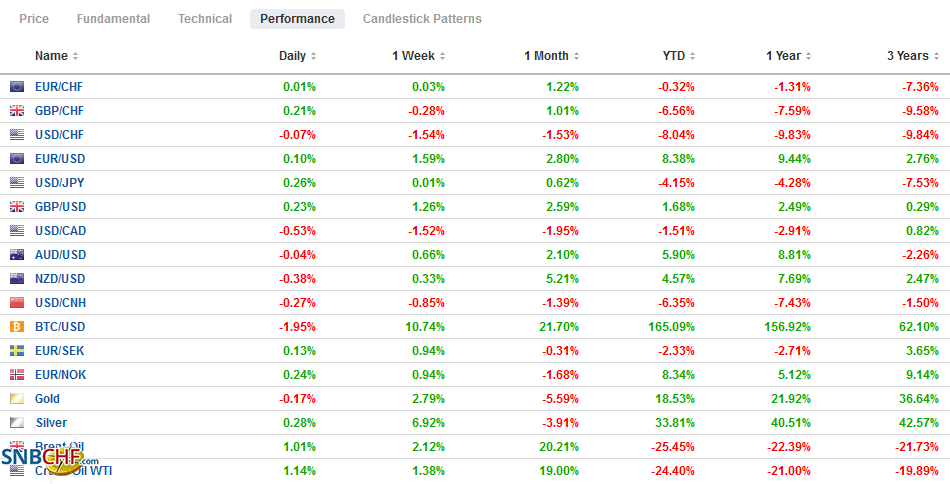

Swiss Franc The Euro has fallen by 0.06% to 1.081 EUR/CHF and USD/CHF, December 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine’s supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea’s Kospi and Taiwan’s Taiex, the MSCI Asia Pacific benchmark secured its fifth consecutive weekly gain. While European bourses are firmer, the 0.2% gain only halves this week’s loss, which threatens to snap a four-week rally. US shares are firm. The NASDAQ is up 1.4% this week coming into today, poised for its third consecutive weekly rise, while the Russell

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.06% to 1.081 |

EUR/CHF and USD/CHF, December 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine’s supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea’s Kospi and Taiwan’s Taiex, the MSCI Asia Pacific benchmark secured its fifth consecutive weekly gain. While European bourses are firmer, the 0.2% gain only halves this week’s loss, which threatens to snap a four-week rally. US shares are firm. The NASDAQ is up 1.4% this week coming into today, poised for its third consecutive weekly rise, while the Russell 2000 may end its four-week advance unless it gains around 0.35% today. Although Asia Pacific yields are lower after US yields softened yesterday and Australia’s 10-year yield eased back below 1.0%, US and European yields are mostly firmer today. The US benchmark is up a couple basis points higher at 0.93% and nine on the week, and seven wider against Germany. Recall that Fitch reviews its BBB- sovereign rating for Italy, and Moody’s reviews Russia and Turkey’s ratings today. The greenback remains heavy, but most of the majors are +/- 0.2%, though the threat from the Reserve Bank of New Zealand that it will consider buying foreign bonds is weighing on the Kiwi. Asian currencies are notably strong among emerging market currencies as the dollar pushes further below KRW1100, and the Taiwanese dollar extends its appreciation to levels not seen since 1997. The JP Morgan Emerging Market Currency Index is edging higher today to secure its fifth consecutive weekly rise. Gold initially extended its recovery to almost $1845 (from around $1765 on Monday) but ran into selling as it approached the 20-day moving average and the (38.2%) retracement of the leg lower since November 9. Oil is firm near nine-month highs in the OPEC decision, where the 500k barrel increase next month is still seen keeping the supply balance favorable. |

FX Performance, December 4 |

Asia Pacific

As widely expected, the Reserve Bank of India kept its key rate steady at 4%. The repo rate began the year at 5.15%, and it was cut to 4.0% in two steps by May, where it has stood. Consumer inflation accelerating to 7.6% in October from 7.3% in September. The November CPI is due around the middle of the month and is expected to have softened to around 7.1%.

The US added China’s third-largest oil company (Cnooc) to the list of companies sanctioned due to ties with the military. It was one of four firms that have been added to the growing list of sanctioned US companies. These moves do two things simultaneously. First, it ties President-elect Biden’s hands. Contrary to pre-election speculation, Biden shows no desire to unilaterally unwind the tariffs the US has imposed, and it likely extends to these other measures as well. Even if he wanted to, reversing course makes him (and the US) look weak. On the other hand, as China recognizes, each new measure gives the US more chits to negotiate with Beijing when negotiations between the new administration begin in earnest.

