USD/CHF pulls back from a multi-day high, stays above 200-bar SMA. Trend-positive RSI increases the odds of upside. Despite bouncing off 200-bar simple moving average (SMA), USD/CHF fails to cross near-term key resistances as it trades around 0.9915 while heading into the European session open on Thursday. With this, the quote can witness pullback to 38.2% Fibonacci retracement of August-September upside, at 0.9880, ahead of highlighting the key 200-bar SMA level of...

Read More »The SNB Is a Passive Clearing House Rather Than an Active Currency Manipulator

This post is a long excursion to make two simple points: The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate. A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a. Observing SNB behaviour over time, it looks to me that what the media call “currency interventions” by the SNB...

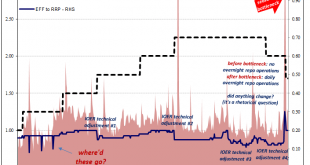

Read More »Money Markets: Sizing Up the Cavalry

There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press. Or is it? In my own conversations...

Read More »ALERT?U.S. Economy Recession Inevitable On October 3, 2019!! (Charles Hugh Smith)

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse #dollar collapse 2019"

Read More »Dollar Firm as Risk-Off Impulses Return

Markets have moved into risk-off mode from a confluence of events emanating from the US Speaker of the House Pelosi formally launched a formal impeachment inquiry; DOJ inserted itself into Trump’s fight with New York state Trump’s speech to the UN General Assembly yesterday was noteworthy for its belligerence RBNZ and BOT kept rates steady, as expected; Czech is expected to follow suit The dollar is broadly firmer against the majors as risk-off impulses return to...

Read More »ALERT?U.S. Economy Recession Inevitable On October 3, 2019!! (Charles Hugh Smith)

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse #dollar collapse 2019"

Read More »FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Swiss Franc The Euro has fallen by 0.13% to 1.0842 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump’s speech at the...

Read More »Financial Storm Clouds Gather

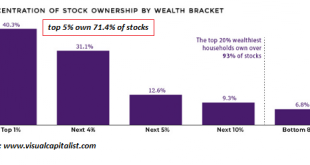

The price of this “solution”–the undermining of the financial system–will eventually be paid in full. The financial storm clouds are gathering, and no, I’m not talking about impeachment or the Fed and repo troubles–I’m talking about much more serious structural issues, issues that cannot possibly be fixed within the existing financial system. Yes, I’m talking about the cost structure of our society: earned income has stagnated while costs have soared, and households...

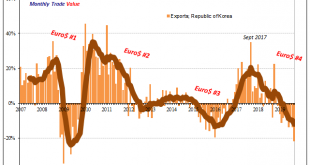

Read More »Waiting on the Calvary

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction. While the dispute with Japan hasn’t helped, it isn’t responsible for the level...

Read More »No rise is health premiums expected in 10 Swiss cantons in 2020

© Ginasanders | Dreamstime.com Every year, Switzerland’s Federal Office of Public Health (FOPH) gives projections of compulsory health insurance premiums for the coming year. After years of rising premiums, many will be relieved by the small projected increases for 2020. Across all of Switzerland, the average premium is expected to rise 0.2% to CHF 315.40 a month. On average, adults will pay CHF 374.40 (+0.3%), young adults (19-25) CHF 265.30 (-2.0%) and children CHF...

Read More » SNB & CHF

SNB & CHF