A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19. In brief, Stan Chart argue the franc is not strong in real terms adjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spot no need for SNB to intervene to try to weaken it therefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near term EUR/CHF...

Read More »Dollar (In) Demand

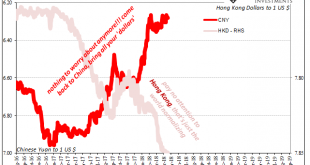

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness. That’s why in early 2016 authorities...

Read More »FX Daily, September 11: Dollar is Firm as ECB is Awaited

Swiss Franc The Euro has fallen by 0.31% to 1.092 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas...

Read More »Negativzinsen – Resultat des chaotischen SNB-Konzepts

Nach der Freigabe der Wechselkurse zu Beginn der 1970er Jahre bestand das geldpolitische Konzept der SNB in sogenannten „Geldmengenzielen“. Es wurde für das kommende Jahr ein Geldmengenziel angestrebt in der Meinung, so die Inflation unter Kontrolle zu halten. Trotzdem: Die Inflation hüpfte damals aufgrund der Angebotsschocks nach Belieben rauf und runter und die SNB schaute konsterniert zu. Trotzig hielt sie aber an ihrem Konzept fest, obwohl dieses auch...

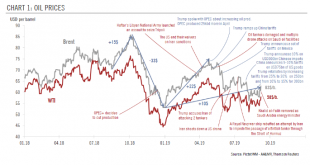

Read More »Oil prices and the global economy

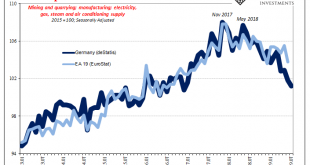

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in...

Read More »A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so. Bureaucratic inertia means a lot more than just resistance to change, it also means, at times and in certain capacities, all sorts of biases. When the bureaucracy predicts one set of circumstance,...

Read More »EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank – a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed. Nevertheless, the price action is all the counts from a technical analysis perspective. EUR/CHF has...

Read More »The Era Of Central Banks Pushing The Economy Forward Is Ending w/ Charles Hugh Smith

Thanks for watching this Silver Doctors Interview. Share your thoughts below and make sure to click the subscribe button to join the Silver Doctors Community. Today's guest, Charles Hugh Smith, shares his thoughts on how capitalism as we have know it is being challenge. During our discussion he shares his thoughts on how monetary policy makes it hard for citizens to save and invest because there's now a problem with then earning little to no interest. Visit SD Bullion to buy gold and...

Read More »The Era Of Central Banks Pushing The Economy Forward Is Ending w/ Charles Hugh Smith

Thanks for watching this Silver Doctors Interview. Share your thoughts below and make sure to click the subscribe button to join the Silver Doctors Community. Today's guest, Charles Hugh Smith, shares his thoughts on how capitalism as we have know it is being challenge. During our discussion he shares his thoughts on how monetary policy makes it hard for citizens to save and invest because there's now a problem with then earning little to no interest. Visit SD Bullion to buy gold and...

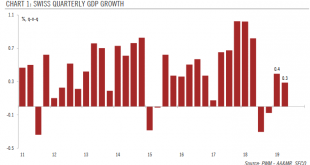

Read More »Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical...

Read More » SNB & CHF

SNB & CHF