After much drama around a JPY104 option, the dollar broke down to almost JPY103.65. It is recovered a little and poked back above JPY104 in the European morning. It holds an option for around 1/10 of yesterday’s expiry or $360 mln today. Resistance is seen in the JPY104.20-JPY104.30 area. The Australian dollar reached $0.7450 yesterday, a new two-year high. It is consolidating a little lower today. Previous resistance around $0.7400 may now offer initial support. It is the fifth consecutive weekly rise of the Aussie. The PBOC’s reference rate for the dollar was set at CNY6.5507, a little higher than the models expected, though lower than yesterday’s CNY6.5592 fix. The dollar fell for the fourth consecutive session. The yuan has posted a weekly gain only five times since the end of H1. Today’s gains brought it to a new two-year high (with the dollar around CNY6.5270).

Europe

Sterling wobbled following the UK claims that the EU was adding last-minute demands in its negotiations. However, that claim itself appears to have been part of the UK negotiations. Still, the press is playing up the chances that a deal is struck over the weekend. The level playing field is said to the key issue. Still, next week, the UK is going to take steps to undermine the Withdrawal Bill. The government seeks to strip the amendments to the Internal Market Bill the House of Lords added to dilute the most contentious parts. It will submit a tax bill that gives the UK unilateral authority to determine which goods from Britain to Northern Ireland can be exempt from tariffs.

German factory orders jumped 2.9% in October, almost twice the increase that economists projected. It was the sixth month of gains. Domestic orders rose a solid 2.4% after 2.7% increases in both August and September. Foreign orders rose by 3.2% after a flat September. Foreign capital goods orders were particularly strong, rising 5.2% after a 3.6% decline in September. Eurozone members boosted their orders of German capital goods by 2.5% after dropping 13% in September, but orders from outside the eurozone surged by 6.5% and probably reflects stronger demand from Asia.

The euro has made a marginal new high today, a little above $1.2175. It consolidated in Asia before turning higher in Europe. The intraday technicals are stretched. While the $1.2200-area offers psychological resistance, the next option barrier is not seen until $1.2250, where an option for nearly 930 mln euros is struck that expires today. It may take a shockingly poor US job report sending the single currency to the barrier today. Initial support was found at around $1.2140. For its part, sterling is consolidating yesterday’s surge that carried it to $1.35. It has held above $1.3410. There is an option for about GBP260 mln struck at $1.3450 that expires today. Meanwhile, the euro continues to chop within Wednesday’s range against sterling (~GBP0.8985-GBP0.9085). So far, today is the first session since late October that the euro has not traded below GBP0.9000.

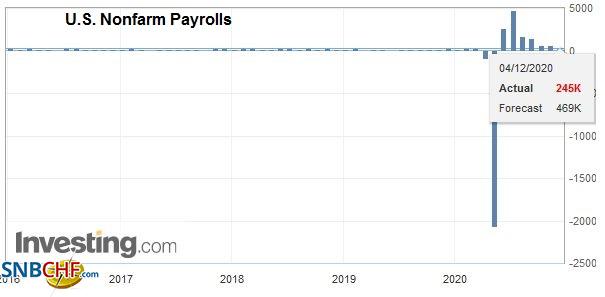

AmericaThe bipartisan stimulus package compromise appears to be drawing more support and could be the basis of a deal. The Democratic House of Representatives and the Democratic President-elect view it as a downpayment of a possibly larger package next year. However, much still depends on the outcome of the two Senate races in Georgia in early January. Both parties want to appear to be responsive to American’s plight as the virus ravages large parts of the country, and many metrics are worse than in the spring. |

