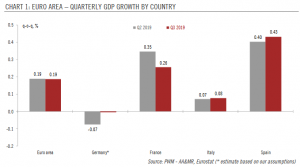

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations.

Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming stable growth for other euro area countries that have not yet published their Q3 estimates, we think German GDP was broadly flat in Q3. Risks are nevertheless tilted to the downside and even if Germany avoids a ‘technical recession’ (two consecutive quarters of negative growth), the country’s economy is

Articles by Nadia Gharbi

Swiss National Bank – Between a rock and a hard place

September 10, 2019We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.

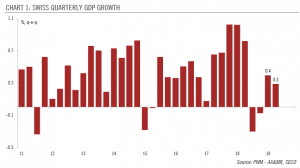

Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical recession in H2 2018. Unlike other European countries, manufacturing contributed positively to growth in Switzerland in Q2—but the devil is in the detail. The solid performance of manufacturing was mainly due to one segment—chemicals and pharmaceuticals, which is less sensitive to exchange rate movements

Swiss National Bank – Between a rock and a hard place

September 10, 2019We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical recession in H2 2018. Unlike other European countries, manufacturing contributed positively to growth in Switzerland in Q2 — but the devil is in the detail. The solid performance of manufacturing was mainly due to one segment — chemicals and pharmaceuticals, which is less sensitive to exchange rate movements and the economic cycle

Read More »Germany: Why Sunday’s state elections matter

August 30, 2019Together with the economic slowdown, declining support for the governing coalition may (or may not) open the way to greater fiscal stimulus.The results of Sunday’s state elections in Saxony and Brandenburg will be scrutinised closely. A heavy CDU or SPD defeat would send shock waves through Berlin.Germany’s slowdown has raised expectations for further fiscal stimulus. The fragile situation of the two mainstream parties makes decision-making more complicated.Nevertheless, at least the debate among officials has started and a gradual approach might emerge in autumn. Notably, there seems to be growing support to agree on measures to tackle climate change. The 2020 budget debate in September may also offer further clues as to whether pressure is really growing or not.Beyond the political

Read More »Italy: Back to polls in Q4 2019?

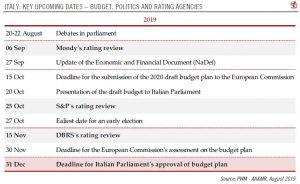

August 17, 2019Recent developments in Italy’s political landscape have increased the probability of early elections in Q4 2019, but the situation is not so straightforward.

Last week, political tensions in Italy intensified as Matteo Salvini, the League’s leader triggered a no confidence vote against Prime Minister Giuseppe Conte.

PM Conte will address the Senate on 20 August. A confidence vote will likely follow the speech, though further delays remain a possibility.

Once the government dissolves, the President of the Republic Sergio Mattarella will open a consultation period, from which point we see three potential scenarios: (i) a new majority with the current parliament’s arithmetic, (ii) a caretaker government is assembled with early elections in Q1 2020 or after and

Italy: Back to polls in Q4 2019?

August 16, 2019Recent developments in Italy’s political landscape have increased the probability of early elections in Q4 2019, but the situation is not so straightforward. Last week, political tensions in Italy intensified as Matteo Salvini, the League’s leader triggered a no confidence vote against Prime Minister Giuseppe Conte.PM Conte will address the Senate on 20 August. A confidence vote will likely follow the speech, though further delays remain a possibility.Once the government dissolves, the President of the Republic Sergio Mattarella will open a consultation period, from which point we see three potential scenarios: (i) a new majority with the current parliament’s arithmetic, (ii) a caretaker government is assembled with early elections in Q1 2020 or after and (iii) early elections in Q4.The

Read More »The case for fiscal stimulus strengthens in Germany

August 14, 2019German real GDP shrank in the second half of the year, reinforcing our view of a significant ECB action in September.The German economy shrank by 0.1% quarter-on-quarter (q-o-q) in Q2. Today’s report contained some positives news, notably regarding the resilience of domestic demand.Nevertheless, the ongoing trade disputes between China and the US, China weakness, the threat of auto tariffs and the threat of a no-deal Brexit to supply chains, in addition to the auto sector’s own issues are all factors that make us much more cautious about the H2 economic prospects than before. As result, we have revised our 2019 GDP growth forecast for Germany sharply down to 0.5%.The pressure on the government to act will likely increase but abandoning the “Black Zero” has a big political cost that no

Read More »DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

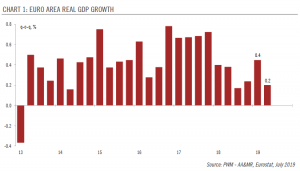

August 1, 2019Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year.

The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1.

While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy.

