According to the June 1, 2022, Financial Times, Janet Yellen, the US Treasury secretary conceded she was wrong last year about the path inflation would take. Yellen told CNN: There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t fully understand, but we recognize that now. To be able to say something meaningful about inflation, it is necessary to establish what inflation is all about. Note that for Yellen inflation is about the growth rate in the consumer price index, which year on year stood at 8.3 percent in April against 4.2 percent in April the year before. The increase in the prices of goods and services is not inflation but rather the

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

According to the June 1, 2022, Financial Times, Janet Yellen, the US Treasury secretary conceded she was wrong last year about the path inflation would take. Yellen told CNN:

According to the June 1, 2022, Financial Times, Janet Yellen, the US Treasury secretary conceded she was wrong last year about the path inflation would take. Yellen told CNN:

There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t fully understand, but we recognize that now.

To be able to say something meaningful about inflation, it is necessary to establish what inflation is all about. Note that for Yellen inflation is about the growth rate in the consumer price index, which year on year stood at 8.3 percent in April against 4.2 percent in April the year before.

The increase in the prices of goods and services is not inflation but rather the symptoms or results of inflation. To establish the definition of inflation, then, we go back in time to see how it originated.

Defining Inflation

Embezzlement underlies inflation. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens.

Because of the reduced weight of coins that were returned to citizens, the ruler was able to generate extra coins that were employed to pay for his expenses. What was passing as a gold coin of a fixed weight was in fact a lighter gold coin. On this Murray N. Rothbard wrote:

More characteristically, the mint melted and re-coined all the coins of the realm, giving the subjects back the same number of “pounds” or “marks,” but of a lighter weight. The leftover ounces of gold or silver were pocketed by the King and used to pay his expenses.

This is an inflation of coins because of the increase in the coins not fully backed by gold. Alternatively, we can say that there is an increase in the medium of exchange out of “thin air” because the ruler made the gold coins lighter. The extra gold coins that the ruler was able to generate enabled him the channeling of goods from citizens to himself without any contribution to the production of goods, so the ruler is engaged here in an exchange of nothing for something.

This embezzlement was strengthened further when banks started to issue paper money unbacked by gold receipts. Instead of holding gold with themselves, individuals stored their gold possession with their banks for safety reasons, and to acknowledge this storage, the banks issued receipts.

Over time, these receipts became accepted as the medium of exchange. Problems would occur, however, once the banks started to issue receipts not backed by gold. The receipts unbacked by gold were now employed in the economy along with the fully backed by gold receipts.

This was the inflation of receipts i.e., the increase in the number of receipts because of the increase in the receipts out of “thin air.” The issuer of unbacked receipts could now engage in an exchange of nothing for something, diverting goods and services to himself without himself producing goods and services.

In the modern world, money, which consists of coin and notes, is no longer backed by gold. Hence, any increase in money supply is the increase in money out of “thin air.” Inflation itself is the increase in the supply of coin and notes, and as a result, the increase in the supply of money sets in motion the exchange of nothing for something.

We can thus infer that inflation is the increase in money supply out of “thin air” that sets into motion an exchange of nothing for something.

According to the above definition, inflation is not about general increases in the prices of goods and services as popular thinking maintains. What we are saying is that inflation is increases in the money supply not backed by gold, or money out of “thin air.” These increases in the supply of money allow for embezzlement which harms the wealth generators.