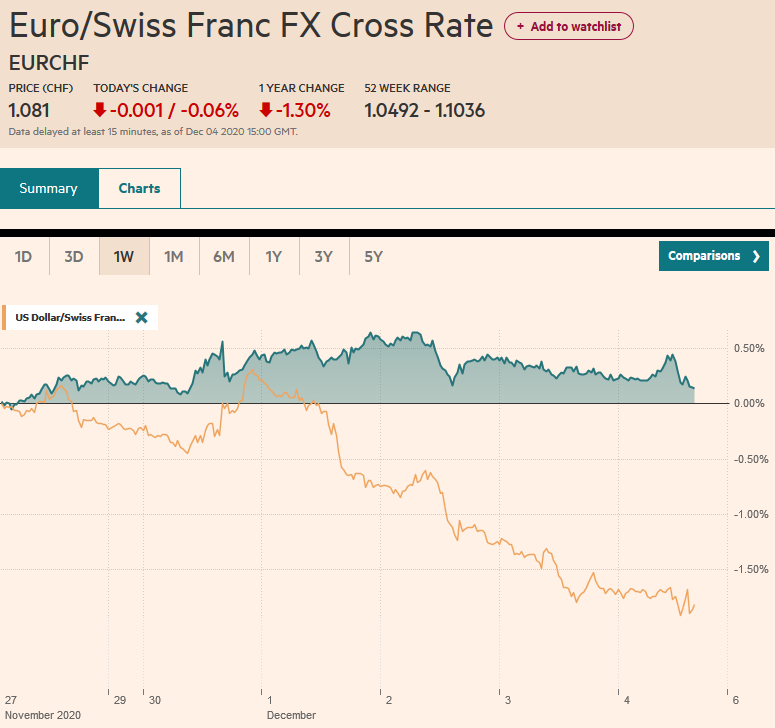

U.S. Participation Rate, November 2020(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

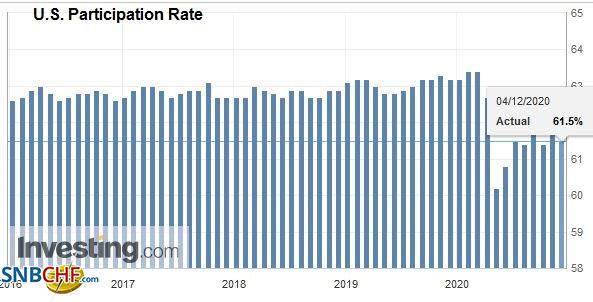

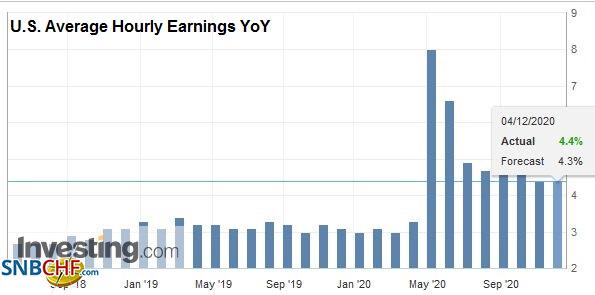

| The immediate focus today is on the jobs report. The Bloomberg survey found a median forecast of a 475k increase, including the loss of 65k government employees, largely accounted for by census workers. Our bias is a bit weaker than the median on the lower than usual holiday-retail hiring. Moreover, we suspect the risk is asymmetrical in that the markets are more likely to have a stronger response to downside surprise than a stronger than expected report. |

U.S. Nonfarm Payrolls, November 2020(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

| Given that the survey is done in the first part of the month and the virus’s surge was more a second-half of the month phenomenon, investors will likely be inclined to look past a positive surprise. |

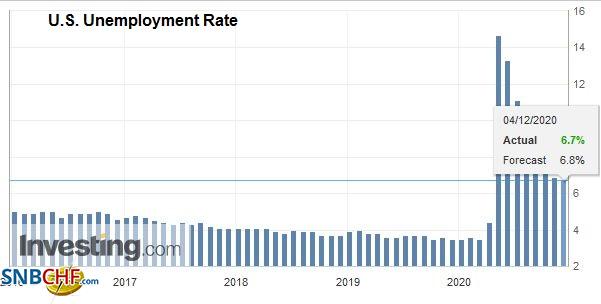

U.S. Unemployment Rate, November 2020(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge |

| The US also reports October trade (larger deficit) and factory orders (Bloomberg’s survey median forecast is for 0.8% after a 1.1% gain in September). |

U.S. Average Hourly Earnings YoY, November 2020(see more posts on U.S. Average Hourly Earnings, ) Source: investing.com - Click to enlarge |

Canada also reports November employment data and October trade figures. Canada’s job creation is slowing. After a jump of 83.6k jobs in October (69.1k full-time), economists expect a mild 20k increase, which could see the unemployment rate tick up to 9.0% from 8.9%. Canada’s trade deficit is likely to be around the C$3.2 bln deficit seen in August and September. If so, it will be about twice the October 2019 shortfall. The difference may owe more to relative price changes (e.g., the drop in oil prices) than a change in Canada’s underlying competitiveness.

That said, the Canadian dollar is trading at new two-year highs. The greenback slipped to marginally below yesterday’s low, around CAD1.2850. There is an option for $540 mln at CAD1.29 that expires today. The US dollar is about 1% lower against the Canadian dollar on the week, and it will be the third weekly loss. The low for October 2018 near CAD1.2780 may be the next target. The US dollar is also grinding lower against the Mexican peso and is at new eight-month lows (~MXN19.8250). Last week’s close was around MXN20.04. The 2020 low was set in mid-February near MXN18.5240.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,MXN,newsletter