USD/CHF stays positive above 200-day SMA, 50% Fibonacci retracement. A sustained run-up beyond 61.8% Fibonacci retracement can aim for late-May highs. Despite successfully trading above key support confluence, the USD/CHF pair fails to provide a daily closing above 61.8% Fibonacci retracement of April-August downpour. The quote takes the bids to 0.9975 while heading into the European open on Thursday. Given the bullish signals from 12-bar moving average convergence...

Read More »Credit Suisse braced for ‘spygate’ reputational fallout

Credit Suisse chairman Urs Rohner announces the findings of the bank’s investigation into the surveillance affair. The usually discrete world of Swiss private banking has been shaken by spying revelations at Credit Suisse, the country’s second largest wealth manager. Chairman Urs Rohner has acknowledged that the sordid affair has damaged the reputation of the bank and the Swiss financial centre. Despite Rohner’s profuse apologies, and the bank pinning the blame...

Read More »ISM Spoils The Bond Rout!!!

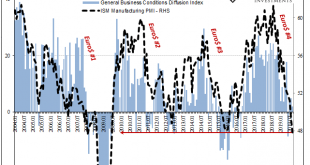

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out. Japan’s central bank says that it might refrain from buying JGB’s at the long end. This is upside down from when YCC was first attached to QQE...

Read More »Repo Quake – A Primer

Chaos in Overnight Funding Markets Most of our readers are probably aware that there were recently quite large spikes in repo rates. The events were inter alia chronicled at Zerohedge here and here. The issue is fairly complex, as there are many different drivers at play, but we will try to provide a brief explanation. There have been two spikes in the overnight general collateral rate – one at the end of 2018, which was a first warning shot, and the one of last...

Read More »SNBCHF has changed sending service

Dear readers, SNBCHF has changed sending service. If you are missing the daily newsletters, please look in your spam or quarantine program. Related posts: FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better Here’s How We Are Silenced by Big Tech USD/CHF technical analysis: Greenback jumps and settles above 0.9726...

Read More »FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Swiss Franc The Euro has risen by 0.66% to 1.0928 EUR/CHF and USD/CHF, October 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today’s activity. All the markets were...

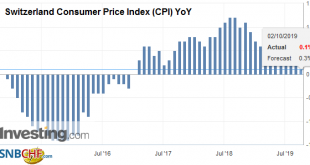

Read More »Swiss Consumer Price Index in September 2019: +0.1 percent YoY, -0.1 percent MoM

02.10.2019 – The consumer price index (CPI) fell by 0.1% in September 2019 compared with the previous month, reaching 102.0 points (December 2015 = 100). Inflation was +0.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.1% compared with the previous month can be explained by several factors including falling prices for foreign package holidays and petrol. The prices of airfares and...

Read More »Credit Suisse COO resigns over spying scandal

(bloomberg) Credit Suisse Group Chief Operating Officer Pierre-Olivier Boueeexternal link has resigned following a spying scandal that has rocked Switzerland’s financial circles and which the lender said caused severe reputational damage to the bank. Bouee, a long-time associate of Chief Executive Officer Tidjane Thiam, assumed responsibility for the surveillance of former Credit Suisse executive Iqbal Khan along with the bank’s head of security. The board of...

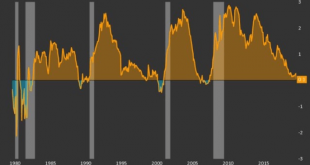

Read More »A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t worry about the...

Read More »Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid. RECENT DEVELOPMENTS The repo market provides an efficient, reliable, and predictable channel to raise short-term funding. It is but one part of a larger short-term funding...

Read More » SNB & CHF

SNB & CHF