I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it. You know the story. When he finally gave in at the end of July,...

Read More »Swiss are skilled but not so dynamic, finds ranking

The Swiss workforce and labour market get high marks in the index. (© Keystone / Gaetan Bally) Switzerland has slipped down a slot in the annual Global Competitiveness Index from the World Economic Forum (WEF)external link. Having come in fourth in 2018, Switzerland now follows Singapore, the United States, Hong Kong and the Netherlands. The index covers 141 countries. The world economy is not ready for a major slowdown, warns WEF. “Ten years on from the global...

Read More »Marc Chandler On The Currency Market

Marc Chandler On The Currency Market

Read More »Marc Chandler On The Currency Market

Marc Chandler On The Currency Market

Read More »FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Swiss Franc The Euro has risen by 0.35% to 1.0912 EUR/CHF and USD/CHF, October 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today’s activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was...

Read More »SNB to cut rates in early 2020 as global economy sours – UBS

In the latest note to the clients, the UBS Economist Alessandro Bee indicated that he sees the Swiss National Bank (SNB) cutting interest rates next year. Key Quotes: “Both the European Central Bank and the Federal Reserve to “react to recession risks” with more rate cuts. That should force the SNB to cut rates in the spring, which is why there shouldn’t be a stronger appreciation of the franc in the next twelve months.” Meanwhile, the KOF Swiss Economic...

Read More »Dollar Soft Despite Heightened Geopolitical Risks

The dollar staged a stunning comeback yesterday as risk-off took hold on rising geopolitical risk; those risks remain high US-China tensions have risen ahead of trade talks that begin Thursday The US abruptly announced that it would withdraw its troops from northeast Syria US reports September PPI; German IP came in better than expected UK Prime Minister Johnson told Chancellor Merkel that a deal is “essentially impossible” Chinese markets re-opened for trading...

Read More »Swiss firms give over CHF5 million a year to parties and candidates

Switzerland is the only country among the 47 members of the Council of Europe which does not have a law governing political party financing. (© Keystone / Gaetan Bally) Switzerland’s biggest firms – mainly banks, pharmaceutical firms and insurance companies – donate at least CHF5 million ($5 million) a year to political parties and candidates, a survey has revealed. The poll of 140 companies by Swiss public radio RTS, published on Tuesdayexternal link, found that one...

Read More »Switzerland’s top UN diplomat in New York

Mirjana Spoljaric was appointed Assistant Secretary-General and Assistant Administrator of the United Nations Development Programme (UNDP) in 2018. (Keystone) When Antonio Guterres was elected United Nations Secretary General in 2016, some criticized the decision because they thought a woman should finally be at the helm of the international organisation. To his credit, Guterres has filled many of the UN’s top posts with women including Mirjana Spoljaric –...

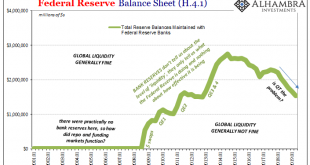

Read More »Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing. But who was falling for it? The stock market, sure. Investors on Wall Street are still betting as if it will work any day...

Read More » SNB & CHF

SNB & CHF