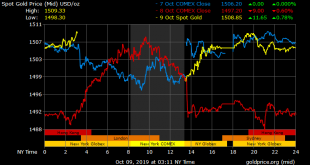

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious metal ◆ China and...

Read More »All-Stars #67 Jeff Snider: Reconciling extreme treasury demand with declining bid-to-cover ratios

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

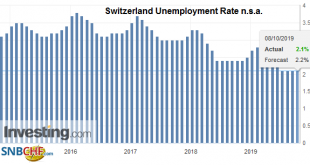

Read More »Switzerland Unemployment in September 2019: Unchanged at 2.1 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in September 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of September 2019, 99’098 unemployed people were enrolled in the Regional Employment Centers (RAV), 454 less than in the previous month. The unemployment rate remained at 2.1% in the month under review. Compared with the same month of the previous year, unemployment fell by 7,488 people...

Read More »FX Daily, October 8: Not a Good Day for Negotiators

Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned...

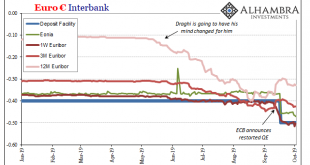

Read More »The Consequences Of ‘Transitory’

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement. Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered,...

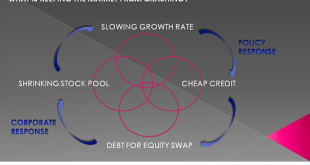

Read More »What’s Holding Up the Market?

The Fed’s nearly free money for financiers policies in support of the Super-Rich do not exist in a vacuum–the disastrous consequences are already baked in. What’s holding up the U.S. stock market? The facile answer is the Federal Reserve (“the Fed has our back,” “don’t fight the Fed,” etc.) but this doesn’t actually describe the mechanisms in play or the consequences of a market that levitates ever higher on the promise of more Fed money-for-nothing injected into...

Read More »Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

◆ Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. ◆ Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below) ◆ Gold buying in China has fallen 3.3 (yoy) to 523.54 metric tons as safe haven buying of gold bars and...

Read More »Switzerland shares details of 3.1 million bank accounts held by foreigners

Data held by around 7,500 Swiss financial institutions like banks, trusts, and insurers were used to compile the information. (© Keystone / Alessandro Della Valle) In its second-ever data sharing exercise as part of a global automatic exchange of information (AEOI) treaty, Switzerland shared financial account information with 63 partner countries. On Monday, the Swiss Federal Tax Authority revealed that it had provided details of around 3.1 million bank accounts held...

Read More »A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July. A Wealth Tax So how does a wealth tax work? The politicians quibble among themselves, as if the little implementation details that differ between them are...

Read More »FX Daily, October 7: Markets Unsettled to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0926 EUR/CHF and USD/CHF, October 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are uneasy as the risks that have dominated investors’ concerns–trade and Brexit–remain front and center today. Expectations are low that this week’s talks between the US and China will lead to a breakthrough or will be sufficient to postpone further the next...

Read More » SNB & CHF

SNB & CHF