Swiss Franc EUR/CHF - Euro Swiss Franc, May 04(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation...

Read More »Bank of England releases new data on its gold vault holdings

An article in February on BullionStar’s website titled “A Chink of Light into London’s Gold Vaults?” discussed an upcoming development in the London Gold Market, namely that both the Bank of England (BoE) and the commercial gold vault providers in London planned to begin publishing regular data on the quantity of physical gold actually stored in their gold vaults. Critically, this physical gold stored at both the Bank...

Read More »What is the Bank of Japan to Do?

Summary: Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution. The Bank of Japan is unlikely to change policy. Its current policy of targeting 10-year bond yields and expanding the balance sheet by JPY80 trillion is aimed at boosting core inflation to 2%. However, the risk is that BOJ Governor Kuroda surprises the...

Read More »Switzerland sees influx of Guinean asylum seekers

The number of people from Guinea seeking refuge in Switzerland rose significantly during the first three months of 2017. The reason for the increase is unclear. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »My town – ordinary but extraordinary

Tama Vakeesan was born in Switzerland – to Tamil parents from Sri Lanka. She lives with them in Langenthal in canton Bern, where the biggest danger is being run over by a snow plough. Tama takes us on a tour and shows us her favourite places in this racially mixed town. (SRF Kulturplatz/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For...

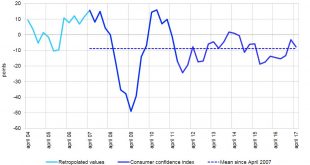

Read More »Consumer Sentiment Stands Near its Average

Bern, 04.05.2017 – With an index value of -8 points, Swiss consumer sentiment in April 2017 is virtually at its long-term average, having been slightly more optimistic in January (-3 points). While expectations for overall economic developments are above average in April, they are less positive than they were in January. Expectations concerning the financial situation and savings possibilities of domestic households...

Read More »Weekly SNB Interventions and Speculative Positions: Interventions despite Positive Outcome in France

Headlines Week May 03, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to his predecessor because the French economic reality is simply different. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators. However serious...

Read More »FX Daily, May 03: Marking Time

Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact...

Read More »Silver Takes the Elevator Down – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Election Effect Debate Last week, we talked about the effect of the French election on the gold and silver markets, and noted: Of course, traders want to know how this will affect gold and silver. As we write this, we see that silver went down 30 cents before rallying back up to where it closed on Friday. Gold went down...

Read More »Euro Drivers

Summary: Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level. There is one variable that explains the euro movement better than any other single variable we have found. The US-Germany two-year interest...

Read More » SNB & CHF

SNB & CHF