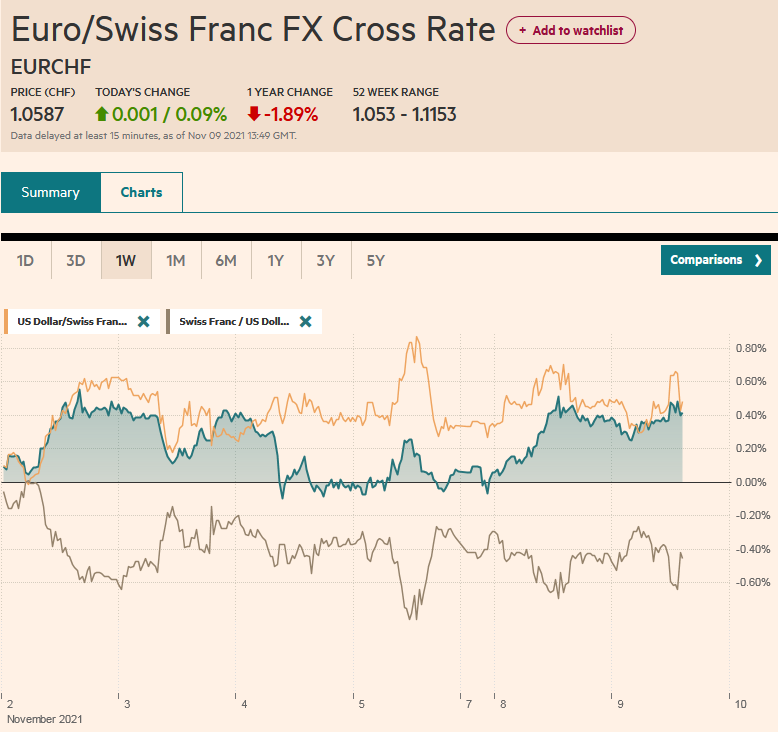

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher against the dollar. The yen is joined by the Scandis and sterling to lead the majors. The New Zealand dollar is the laggard. Emerging market currencies are also mostly stronger, and the JP Morgan EM FX Index is rising for the third consecutive session, the longest streak in a couple of months. The

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, China, Currency Movement, Featured, Federal Reserve, France, Germany, Japan, jobs, Mexico, newsletter, Romania, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has risen by 0.09% to 1.0587 |

EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher against the dollar. The yen is joined by the Scandis and sterling to lead the majors. The New Zealand dollar is the laggard. Emerging market currencies are also mostly stronger, and the JP Morgan EM FX Index is rising for the third consecutive session, the longest streak in a couple of months. The Turkish lira is a notable exception, even after the central bank hiked the reserve requirements for foreign currency and precious metal deposits by 200 bp. Note that the central bank meets next week (November 18). Asia Pacific equity markets are mixed. Japan, Australia, and Indian markets eased. Europe’s Stoxx 600 continues to run. It is up for the ninth consecutive session today and has fallen only once since October 21. US future indices are edging higher. The US 10-year yield is off around three basis points to 1.46%. European yields are mostly 2-3 bp lower. Gold is firm near yesterday’s highs. It has rallied from last week’s lows near $1759 to $1827 earlier today to fray the upper Bollinger Band. December WTI is near $82.50 ahead of the EIA’s short-term energy outlook, which is seen as a key factor in how the US responds to OPEC+ decision to stick to the gradual increase in supply. After yesterday’s jitters, some preliminary signs that Russia will deliver more gas to Europe helped ease prices. Copper successfully tested the 200-day moving average last week and is rising for the third consecutive session. Technically, it looks bullish, and inventories are low. |

FX Performance, November 09 |

Asia Pacific

In Japan, cash earnings rose a disappointing 0.2% in September. The consensus was for a 0.6% increase. Recall that cash earnings fell from April 2020 through February 2021. They have been rising since. Still, to boost consumption, the supplemental budget is expected to include a cash component. Separately, Japan reported its September current account. It was a little smaller than expected and down sharply from September (JPY1.03 trillion vs. a revised JPY1.5 trillion). The trade balance was in deficit for the second consecutive month. The balance of payments data includes some investor flows. Japanese investors bought the most US bonds in 18 months, in September, and purchased the most Dutch bonds since April 2019. They were net sellers of Australian bonds for the fifth consecutive month