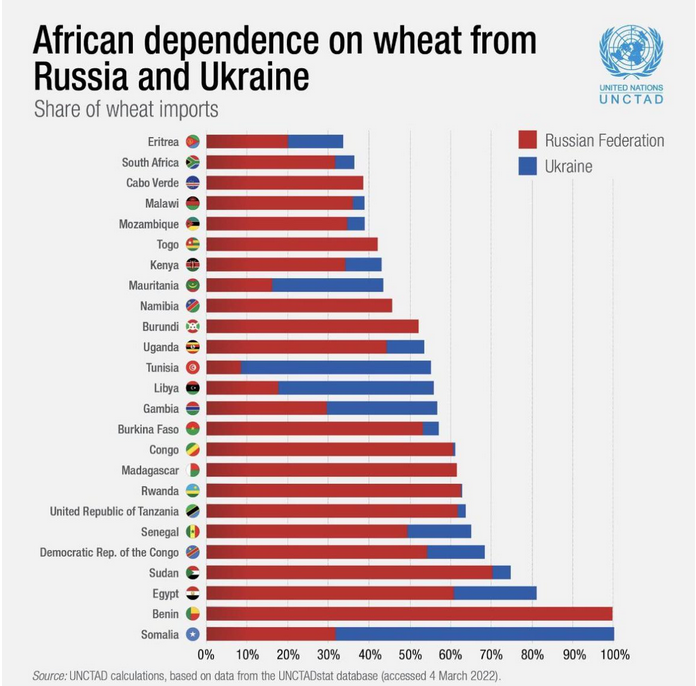

While various supply shocks such as the covid response and the Ukraine-Russia war may push the prices of some goods and services higher, they are not inflation. Hence, the US Treasury secretary by admitting that she underestimated the strength of inflation because she misjudged the strength of these shocks is running the risk of being wrong again because she regards inflation as increases in prices rather than increases in money supply out of “thin air.”

Money and Prices

We find it extraordinary that in attempting to explain movements in prices, commentators have nothing to say about the role of money in forming the prices of goods and services. After all a price of something is the amount of money paid per unit of something.

Note that both real and monetary factors determine prices. Consequently, it can occur that if the real factors are “pulling things” in an opposite direction to monetary factors, no visible change in prices is going to take place.

If the growth rate of money is 5 percent and the growth rate of goods supply is 1 percent, then prices are likely to increase by about 4 percent. If, however, the growth rate in goods supply is also 5 percent then no appreciable increase in prices is likely to take place.

If one were to hold that inflation is about increases in prices then one would conclude that, despite the increase in money supply by 5 percent, inflation is 0 percent. However, if we were to follow the definition that inflation is about increases in the money supply, then we would conclude that inflation is 5 percent, regardless of any movement in prices.

When money is injected, it enters a particular market, and once money enters the market, this means that more money is paid for the product in that market. Alternatively, we can say that the price of the good in this market has increased.

Once the price of a good increases to the level that is perceived as fully valued, money moves to another market which is considered to be undervalued. The shift of money from one market to another market implies that once money has risen, it will have an effect on average prices following a time lag.

