To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to some far off location nowhere near our experience. In economic terms, what is really a technocratic ideal hasn’t helped with this confirmation bias. The Fed is staffed with the best and the brightest, supposedly, so there is no way the economy could stay down forever. Even if they managed to screw up time and again, eventually they will have to get it right. The same kind of sentiment is applied to other central banks whether they ever deserved it or not (even the BoJ). Within this paradigm, what the Fed in particular is doing now makes it all the worse. There is a great deal of misunderstanding about what these “rate hikes” mean. There is none about what they are supposed to mean, which is the successful completion of years of monetary “accommodation” that greatly aided in bringing about full recovery. But that is not what is going on here.

Topics:

Jeffrey P. Snider considers the following as important: China, CPI, currencies, depression, economy, EuroDollar, eurodollar standard, exports, Featured, Federal Reserve, Federal Reserve/Monetary Policy, global trade, inflation, Markets, Money, money printing, newsletter, PBOC, PPI, rate hikes, recovery, Reflation, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to some far off location nowhere near our experience.

In economic terms, what is really a technocratic ideal hasn’t helped with this confirmation bias. The Fed is staffed with the best and the brightest, supposedly, so there is no way the economy could stay down forever. Even if they managed to screw up time and again, eventually they will have to get it right. The same kind of sentiment is applied to other central banks whether they ever deserved it or not (even the BoJ).

Within this paradigm, what the Fed in particular is doing now makes it all the worse. There is a great deal of misunderstanding about what these “rate hikes” mean. There is none about what they are supposed to mean, which is the successful completion of years of monetary “accommodation” that greatly aided in bringing about full recovery. But that is not what is going on here. It is vastly different, a fact that doesn’t seem to have registered in all that many places. I wrote the day the FOMC voted for the last one:

The intersection of the modeled path of the long run economic trajectory with that of the dramatically reduced federal funds rate is the Fed essentially declaring that the economy we have today is the best then can do; this, under these orthodox terms, is it. Even if it means Industrial Production declining for fifteen straight months, that is not something the FOMC means any longer to fix. The committee just voted to tell you that it no longer believes that doing so is its job. If we are in a depression, as IP for consumer goods as well as the related denominator for the unemployment rate show, then there is nothing the FOMC can do about it.

It seems to be taken instead in the popular imagination that by raising rates monetary officials do not want to wait for the “overheating” they once talked incessantly about. But if you listen to what they say, and read what it is they write about, overheating is no longer a topic of conversation let alone an expectation. There is no surge in demand coming, a prediction as valid today as it was in 2014, only now mainstream economists and central bankers agree with it (what other choice did they have?).

Commodities, in particular, however, appear to be either unaware or unbothered. Despite immense accumulations of inventory, especially oil, prices have been resurrected like the mythical phoenix from the ashes. In the oil space, OPEC has promised to cut back and its members have largely lived up to the pledge, but it has always been a surge in demand that was to reduce the so-called glut. Even in gasoline, crack spreads have been unusually high without any current justification for them; it is entirely about tomorrow and what many seem to believe is so much better economic prospects.