While many investors have been chased from the Chinese real estate market, not Goldman Sachs Asset Management. Reports today suggest it has been buying dollar-denominated real estate debt in China. A Bloomberg index shows prices are off more than 20% in the past two months. Goldman has also reportedly bought local government yuan debt as well. China is expected to report October CPI and PPI first thing tomorrow in Beijing. Rising commodity prices (e.g., coal and oil) and the increase in input and output prices in the PMI point to an acceleration of PPI. Consumer prices are likely to soar, but from a low base (0.7% year-over-year in September) as pork prices may have passed their trough and higher vegetable prices have been reported. Non-food prices are also expected to have edged higher. The median forecast in Bloomberg’s survey sees the CPI jumping to 1.4%, which would be the highest since September 2020.

The dollar is falling against the yen for the fourth consecutive session. It is trading at its lowest level since October 11, when it first rose above JPY113. It recorded a low near the middle of the Asian session, slightly below JPY112.75. The (38.2%) retracement objective of the leg up that began after the September FOMC meeting is found near JPY112.55. A break could spur a move to JPY112.00. The Australian dollar continued to find demand below $0.7400. It is encountering resistance near $0.7435 (the 38.2% retracement of the fall since the end of last month). A move above there would target the $0.7460-$0.7480 area. The US dollar is little changed against the Chinese yuan, but it briefly traded below CNY6.39 for the first time this month and could not rise above CNY6.40. It appears to be the first back-to-back decline in the dollar since October18-19. The PBOC set the dollar’s reference rate at CNY6.3903, a little firmer than the CNY6.3893 expected (Bloomberg survey). The central bank injected funds for the second session as it may be helping to prepare the market for the repayment of a large (CNY800 bln) medium-term lending facility loan next week.

Europe

Germany reported a jump in its September trade surplus to 16.2 bln euros after a revised 11.7 bln euro surplus in August (from 10.7 bln euros). However, exports unexpectedly declined for the second month (-0.7% after a revised -0.8% previously). Imports were also weaker than expected but eked out a 0.1% gain after a revised 2.1% rise in August. Supply chain disruptions are a common complaint. Separately, Germany’s November IFO survey was mixed. The current assessment deteriorated sharply (12.5 form 21.6), which is understandable given that the Covid cases are setting local records. On the other hand, the expectations component jumped to 31.7 from 22.3, which snaps a five-month slide.

France’s September trade balance did not deteriorate as much as feared in September. However, the 6.78 bln euro deficit was a bit wider than the 6.66 bln deficit seen in August. Separately, the central bank indicated that it appears the economy surpassed the early 2020 peak in October by about 0.5%. Continued growth this quarter will solidify it.

While the Federal Reserve seemed to soften its view that inflation will prove transitory by modifying it with “expected,” the ECB’s Lagarde and Lane have not. Indeed, they both argued that monetary and fiscal support is needed to boost the chases of a strong recovery and ensure inflation build-up persists. However, as the German coalition takes shape, FDP leader Linder is seen as the most likely candidate for finance minister. He is talking tough on fiscal policy and seeks an early return to orthodoxy. Some fear that this will carry over to EU debates as well.

The euro has extended the rally that began last Friday after reaching a new low for the year (~$1.1515). It rose slightly above $1.1605 today to kiss the 20-day moving average. Last week’s high was closer to $1.1615, and it may take a move above $1.1625 to signal a breakout, but we are skeptical that such a move will be mustered ahead of tomorrow’s US CPI. Similarly, sterling, which approached $1.34 at the end of last week, is straddling the $1.36 area late in the European morning. In doing so, it has now recouped (61.8%) of the decline triggered by the BOE’s decision to stand pat last week. The intraday momentum studies are stretched. This fits into our scenario of the dollar correcting lower until the run-up to the CPI. Lastly, note that Romania, which hiked rates last month by 25 bp, is likely to take a big bite today with a 50 bp move that would bring the policy rate to 2.0%. Tomorrow, Romania reports October CPI, and it is expected to have risen above 7%. Year-to-date, the Romanian leu is the second weakest currency in the region, off about 6.8%. Only the Turkish lira has done worse (-23.4%).