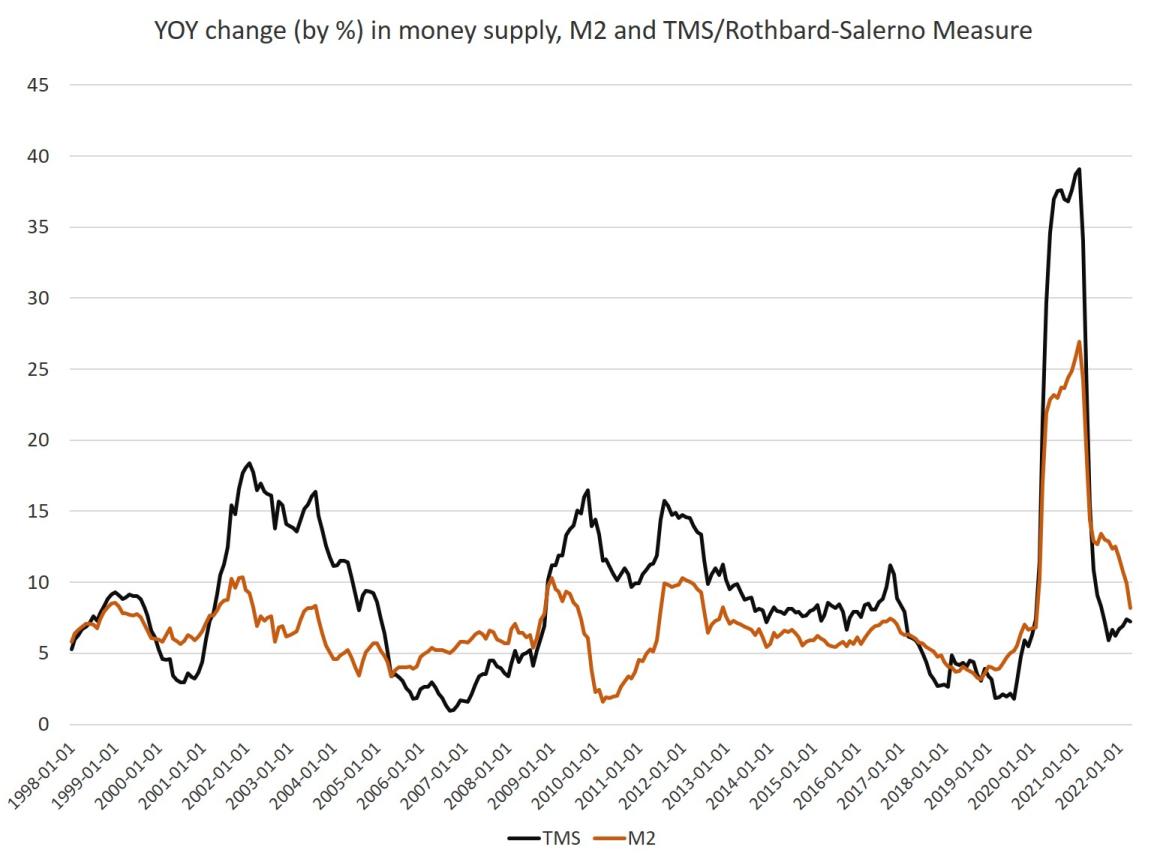

Because of past huge increases in money supply at the present time, the yearly growth rate of prices displays a visible strengthening. The yearly growth rate of our measure of adjusted money supply (AMS) climbed to 79.0 percent in February 2021 from 6.5 percent in February 2020.

Increasing Interest Rates Won’t Counter Inflation

A policy of raising interest rates to counter increases in prices comes from the view that higher interest rates will weaken the demand for goods and services. As a result, this sill lower the prices of certain goods and services.

This policy distorts market interest rates, making it more difficult for businesses to recognize signals issued to them by time preferences of consumers. This, in turn, results in the misallocation of resources and causes economic impoverishment.

Furthermore, a higher interest rate policy does not address inflation, itself. Consequently, because of a misleading definition of inflation, the central bank policy is focusing on the symptoms of inflation rather than closing the loopholes for the increases in money supply, which then causes an increase in prices.

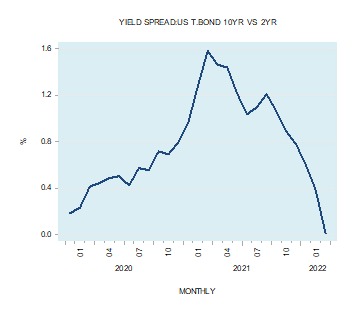

As a result, a tighter interest rate policy of the central bank leaves the inflationary framework intact. This means that once the tighter stance of the central bank is reversed, with the revival in economic activity, the money supply is likely to increase.

The closure of all the loopholes for increases in the money supply in order to counter inflation and the impoverishment of wealth generators is required. The major loopholes include Federal Reserve lending to the government and the existence of fractional reserve banking.

Conclusion

Treasury secretary Janet Yellen has conceded that last year she underestimated the strength of inflation. However, without a valid definition of inflation she risks being wrong again. Contrary to popular thinking, inflation is not about general increases in the prices of goods and services but about increases in the money supply out of “thin air.” On this Ludwig von Mises wrote:

To avoid being blamed for the nefarious consequences of inflation, the government and its henchmen resort to a semantic trick. They try to change the meaning of the terms. They call “inflation” the inevitable consequence of inflation, namely, the rise in prices. They are anxious to relegate into oblivion the fact that this rise is produced by an increase in the amount of money and money substitutes. They never mention this increase. They put the responsibility for the rising cost of living on business. This is a classical case of the thief crying “catch the thief”. The government, which produced the inflation by multiplying the supply of money, incriminates the manufacturers and merchants and glories in the role of being a champion of low prices.

Tags: Featured,newsletter