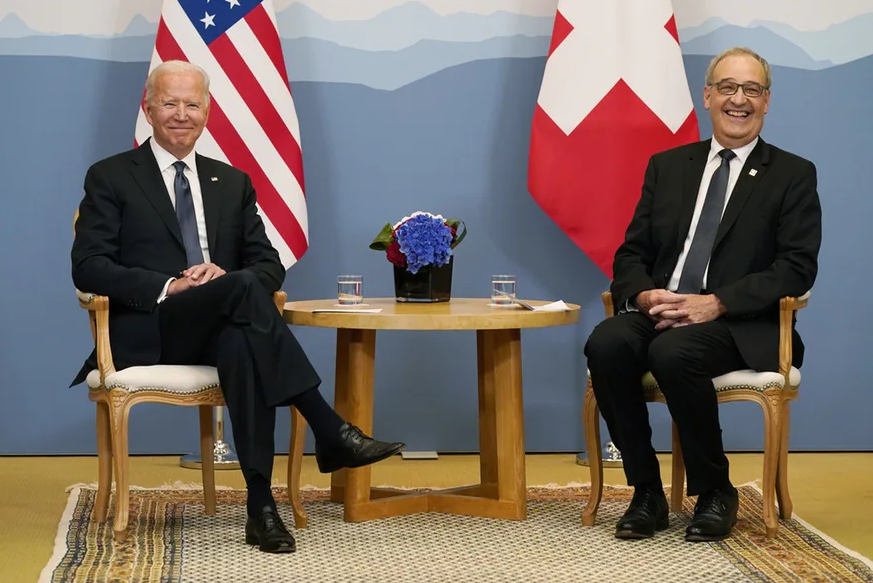

Switzerland joined the IMF in 1992 and is one of 24 members of the International Monetary and Financial Committee IMFC (Archive picture) Keystone/Stephen Jaffe/Handout The government seeks to renew its policy to support assistance measures by the International Monetary Fund (IMF). It asked parliament to approve plans to continue international monetary cooperation to the tune of CHF10 billion (.8 billion) by 2028. The existing legal basis expires in April 2023, according to officials. The government also agreed to a further financial contribution of CHF50 million to the IMF’s poverty reduction trust and CHF7.5 million to the IMF’s debt relief for Sudan. “Global financial stability is especially important to Switzerland as an internationally highly interconnected

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Featured, newsletter, Politics

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Switzerland joined the IMF in 1992 and is one of 24 members of the International Monetary and Financial Committee IMFC (Archive picture) Keystone/Stephen Jaffe/Handout

The government seeks to renew its policy to support assistance measures by the International Monetary Fund (IMF).

It asked parliament to approve plans to continue international monetary cooperation to the tune of CHF10 billion ($10.8 billion) by 2028.

The existing legal basis expires in April 2023, according to officials.

The government also agreed to a further financial contribution of CHF50 million to the IMF’s poverty reduction trust and CHF7.5 million to the IMF’s debt relief for Sudan.

“Global financial stability is especially important to Switzerland as an internationally highly interconnected and dynamic economy with its own currency a major financial centre,” it said in a statement on Wednesday.

Switzerland joined the IMFExternal link in 1992 and shares a permanent seat on the executive board together with Poland.

In another development, the government is paving the way for the private financial sector to issue so-called “green bonds” to raise money on the capital market to finance projects with a positive impact on the environment.

It says the move can help “enhance the application of international standards in Switzerland” and for the Swiss financial centre to be an international leader in sustainable financial services”.

The finance and the environment ministries have been mandated to prepare the necessary documents for a decision by the end of next year.

Tags: Featured,newsletter,Politics