America

The US non-farm payroll survey is subject to statistically significant revision. The market, understandably, focuses on the most recent data. However, the revisions alter the general profile. Consider that in Q1, the initial estimates suggested the US grew 1.344 bln jobs. The revisions put it at 1.55 mln. Q2 initially was 1.675 mln and has subsequently been revised to 1.845 mln. The biggest revision was in Q3. It has been revised up by more than half a million jobs to 1.886 mln, and the September series is subject to another revision. As a rule of thumb, the revisions are in the direction of the underlying trend. So far this year, there has only been one downward revision (March off ~130k lower than the initial estimate).

The US reports October producer prices today and consumer prices tomorrow. Due to the base effect, the 0.5%-0.6% expected month-over-month increase in the core and headline measures, respectively, the year-over-year rate may steady at 8.6% and 6.8%. The market seems somewhat less sensitive to the PPI compared with CPI. Canada’s economic data calendar is empty this week and is light next week too. Mexico reported a nearly 24% month-over-month jump in October vehicle production. The time series is volatile, but at almost 258k, it is up slightly on the year and is the best since June. Vehicle exports (mainly to the US) rose by nearly 15%, the second-biggest increase since July 2020. The 224.5k vehicles shipped are also the most since June. Today’s focus is on Mexico’s CPI. The central bank, which meets on November 11, argues it is data-dependent. Worker remittances have been vital, but the economy is weak, illustrated by the 0.2% contraction recorded in Q3. However, the challenge is that inflation is high and accelerating. Both the headline and core rates are expected to have risen more in October than September. The year-over-year headline rate is expected to rise to almost 6.20% (Bloomberg survey) from 6.0% in September. Moreover, the base-effect works against Mexico this month. In November 2020, CPI rose by less than 0.1%. When this drops out of the 12-month comparison, headline inflation will likely rise sharply. Last November was the first time since 2001 that November prices did not increase more than in October.

The Fed’s Quarles made it official. Although his term as governor could continue, his term as the first Vice-Chair of Supervision has expired. When his term as the Chair of the Financial Stability Board ends next month, he will resign from the Federal Reserve, as is customary. The position was created by Dodd-Frank legislation in 2010, but it was left unfilled until 2017. Governor Tarullo had fulfilled the function, but he should have been appointed as Vice-Chair of supervision by Obama. Trump nominated Quarles, and it seems that part of some criticism of Powell is more directed at Quarles. Yellen has defended Powell from such criticism. Biden has yet to nominate someone for the position, and although the Fed’s committee may be able to fulfill the function, having an appointment ready would have underscored the importance it holds.

Perhaps part of the issue is that Governor Brainard appears to be under consideration for both the Vice-Chair post and, some think, the Chair itself. This need not be a significant hurdle. The most likely scenario seems to be, as it has for a couple of months, that Powell will be re-nominated, and Brainard will be offered the Vice-Chair of Supervision. We understand that Powell has Yellen’s support, and for the President to go against his own Treasurer’s inclination would be surprising. Talk is that an announcement could be made before the end of the month. Note that Clarida’s term as Vice-Chair expires early next year too. Meanwhile, today sees one of the most hawkish FOMC members speak, St. Louis’s Bullard, who underscored yesterday by indicating he thinks that two hikes next year will be appropriate. Also, later in the day, the most dovish FOMC member, Minneapolis’s Kashkari, speaks. He does not think a hike will be warranted until 2024. Kashkari is a good example of why where one sits on the partisan divide (Republican) does not allow one to simply deduce their stand on monetary policy decisions.

The US dollar tested the 200-day moving average against the Canadian dollar (~CAD1.2480) ahead of the weekend. It has drifted lower to around CAD1.2430 today. There are options for about $550 mln at CAD1.2400 that expire today. However, intraday momentum is stretched, suggesting limited downside in early North American activity. More likely is a return to resistance around CAD1.2460. The greenback is slipping lower against the Mexican peso. It is the fourth consecutive session of lower lows. Support is seen in the MXN20.20 area. President AMLO replaced a key aide, Nieto, responsible for the anti-corruption and anti-money laundering campaign, over a lavish wedding in Guatemala. Mexico reports its October CPI figures today, and a modest acceleration is likely. Banxico meets on Thursday and is widely expected to hike rates by 25 bp. We suggest the risk of a 50 bp move is greater than the odds of its standing pat.

Tags: #USD,China,Currency Movement,Featured,Federal Reserve,France,Germany,Japan,jobs,Mexico,newsletter,Romania