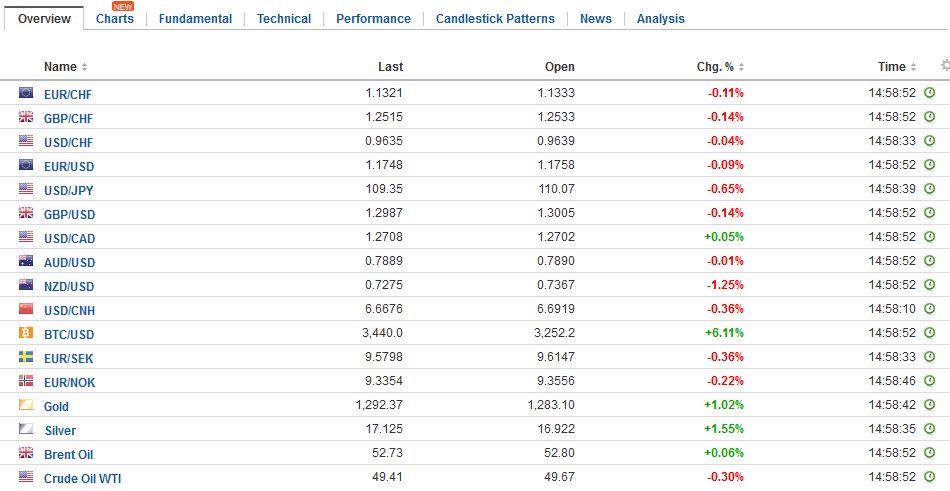

Swiss Franc The euro has depreciated by 0.13% to 1.1312CHF. EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The net impact is to lift the US dollar, yen and gold. The geopolitical tensions saw more profit-taking in equities. Debt markets are little changed, but the US Treasuries area a little firmer. We suspect that like yesterday, North American participants are likely to unwind some of the anxiety-led price action. Some suspect that the US rhetoric is aimed at putting more pressure on China, but others appear to see the US visceral response as part of the current administration’s modus operandi. There is a search for historical parallels,

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, french, FX Trends, GBP, Japan Core Machinery Orders, Japan Producer Price Index, JPY, Korea, newslettersent, NZD, SPY, TLT, U.K. Construction Output, U.K. industrial production, U.K. Manufacturing Production, U.K. trade balance, U.S. Core Producer Price Index, U.S. Initial Jobless Claims, U.S. Producer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe euro has depreciated by 0.13% to 1.1312CHF. |

EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe net impact is to lift the US dollar, yen and gold. The geopolitical tensions saw more profit-taking in equities. Debt markets are little changed, but the US Treasuries area a little firmer. We suspect that like yesterday, North American participants are likely to unwind some of the anxiety-led price action. Some suspect that the US rhetoric is aimed at putting more pressure on China, but others appear to see the US visceral response as part of the current administration’s modus operandi. There is a search for historical parallels, and although many suggest the Cuban Missile Crisis, we suggest a more apropos precedent is Iran. Still, some recall Nixon’s “madman theory,” which is essentially keeping one’s adversary off balance by having them think that one is unpredictable and is capable of anything. Meanwhile, the Canadian dollar has fallen out of favor. Recall it fell every day last week and is off for the third day (0.2%) this week. The US dollar is at its best level in nearly a month (~CAD1.2735). Near-term potential extends toward CAD1.2770-CAD1.2810). The Australian dollar is consolidating within yesterday’s ranges, but it looks poised to retest yesterday’s highs near $0.7920. |

