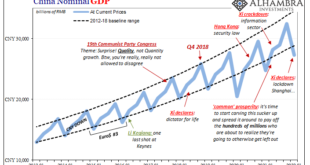

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth. Xi Jinping saw how a very different post-2008 global economy without any recovery was going to...

Read More »China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

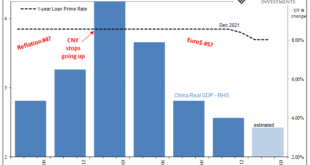

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated. The FOMC will vote to raise the federal funds range (and IOER plus RRP) for the first time since December 2018 Over in China, however, it’s nearly certain to be the opposite....

Read More »Second Wave Global Trade

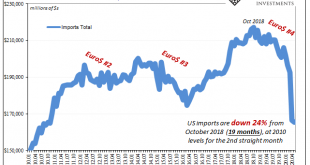

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »No Flight To Recognize Shortage

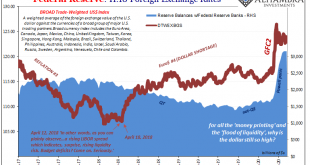

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New...

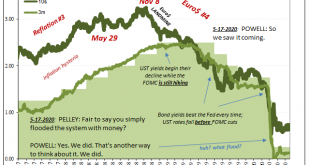

Read More »So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal. That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism. For two years...

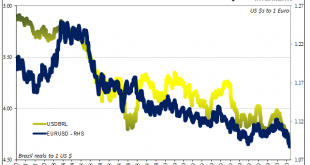

Read More »You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes. There were rumors that Banco (central) do Brasil was intervening or was going to intervene in its local currency markets, which may be an important signal. More of swaps that aren’t really currency swaps (which you can read about...

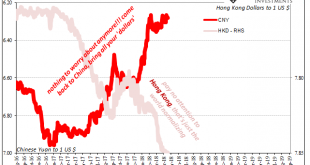

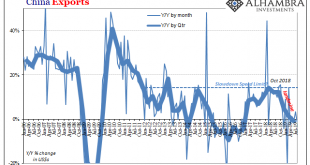

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

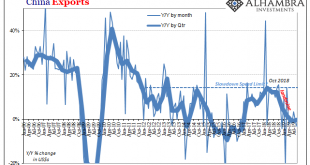

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

Read More »Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness. That’s why in early 2016 authorities...

Read More »Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org