The Money Market Event is the biggest feast of the Swiss National Bank and a selected list of money managers that work together with the central bank. It is initiated by important speeches and ended with a generous buffet dinner. In the first speech, Andrea Mächler addressed three points:

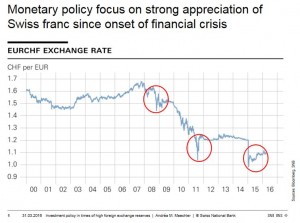

The expansion of the SNB balances sheet as measure against the so-called “strong franc” in a historic perspective.

How the SNB takes over currency risks from the private sector.

Details on the balance sheet expansion: Which kind of assets and liabilities does the SNB possess?My annotations are marked in bracket [ and ].

Welcome to the SNB’s traditional Money Market Event in Zurich. I am delighted that so many of you have responded to our invitation. A year ago, you were welcomed here by Fritz Zurbrügg, my colleague in the Governing Board and predecessor as the Head of Department III. It was only a few weeks after the minimum exchange rate had been discontinued, and monetary policy was the hottest topic in town.

This year, I will focus on the Swiss National Bank’s investment policy. In the past few years, the SNB has become a big asset manager. Consequently, I want to look at two questions today.

Read More »