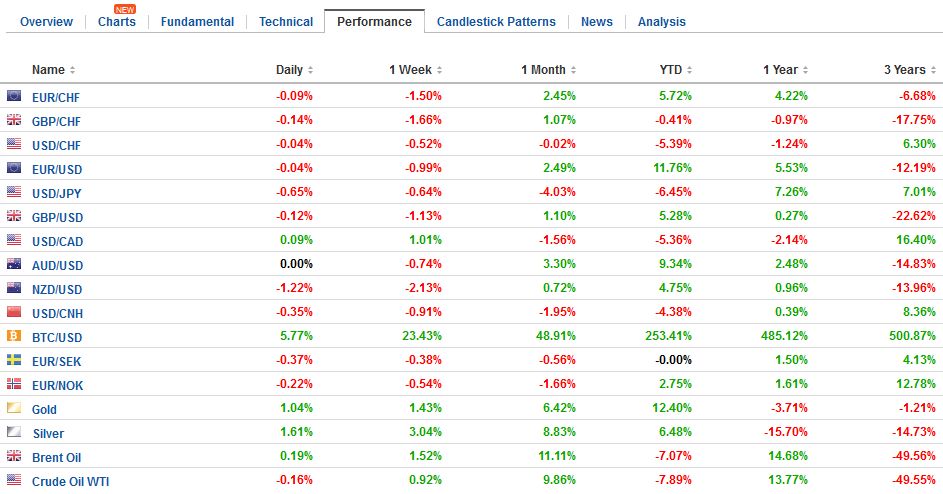

FX Daily Rates, August 10 |

| The euro seems to be in nearly a cent range–$1.1680-$1.1770. There are 515 mln euro options struck at $1.17 that expire today. A break of $1.1680 would target $1.16. The dollar also appears to be confined to a little less than a big figure against the yen (~JPY109.50-JPY110.40). A break of JPY109.40 would target JPY109. Sterling has flirted with the week’s low near $1.2950. Additional support is seen near $1.2930, which is a retracement objective of the rally since late June, and a convincing break could spur another cent decline. There are options struck at GBP0.9050 (~612 mln euros) that will be cut today.

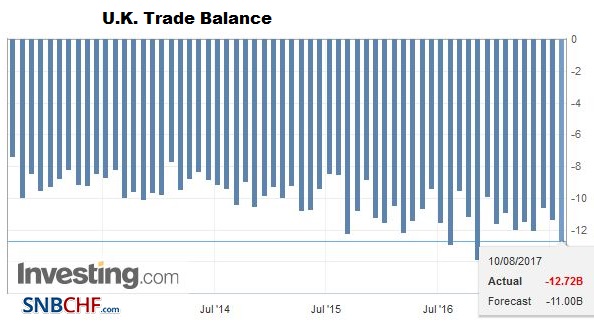

The debt markets are narrowly mixed. Most European 10-year benchmark yields are a little firmer, and the two-year sector yields are edging higher as well, which is producing a minor bearish flattening of the curve. US yields are a fraction softer. Gold reached almost $1280 yesterday, and the attempt to extended the gains today appears to be fizzling in the European morning. Separately, the UK reported that its trade balance deteriorated in June. The visible deficit (merchandise) increased to GBP12.7 bln from GBP11.3 bln in May. The overall deficit (combines with service surplus) was GBP4.56 bln from GBP2.51 bln in May. UK exports (volume) was off by 0.7%, while the total value was off 2.8%. Imports rose 3.3%. The J-curve effect whereby a depreciating currency first causes deterioration in the trade balance before improving is thought to be nearly over. The weakness of sterling (even if not against the dollar) is expected to generate import-substitution behavior by consumers and businesses, and this was picked up in the recent BOE recent agent survey. |

FX Performance, August 10 2017 |

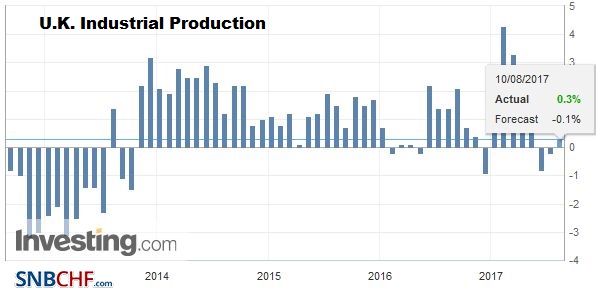

United KingdomThe UK reported better than expected industrial output figures but the impact on Q2 GDP estimates is minor. Industrial output rose 0.5% instead of 0.1% as many economists expected. The May series was revised from-0.1% to flat. The year-over-year rate stands at 0.3%. In May it was -0.2%. However, the rise in UK industrial output was a bit of a fluke. |

U.K. Industrial Production YoY, June 2017(see more posts on U.K. Industrial Production, ) Source: investing.com - Click to enlarge |

