to GDP, has negative yields out through nine years. The Swiss curve is negative through 15 years. It is not just core countries either. Ireland, which holds national elections in a couple of weeks, has negative yields out four years. Spain,...

Read More »Bizarro World of Negative Interest Rates and Central Banks Pushing for Wage Increases

In many ways, the world has turned upside down. It is not just central banks that have set policy rates below zero, but the entire German curve out through eight years have negative yields. Japan, which has the largest debt burden relative to GDP, has negative yields out through nine years. The Swiss curve is negative through 15 years. It is not just core countries either. Ireland, which holds national elections in a couple of weeks, has negative yields out four years. Spain,...

Read More »Germany–A Hegemonic Challenge for the Heartland

(co-authored with Matt Dabrowski) The great British geographer Halford Mackinder invented the term “geopolitics” over 100 years ago. He painted a grand vision of international relations that revolved around one fear: dominance of what he called the “Heartland” of Eurasia. Mackinder believed the road to dominance ran through Eastern Europe. His ideas have remained influential ever since, for as long as the West has concerned itself about the impact of Eurasia on world affairs. For...

Read More »Germany–A Hegemonic Challenge for the Heartland

(co-authored with Matt Dabrowski) The great British geographer Halford Mackinder invented the term “geopolitics” over 100 years ago. He painted a grand vision of international relations that revolved around one fear: dominance of what he called the “Heartland” of Eurasia. Mackinder believed the road to dominance ran through Eastern Europe. His ideas have remained influential ever since, for as long as the West has concerned itself about the impact of Eurasia on world affairs. For...

Read More »Emerging Markets: Preview of the Week Ahead

EM assets for the most part fared well last week, and positive sentiment should carry over into this week. China reported January foreign reserves over the weekend, and they fell less than expected to $3.231 bln. China markets are closed this week for the New Year holiday. While there should be little risk of negative headlines from the mainland, markets should watch how CNH trades in the offshore markets that are open. Oil prices should also be regarded as an important factor behind...

Read More »Emerging Markets: Preview of the Week Ahead

EM assets for the most part fared well last week, and positive sentiment should carry over into this week. China reported January foreign reserves over the weekend, and they fell less than expected to $3.231 bln. China markets are closed this week for the New Year holiday. While there should be little risk of negative headlines from the mainland, markets should watch how CNH trades in the offshore markets that are open. Oil prices should also be regarded as an important factor behind...

Read More » SNB & CHF

SNB & CHF