Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods. Thus, most kinds of turmoil are noticeable. Most. My own brief survey of this morning’s news from Asia seems to suggest mainstream opinion coalescing on PBOC Governor Zhou Xiaochuan for the blame in Hong Kong. The central banker published an unscheduled post at the bank’s website that was a bit more profound and direct than is typical. Anything is possible, but HKD turmoil that nobody seems to care

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Fixed Asset Investment, currencies, Dollar, economy, EuroDollar, eurodollar decay, Featured, Federal Reserve/Monetary Policy, hibor, Hong Kong, Markets, newsletter, PBOC, pboc balance sheet, RMB, Zhou Xiaochuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods. Thus, most kinds of turmoil are noticeable. Most.

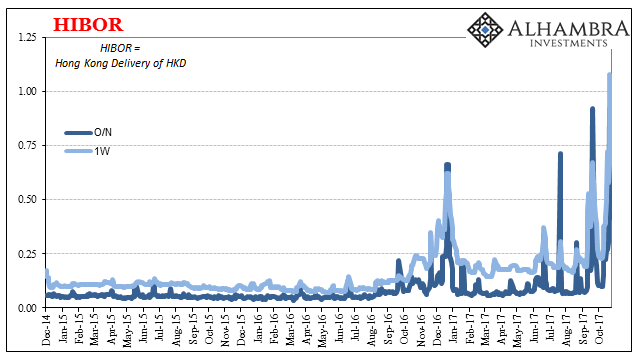

My own brief survey of this morning’s news from Asia seems to suggest mainstream opinion coalescing on PBOC Governor Zhou Xiaochuan for the blame in Hong Kong. The central banker published an unscheduled post at the bank’s website that was a bit more profound and direct than is typical. Anything is possible, but HKD turmoil that nobody seems to care about would be a more likely cause in my view. |

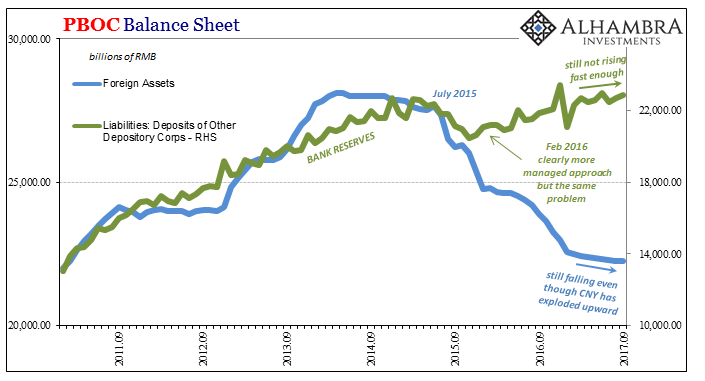

PBOC Balance Sheet, Sep 2011 - 2017(see more posts on pboc balance sheet, ) |

Still, Zhou’s sudden essay that appeared on Saturday, the day after some real fireworks in Hong Kong money, should stir some serious global reflection. To start with, this isn’t the first time China’s central bank chief has made a cryptic warning of sorts. In early 2014, he was especially blunt about the situation then facing China.

|

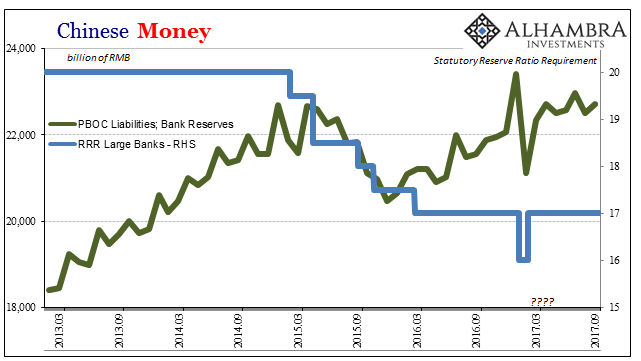

Chinese Money, March 2013 - Sep 2017 |

| The tone of his message was such that it almost seemed Zhou was thinking about China’s big problem as an externality. At the very same moment the Western media was, but of course, still describing the PBOC under his leadership in near omniscient terms, so his statement stood out against the dominant groupthink.

To me, it was a pretty clear message that the PBOC was instead quite worried. As I wrote a few days later in April 2014:

|

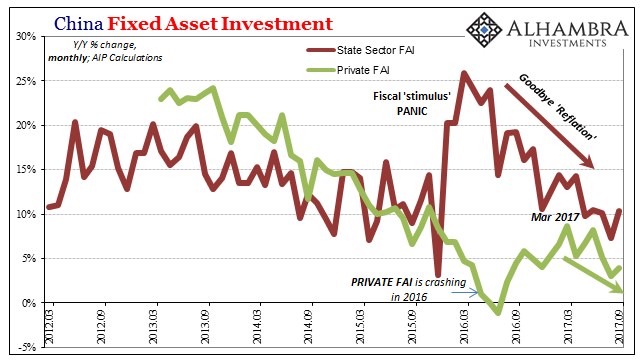

China Fixed Asset Investment, March 2012 - Sep 2017(see more posts on China Fixed Asset Investment, ) |

| The true extent of the PBOC’s power outside public imagination was, and is, especially limited. Let’s be clear, what followed as the “rising dollar” proved Governor Zhou’s warning quite prescient. China’s economy tumbled toward a “hard landing” (and that is still a legitimate possibility even today), only cushioned in early 2016 when the PBOC and the rest of the Communist government finally acted in response to a true externality.