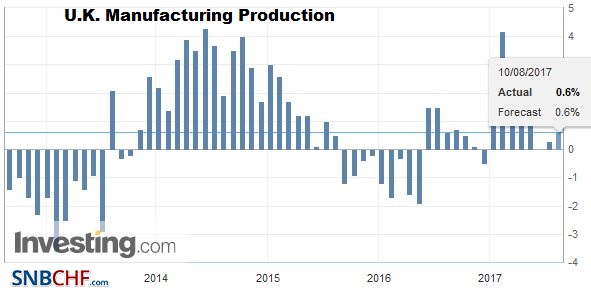

| Manufacturing output was flat, and the fact that the North Seas producers did not shut for the normal summer maintenance appeared behind the better report. Vehicle production fell 6.7%, the largest drop in 3.5 years. |

U.K. Manufacturing Production YoY, June 2017(see more posts on U.K. Manufacturing Production, ) Source: investing.com - Click to enlarge |

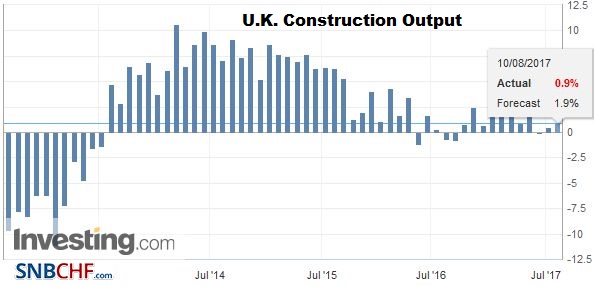

| Construction output fell 0.1.%. The median forecast in the Bloomberg survey was for a 1.4% gain. On the other hand, the May series was revised to show a 0.4% decline rather than the original 1.4% fall. |

U.K. Construction Output, June 2017(see more posts on U.K. Construction Output, ) Source: investing.com - Click to enlarge |

U.K. Trade Balance, June 2017(see more posts on U.K. Trade Balance, ) Source: investing.com - Click to enlarge |

|

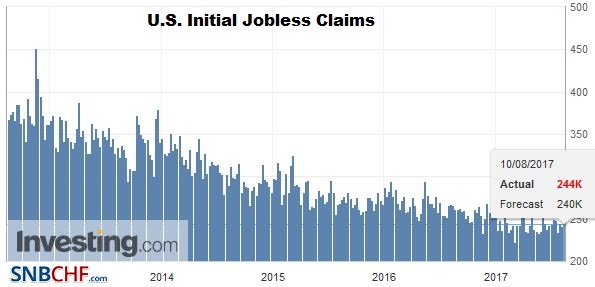

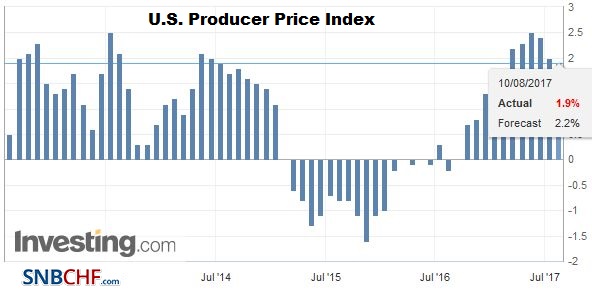

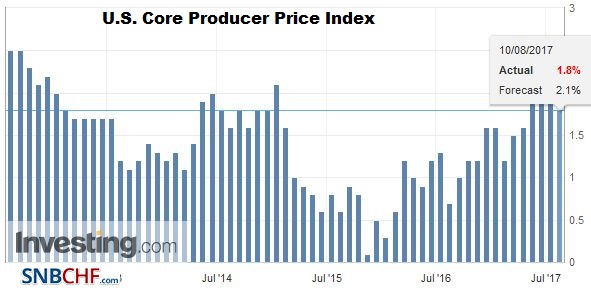

United StatesThe US weekly initial jobless claims and producer prices are not the stuff that typically moves the global capital markets. Keen interest today is in NY Fed’s Dudley press briefing at 10:00 ET. To the extent Dudley speaks about policy, we would expect further indication that the Fed is prepared to announce its balance sheet operations at the September FOMC meeting to begin in October. He had indicated earlier this year that the Fed might pause its rate hike around the time that it balance sheet operations would begin. This seems to be consistent with a range of Fed official comments. After hiking rates in March and June, there is no urgency for a third move. Firmer (core) inflation in the coming months would allow a December hike. |

