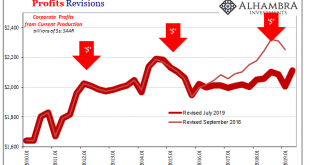

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%. The release also gave us the first look at second quarter corporate profits. Like the headline GDP revisions, there wasn’t really much to them. At least not when viewed in isolation....

Read More »Swiss Research Leads to Cancer Break Through

Researchers at the Paul Scherrer Institute recently deciphered the structure of the CC chemokine receptor 7 (CCR7), a signaling protein. © Bogdan Hoda | Dreamstime.com Cancer cells use CCR7 to guide themselves into the lymphatic system, spreading cancer throughout the body. The resulting secondary tumors, called metastases, are responsible for most cancer deaths. This new understanding of CCR7 is a break through that forms a foundation for developing drugs that could...

Read More »Dear Trump Advisors: Prop the Market Up Now and Lose in 2020, or Let the Market Crash and Win in 2020

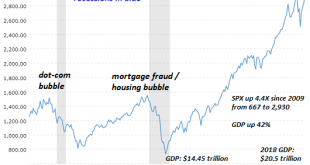

The Everything Bubble has topped out, and trying to push it higher for the next 14 months is a sure way to increase the damage next year. One of the more reliable truisms is that Americans vote their pocketbook: if their wallets are being thinned (by recession, stock market declines, high inflation/stagnant wages, etc.), they throw the incumbent out, even if they loved him the previous year when their wallets were getting fatter. (Think Bush I, who maintained high...

Read More »Hold on to your cash, the real financial crisis is yet to come- Bill Bonner

Bill Bonner Interview: hold on to your cash, the real financial crisis is yet to come.

Read More »Hold on to your cash, the real financial crisis is yet to come- Bill Bonner

Bill Bonner Interview: hold on to your cash, the real financial crisis is yet to come.

Read More »FX Daily, August 30: US Dollar Finishing August on Firm Note as Euro nears Two-Year Lows

Swiss Franc The Euro has fallen by 0.03% to 1.0903 EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China’s retaliatory tariffs. A lull between...

Read More »Monthly Macro Monitor: Market Indicators Review

This is a companion piece to last week’s Monthly Macro report found here. The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic. That to me, is evidence that this move is overly...

Read More »Swiss Trade with Much of South America should Soon be Tarif Free

A deal agreed between EFTA and the South American Mercosur bloc, which includes Argentina, Brazil, Uruguay and Paraguay, with a combined population of 260 million, is close to signing. © Tomas Griger | Dreamstime.com EFTA includes Iceland, Liechtenstein, Norway, and Switzerland. Under the deal, 95% of Switzerland’s CHF 3.6 million annual exports to the bloc would be tarif free. The deal is important because the EU recently agreed a similar Mercosur deal, so this deal...

Read More »USD/CHF Technical Analysis: 0.9890/95 to challenge buyers

USD/CHF takes the bids near 38.2% Fibonacci retracement of April-August downpour. 200-day EMA, four-month-old falling trend-line acts as key upside resistance. Despite breaking 50-day exponential moving average (EMA), USD/CHF remains below key resistance confluence as it takes rounds to 0.9880 during Friday’s Asian session. The pair needs to provide a daily closing beyond 0.9890/95 region including 100-day EMA and four-month-old descending trend-line in order...

Read More »The Fantasy of Central Bank “Growth” Is Finally Imploding

Having destroyed discipline, central banks have no way out of the corner they’ve painted us into. It was such a wonderful fantasy: just give a handful of bankers, financiers and corporations trillions of dollars at near-zero rates of interest, and this flood of credit and cash into the apex of the wealth-power pyramid would magically generate a new round of investments in productivity-improving infrastructure and equipment, which would trickle down to the masses in...

Read More » SNB & CHF

SNB & CHF