So what does Zhou have to say this time? Quite a bit, as it turns out, including a lot that he has already said before. Unlike Western central bankers, the PBOC head isn’t afraid to use the term “bubble”, or whatever the Chinese word might be for it. China has a debt problem, a macro leverage ratio of 247% (that we know of) Governor Zhou was careful to highlight. So much leverage and debt, however, are symptoms of other imbalances. His essay was pointed in describing the PBOC’s tasks in those terms, “prevention and control of financial risks should be based on both the symptoms and the root cause, taking the initiative to attack and defend and actively respond to both.” |

China HIBOR, Dec 2014 - Oct 2017(see more posts on hibor, ) |

If high leverage and bubbles are the symptoms, what is the root cause? That he doesn’t tell us explicitly, but it doesn’t take a whole lot to guess. Again, the way it is all written (and I am assuming it’s the same in Chinese as the English version) is as a warning for something else that’s out there with the potential to do grave harm to China and the rest of the world.

You can make up your own mind about the timing of this piece, especially the part quoted above in relation to Hong Kong. To my mind it is every bit as peculiar and fitting as Zhou’s 2014 statement, particularly given the context of what was actually going on at the time – which was the opposite of conventional thinking. |

China's Dollars, Aug 2016 - Oct 2017 |

| After all that has taken place via Hong Kong and “dollars” the past few months, a warning of this sorts from the PBOC’s top official could be a profound statement of “it’s not our fault.” This is especially possible given the reference to China’s “high-risk prone period” due to “multiple factors at home and abroad.” |

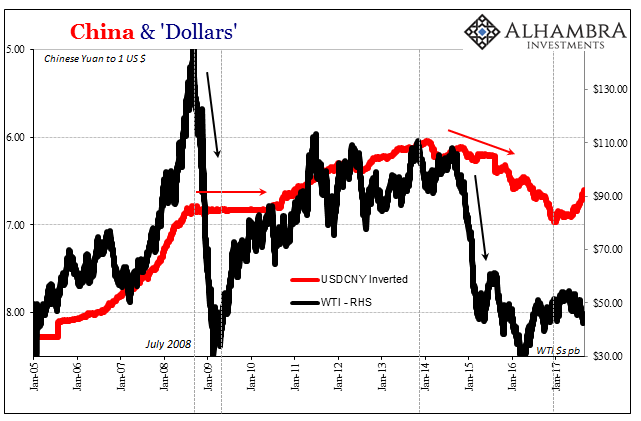

China and Dollars, Jan 2005 - 2017 |

| After all, all those bubbles and leverage channels were created originally in response to that one foreign factor that showed up for China in July 2008 – and then never left. |

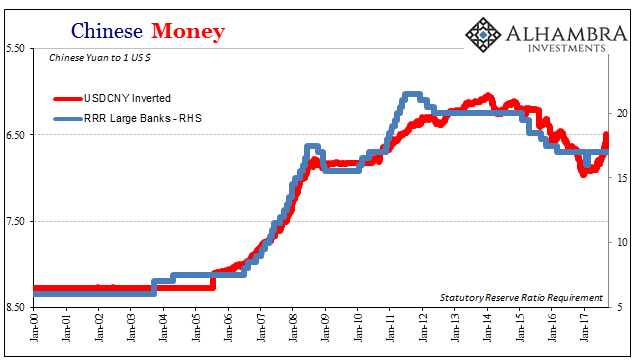

Chinese Money, Jan 2000 - 2017 |

The Hong Kong element is simply the latest in a long line of PBOC and overall Chinese efforts to deal with what is for them a truly exogenous element. Unless and until they can extricate themselves from this situation, risks of a “black swan” or “grey rhino” can only remain quite high. I have no doubt that is what Zhou was saying in that poignant passage; until they get out of the eurodollar, they are stuck with the huge risks of a malfunctioning global system that initially caused them to go nuts (bubbles) thinking it was all a temporary problem or setback.

And unlike how that central bank is still characterized, the PBOC is essentially powerless, or at least far less powerful than is widely believed, to do something about it. That was certainly proved under the “rising dollar.”

Though that one specific period of eurodollar decay may have come to an end, the eurodollar decay itself grinds on forever forward – as we see in China now via Hong Kong. They are feverishly working on several ways to get around the “dollar” but until those (RMB internationalization) actually become workable to a sufficient scale the Chinese system is particularly vulnerable. And that may be a day farther off into the future than anyone would like (largely because Western central bankers are all focused on everything but dollars).

Maybe Governor Zhou just wanted to update the world as to the PBOC’s situation after the 19th Communist Party Congress concluded. Or, like 2014, maybe he isn’t nearly as confident as he is often portrayed. For good reason.

Tags: $CNY,China Fixed Asset Investment,currencies,dollar,economy,EuroDollar,eurodollar decay,Featured,Federal Reserve/Monetary Policy,hibor,Hong Kong,Markets,newsletter,PBOC,pboc balance sheet,RMB,Zhou Xiaochuan