Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi was at pains to describe the 1.7% median projection for 2020 inflation as consistent with the ECB’s target of “below, but close to 2% over the medium-term”. Although we certainly did not expect the ECB to claim victory that early, Draghi could have been more

Topics:

Frederik Ducrozet considers the following as important: ECB staff forecasts, ECB staff projections, Euro area GDP growth, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.

The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi was at pains to describe the 1.7% median projection for 2020 inflation as consistent with the ECB’s target of “below, but close to 2% over the medium-term”. Although we certainly did not expect the ECB to claim victory that early, Draghi could have been more explicit using the same staff projections.

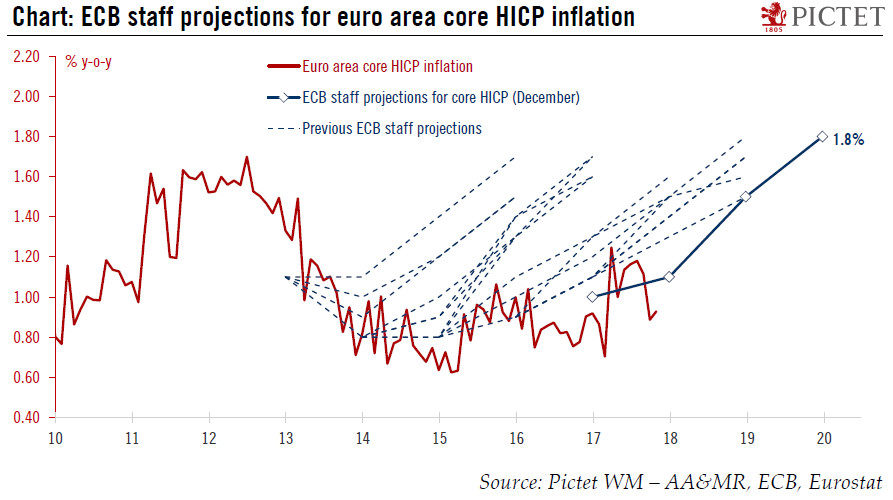

First, the detailed staff forecasts are consistent with headline inflation reaching 1.8% in H2 2020. Second, core inflation is projected at 1.8% on average in 2020, implying a much steeper convergence path toward the target given the lower starting point for core HICP, at 1.0% in 2017 and 1.1% in 2018. Meanwhile, wage growth was revised higher, up to 2.7% in 2020, the highest in almost a decade, reflecting the ECB’s confidence in the Phillips curve, as unemployment is expected to decline to 7.3% in 2020.

Based on our forecasts of a rebound in cyclical inflation in H1 2018, we expect the ECB staff to slightly upgrade their 2018-19 projections for core inflation at the March meeting. This would likely support further hawkish adjustments in the ECB’s forward guidance, starting with the infamous de-linking between QE guidance and the inflation outlook in March, and culminating with a tapering announcement which we expect to be made in summer 2018.