U.S. Initial Jobless Claims, August 10 2017(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

U.S. Producer Price Index (PPI) YoY, July 2017(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

|

|

|

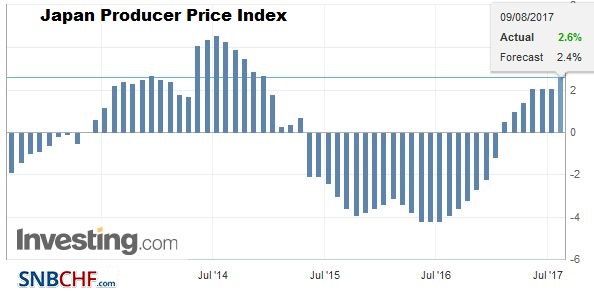

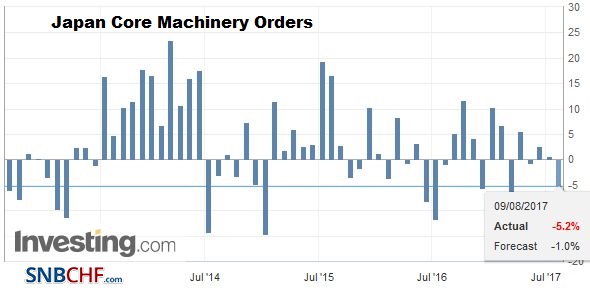

Japan |

Japan Producer Price Index (PPI) YoY, July 2017(see more posts on Japan Producer Price Index, ) Source: investing.com - Click to enlarge |

Japan Core Machinery Orders YoY, June 2017(see more posts on Japan Core Machinery Orders, ) Source: investing.com - Click to enlarge |

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week’s time. This, in turn, brought fresh condemnation in from Japanese and Korean officials.

In any event, South Korea bears the brunt of the adjustment. The Korean won fell nearly 0.6% following yesterday’s 0.9% slide. It is the third day this week that the won fell and it is set to extend its down draft for the fourth week. For the better part of the past six months, the dollar has traded between KRW1110 and KRW1160. At the end of July, the greenback tested the lower end of the range. Near KRW1142, it has approached levels last seen in early July.

Part of the pressure stems from foreign investors selling Korean shares. The Kospi fell 0.4% for its third consecutive loss. Its loss this week of about 1.5% is minor. Foreign investors sold about $230 mln of Korean shares today after selling $270 mln yesterday. Still, we note that the Kospi recovered in late dealing that pared its losses by nearly 2/3 before the close.

Hong Kong and Taiwan shares fell more than Korea today, losing 1.1% and 1.3% respectively. The MSCI Asia Pacific Index fell a little less than 0.5%, on par with Wednesday’s loss as well. It has gained once (Monday) in the past five sessions. European markets are also modestly lower. The Dow Jones Stoxx 600 is off about 0.3%, led by energy and materials. It fell nearly 0.75% yesterday.

Of the major currencies, the New Zealand dollar has been the hardest hit. It is off just shy of 1% as the market responded to stepped up the warning by the central bank. After leaving rates on hold, as widely expected, RBNZ officials said that a weaker currency was “needed.” Last time, officials said a weaker currency would be “helpful.” There is some thought that the rhetoric was a prelude to intervention. The New Zealand dollar is recording a large outside day and a close below yesterday’s low (~$0.7310) is needed. We see near-term potential extending toward $0.7200.

France

France and the UK reported industrial production data for June. France disappointed. French industrial output fell 1.1% in June, while the median Bloomberg forecast was for a 0.6% decline after May’s 1.9% gain. It suggests a possible loss of momentum at Q2 drew to a close and is consistent with the July PMI that showed a slower start to Q3. Although it has not emerged as a market factor, we think Macron’s waning support (below US President Trump’s support in the US) is important. It will impact Macron’s ability to push his reform agenda, which we note that his two predecessors were also stymied in their reform efforts. It will also impact the Franco-German relations after next month’s German elections 2%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Featured,french,Japan Core Machinery Orders,Japan Producer Price Index,Korea,newslettersent,NZD,SPY,U.K. Construction Output,U.K. Industrial Production,U.K. Manufacturing Production,U.K. Trade Balance,U.S. Core Producer Price Index,U.S. Initial Jobless Claims,U.S. Producer Price Index,USD/CHF