Tentative signs of weakening domestic demand, the possibility of a hard Brexit, potential US tariffs on EU cars, the ongoing trade frictions between the US and China as well as the slow rotation of the Chinese economy are all factors that make us cautious about economic prospects in H2. As a result, we have revised down our

DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

July 31, 2019Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year.The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1.While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy.Tentative signs of weakening domestic demand, the possibility of a hard Brexit, potential US tariffs on EU cars, the ongoing trade frictions between the US and China as well as the slow rotation of the Chinese economy are all factors that make us cautious about economic prospects in H2. As a result, we have revised down our 2019 GDP growth forecasts for the euro area to 1.1% from 1.4%.The ECB did not

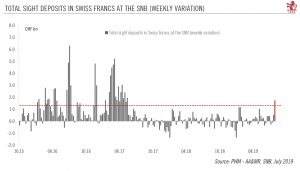

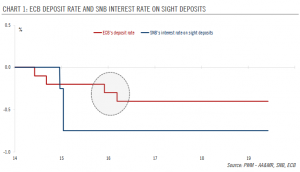

Read More »Looking for evidence of SNB intervention

July 30, 2019Before any rate cut, intervention in the forex market is likely to remain the Swiss National Bank’s first line of defence to counter any appreciation of the CHF.Data published on Monday revealed that commercial banks’ sight deposits at the Swiss National Bank (SNB) rose by CHF1.7bn last week (see chart), the largest weekly increase since May 2017. The amount suggests the SNB intervened in the FX market, probably ahead of the ECB’s meeting last Thursday.Weekly releases of commercial banks’ sight deposits at the SNB will be key to watch as they could be a precursor to rate cuts. When the SNB lowered its policy rate to -0.25% in December 2014 and then removed the exchange rate floor and lowered the policy rate further (to -0.75%) a month later, this was after massive intervention in the FX

Read More »Semaña grande for Sánchez

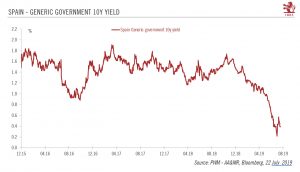

July 23, 2019The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well.

April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a government, with a parliamentary vote due to take place on July 23. To be elected, Sánchez will need an absolute majority (176 out of 350 seats). If he fails, the Socialist will need to secure a simple majority (more votes in favour than against) at the second investiture vote 48 hours later, on July

Semaña grande for Sánchez

July 22, 2019The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well.April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a government, with a parliamentary vote due to take place on July 23. To be elected, Sánchez will need an absolute majority (176 out of 350 seats). If he fails, the Socialist will need to secure a simple majority (more votes in favour than against) at the second investiture vote 48 hours later, on July 25. If he fails again, the country could be facing fresh general elections

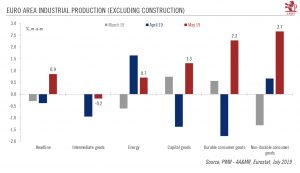

Read More »Euro area manufacturing is not out of the woods

July 19, 2019Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead.

After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and energy also increased. However, output of intermediate goods slipped.

While the monthly print was solid, a closer look at the sectoral breakdown reveals that the improvement in May was sporadic. Indeed, the jump in industrial production was driven almost entirely by just two sectors, pharma and autos.

Euro area manufacturing is not out of the woods

July 18, 2019Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead.After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and energy also increased. However, output of intermediate goods slipped.While the monthly print was solid, a closer look at the sectoral breakdown reveals that the improvement in May was sporadic. Indeed, the jump in industrial production was driven almost entirely by just two sectors, pharma and autos. Pharma production rose sharply in Germany, France and Spain for reasons that

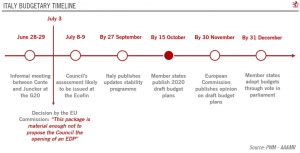

Read More »A truce between Rome and Brussels

July 5, 2019For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.

In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore, public spending will be lower than projected this year due to a lower-than-expected take-up of the government’s ‘citizenship income’ and early retirement scheme. The 2019 structural deficit will improve by 0.3pp of GDP (including

A truce between Rome and Brussels

July 5, 2019For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore, public spending will be lower than projected this year due to a lower-than-expected take-up of the government’s ‘citizenship income’ and early retirement scheme. The 2019 structural deficit will improve by 0.3pp of GDP (including one-offs), instead of deteriorating by 0.2pp as originally agreed with the

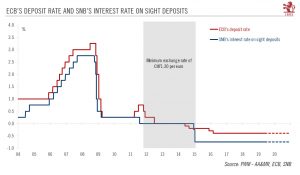

Read More »Swiss monetary policy – it’s (almost) all about the Swiss franc

June 26, 2019With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months.

How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the ECB, especially in the case of a small 10 basis point deposit rate cut by the latter, as we expect.

The SNB’s first line of defence is more likely to be FX market interventions to counter any appreciation of the CHF. If FX interventions prove ineffective, the SNB would resort to a rate cut. Our

How dovish can Swiss monetary policy go?

June 11, 2019The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in March, the CHF has appreciated by 1.5% against the EUR and by 1.3% against the USD.In this context, we believe the bank’s policy statement will remain broadly unchanged. The interest on sight deposits at the SNB will remain at 0.75% and the central bank will reiterate its willingness to intervene in the

Read More »How dovish can Swiss monetary policy go?

June 11, 2019The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.

At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in March, the CHF has appreciated by 1.5% against the EUR and by 1.3% against the USD.

