Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we are told is the number one issue globally. You’d think that nation’s exports were crashing by 30-40% by now. Over this past weekend, the total (dollar) value of exported goods leaving China was down by 3.2% in the month of September 2019 when compared with September 2018. China Exports, 2006-2019 -

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, China, CPI, currencies, Deflation, dollar shortage, economy, EuroDollar, eurodollar squeeze, exports, Featured, Federal Reserve/Monetary Policy, global trade, imports, inflation, Markets, newsletter, overproduction, PBOC, PPI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

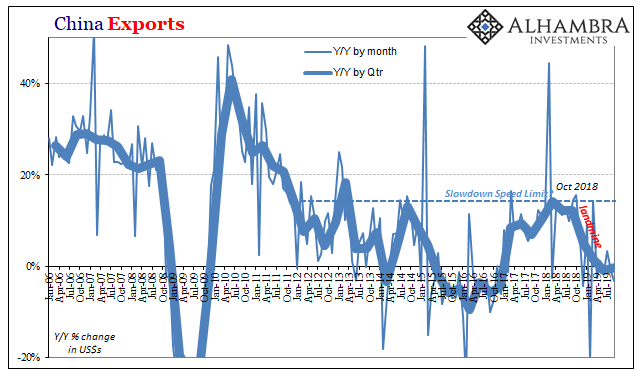

| Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs.

It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we are told is the number one issue globally. You’d think that nation’s exports were crashing by 30-40% by now. Over this past weekend, the total (dollar) value of exported goods leaving China was down by 3.2% in the month of September 2019 when compared with September 2018. |

China Exports, 2006-2019 |

| For the entire quarter, exports were basically unchanged in this year’s third quarter versus last year’s.

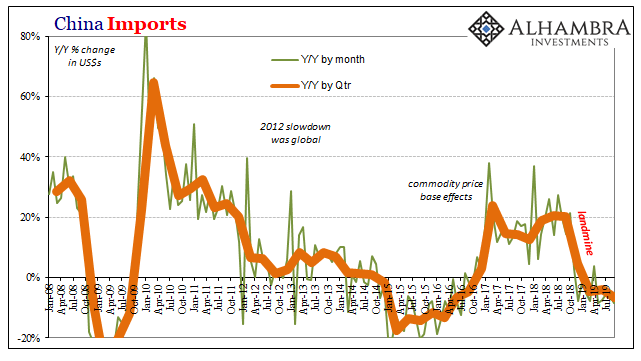

A -0.3% change is sufficiently bad on its own, though, and a relatively accurate assessment of global demand regardless of protectionism. Realistic and actual global growth would see Chinese exports churning regularly at better than a 20% rate. The downturn globally is confirmed at around zero to slightly negative. As we’ve said throughout, the world needs to pay closer attention to the other side of Chinese trade. Imports tumbled by 8.5% year-over-year last month, matching the worst slide (May 2019) in the last three years. For the third quarter as a whole, the total dollar value of goods and materials imported into China from the rest of the world fell by 6.5% from Q3 2018. It was the worst quarter since the second of 2016 – the bottom of Euro$ #3. There’s no end in sight to the negative pressures. |

China Imports, 2008-2019 |

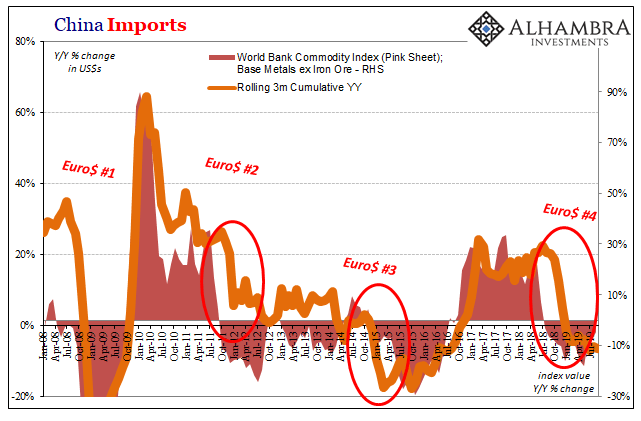

| Stimulus isn’t stimulating and China isn’t being driven down by a few billion in US tariffs on goods coming out of it. The catalytic agent for this globally synchronized downturn isn’t conveniently political.