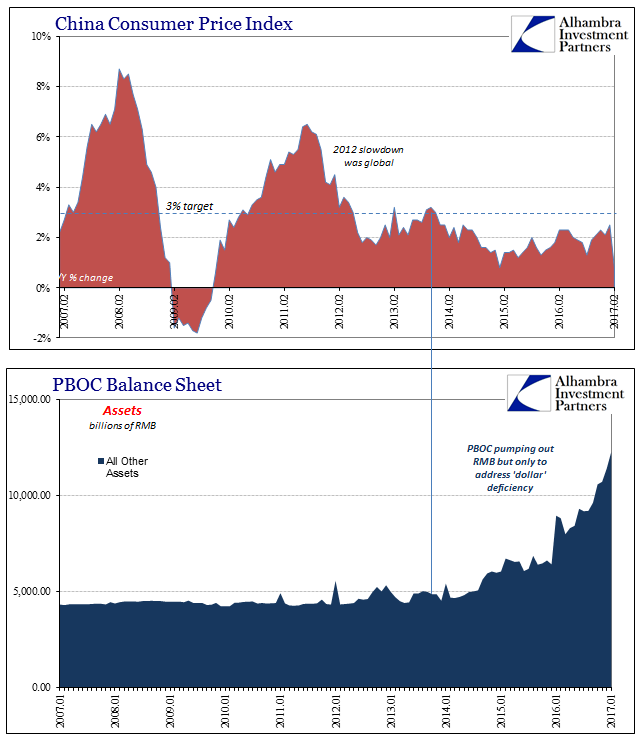

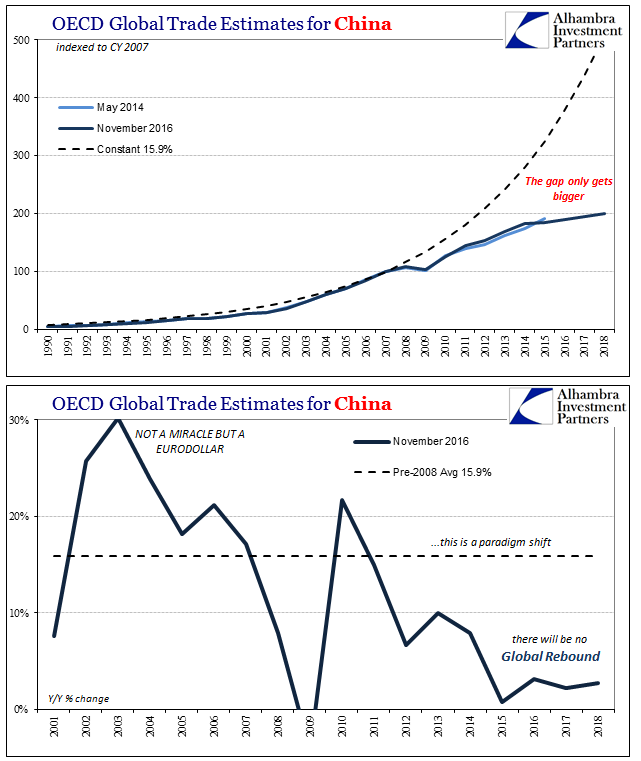

A good deal of this hope rests on China, as well. While the Fed is to “reflation” confirmation of firming demand, the Chinese have been put to serious action. There was enormous fiscal “stimulus” to start 2016 and then equally enormous (sounding) monetary effort later in the year. Without the backing of “dollars”, the PBOC has been printing money in a way the Fed could only wish.

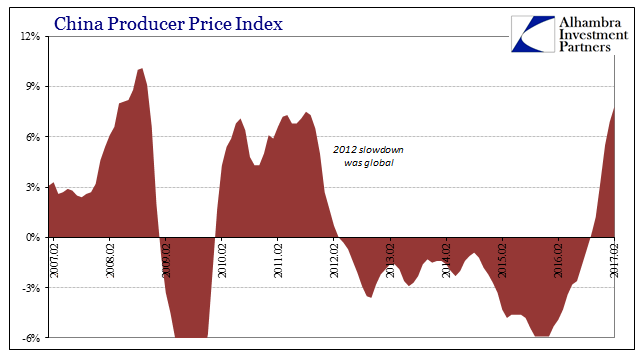

| As such, producer prices in China have spiked to levels not seen since before the Great “Recession.” The Chinese PPI registered 7.9% in February 2017, higher than at any time during the initial “recovery” period (before the events of 2011 and the economic consequences thereafter) and the fastest price increase since late 2008.

That is the combined elements of low base effects with this renewed sense that tomorrow just has to be better because it can’t get any worse or linger without growth forever. Something just has to go right. |

China CPI PPI, February 2007 - 2017 |

| Contrasting that PPI number, however, was China’s CPI. A product (pardon the pun) largely of fresh food prices, the CPI on that side of the Pacific just decelerated sharply to 0.8% in the very same month. But while food prices were to blame, outside of that segment it wasn’t as if fresh RMB was pushing up everything else; to the contrary, China’s “core” CPI (ex food and energy) rose just 1.8%. For reference, the PBOC targets 3% as its definition of “stable prices.” |