In this context, we believe the bank’s policy statement will remain broadly unchanged. The interest on sight deposits at the SNB will remain at

Why has euro inflation stayed so low?

June 6, 2019Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.

The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can legitimately ask why inflation remains so low in the euro area, with the underlying inflation trend remaining close to 1.0% y-o-y. This remains a conundrum for the euro area’s outlook and the European Central Bank’s (ECB) next monetary policy moves, especially as several measures show that wage growth started

Why has euro inflation stayed so low?

June 5, 2019Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can legitimately ask why inflation remains so low in the euro area, with the underlying inflation trend remaining close to 1.0% y-o-y. This remains a conundrum for the euro area’s outlook and the European Central Bank’s (ECB) next monetary policy moves, especially as several measures show that wage growth started to pick up last year. Recent research by the ECB may provide an answer. It

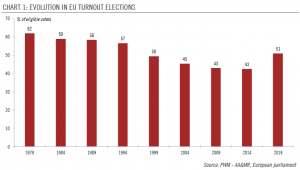

Read More »European elections – a more diverse but still pro-Europe parliament

May 28, 2019Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged.Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered a parliament with a pro-European majority, broadly in line with opinion polls.The traditional centre-right European Popular Party (EPP) and the centre-left Socialist & Democrats (S&D) remained respectively the first and the second groups, but both suffered major losses. Indeed, the “grand coalition” of EPP and S&D has lost its traditional absolute majority for the first time

Read More »European elections – a more diverse but still pro-Europe parliament

May 28, 2019Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged.

Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered a parliament with a pro-European majority, broadly in line with opinion polls.

The traditional centre-right European Popular Party (EPP) and the centre-left Socialist & Democrats (S&D) remained respectively the first and the second groups, but both suffered major losses. Indeed, the “grand coalition”

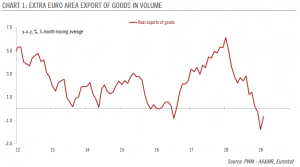

Rising downside risks to euro area growth

May 23, 2019While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected.

A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this dispute is not insignificant. Potentially weaker domestic demand in the US, China and the rest of Asia as a result of the trade dispute could mean that exports of euro area final goods to those countries also suffer. Unsurprisingly, Germany stands out as the most exposed country, not only in absolute terms

Rising downside risks to euro area growth

May 22, 2019While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected.A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this dispute is not insignificant. Potentially weaker domestic demand in the US, China and the rest of Asia as a result of the trade dispute could mean that exports of euro area final goods to those countries also suffer. Unsurprisingly, Germany stands out as the most exposed country, not only in absolute terms but also relative to GDP.Aside from the US/China trade dispute, Europe

Read More »No doubt remaining: German domestic demand is resilient

May 16, 2019German activity has accelerated in the first quarter of the year on the back of a strong domestic economy.German GDP rose by 0.4% quarter-on-quarter in Q1, accelerating from a flat figure in Q4.The strong Q1 GDP growth is good news and confirms our long-held view that domestic demand remains resilient despite many external headwinds.The signal given by other data (factory orders, surveys) suggests that some negative payback is likely in Q2.The prospect of higher German growth (on average) in H2, driven by some reversal of weak global trade growth is in jeopardy following the intensification of the trade dispute between the US and China.Even if confined to the US and China, Germany would be impacted through uncertainty and trade spill overs.Of major importance is potential auto tariffs.

Read More »French tax cuts designed to reboot Macron’s presidency

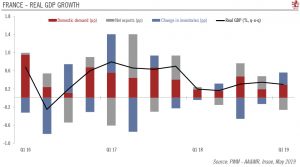

May 10, 2019The French government’s response to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year.Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is included in the 3.1% public deficit planned for this year. The measures announced in April after the ‘Grand Débat’ will mostly impact 2020, although some measures will already kick in in 2019.While costly, the measures will enhance households’ purchasing power. Indeed, Q1 GDP data showed domestic demand already improving on the back of household consumption, although some of that

Read More »French tax cuts designed to reboot Macron’s presidency

May 10, 2019The French government’s respond to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year.

Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is included in the 3.1% public deficit planned for this year. The measures announced in April after the ‘Grand Débat’ will mostly impact 2020, although some measures will already kick in in 2019.

While costly, the measures will enhance households’ purchasing power. Indeed, Q1 GDP data showed domestic demand

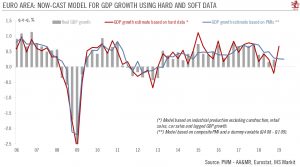

Euro area Q1 GDP growth could be stronger than expected

April 26, 2019The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be published, but we will have some clues on growth composition when euro area countries such as France publish their own GDP figures the same day (on Tuesday, 30 April).There have been some interesting developments in the euro area recently, notably the divergence between hard and soft data. Survey data

Read More »Swiss Policy Mix Review

April 17, 2019Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB

The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295 million. Over the last 10 years, the Swiss government has consistently underestimated the federal budget surplus, with 2014 being the only exception.

Switzerland was lucky in the timing of the introduction of its fiscal rule,