The consequences of it are, and may still be yet. The global dollar shortage continues to squeeze China’s badly managed monetary system. The PBOC cannot gain headway because, contrary to Western imagination, Chinese technocrats are not actually patient geniuses playing some hidden long game at the rest of the world’s expense. |

China Imports, 2008-2019 |

| They are hanging on merely hoping something goes right.

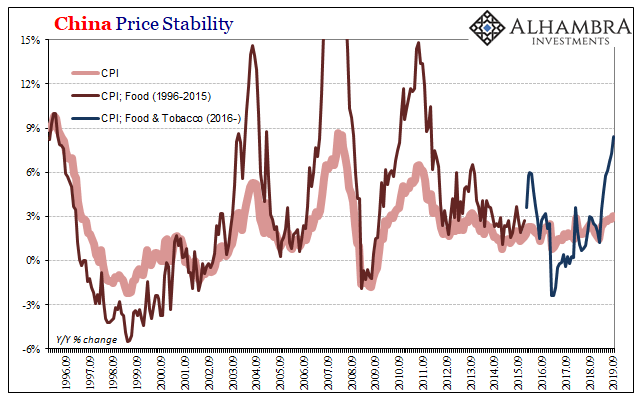

As I say, our idiots are only slightly more than theirs. And just to pour salt in the wound of China’s beleaguered consumers, which just so happens to be, in this case, everyone who eats, consumer prices have jumped thanks to mismanaged pork herds. The details are typical Communist technocrat; suffice to say, “unforeseen” shortages that are driving pork prices through the roof at the worst possible moment. China’s National Bureau of Statistics reports that food prices (combined with tobacco prices) climbed an incredible 8.4% year-over-year in September. Food prices haven’t accelerated this much this quickly since the early days of the “recovery” following the Great “Recession.” At least then it was predicated somewhat on expectations for the resumption of rapid growth. |

China Price Stability, 1996-2019 |

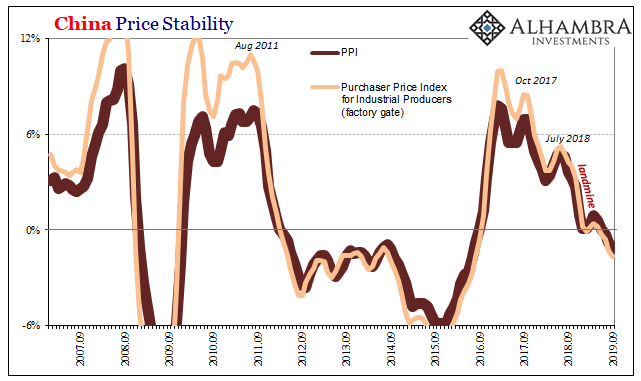

| But compare that so-called cost-push variety of inflation with what’s going on over in China’s production economy. Producer prices indicate a distinct lack of demand all over. The system is once again experiencing widespread overproduction – meaning deflation.

The country’s producer price index declined by 1.2% year-over-year last month, while factory gate prices fell by nearly 2%. These are the largest declines since 2016, further establishing this trend going the wrong way. Falling prices suggest systemic discounting which would only be necessary and necessarily prevalent under seriously weakening conditions. |

China Price Stability, 2007-2019 |

That figures with what the import data tells us. China’s growing weakness and riskiness isn’t a product of US trade policies, but it is external. As if their dollar problem wasn’t enough, now authorities have to contend with the harmful opposite in food prices.

It could not have come at a more inopportune time. Weakening economic demand plus skyrocketing costs of living all adding up together at a crucial moment in the global condition. As I wrote last week, as China goes so does everyone else down the supply chain; it’s what puts the sync in synchronized downturn.

The global system had already turned before anyone was speaking the language of protectionism. The eurodollar squeeze was in play and had created noticeable global disruptions by the time anyone at the IMF or anywhere else finally noticed them. Which is a shame because in that October 2018 WEO the organization actually mentioned it – “tighter financial conditions” – even if incorrectly attributing the negative factor to “rate hikes” rather than the growing global dollar shortage.

What that means is relatively simple. Euro$ #4 is still there, it keeps going even though it’s nearly two years old already. In many important ways, as noted with this morning’s US retail sales figures, it may be just getting started.

Tags: China,CPI,currencies,Deflation,dollar shortage,economy,EuroDollar,eurodollar squeeze,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,inflation,Markets,newsletter,overproduction,PBOC,PPI