China CPI PBOC and Balance Sheet, 2007 - 2017 |

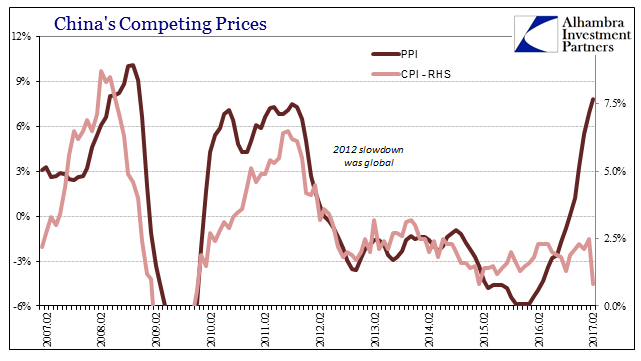

| It seems very likely the same chasm between commodity hope and undisturbed economic reality that we find all over the world to start 2017, almost a mirror of what began 2016. |

China CPI vs PPI, February 2007 - 2017 |

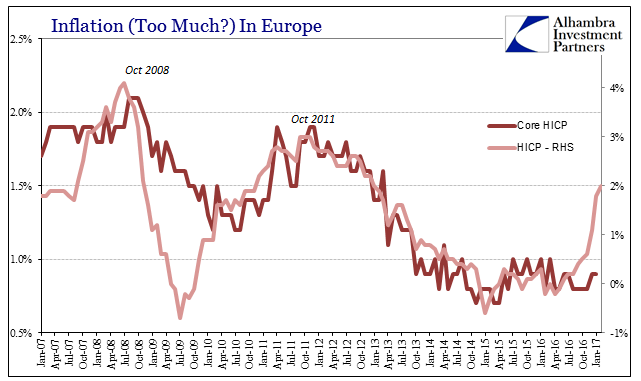

Europe Inflation HICP Core, January 2007 - 2017 |

|

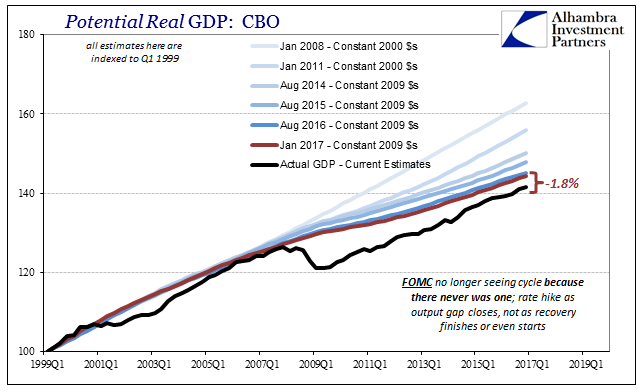

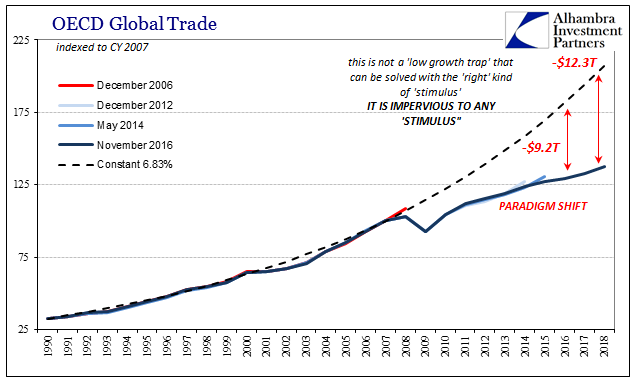

| Acceleration outside of commodities is sorely lacking, the very confirmation that at some point will be required if “reflation” is to continue on. It cannot remain a dream forever, especially since there are enormous imbalances yet to be overcome. The world economy is not poised for the liftoff that only three years ago was widely believed. The “rising dollar” canceled the launch. Apparently the mission scrub wasn’t broadcast to the public. The very quiet acceptance and surrender on this account isn’t surprising, as in sharp contrast to how QE was introduced its ragged end passed without any public comment. Wouldn’t want too many questions about how no one in position of authority saw this coming: |

Potential Real GDP, 1999 - 2019 |

Trade War Total Global Trade, 1990 - 2018 |

|

Trade War China, 1990 - 2018 |

Tags: China,CPI,currencies,depression,economy,EuroDollar,eurodollar standard,exports,Featured,Federal Reserve,Federal Reserve/Monetary Policy,global trade,inflation,Markets,money,money printing,newsletter,PBOC,PPI,rate hikes,recovery,Reflation