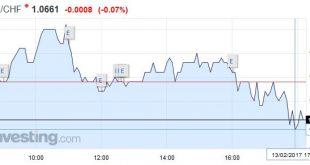

Swiss Franc EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with...

Read More »FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Summary: Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen’s testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump’s upcoming speech to Congress. There is a lull in the maelstrom launched by the Trump Administration. His ban on...

Read More »The Dollar’s Underlying Trend Resumes

For the last several weeks, we have been looking for the dollar correction that began around the Fed’s rate hike in the middle of December to be completed and for the uptrend to resume. The precise timing of the turn is difficult to get right, but our view is anchored by our macroeconomic assessment and is understanding of the key drivers. Our technical work suggests the dollar indeed has been carving out a bottom, and...

Read More »FX Daily, February 10: US Dollar Holding on to Week’s Gains

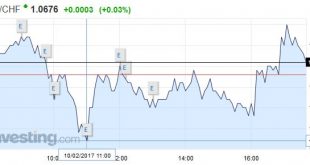

Swiss Franc EUR/CHF - Euro Swiss Franc, February 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling vs the Swiss Franc has been climbing recently as the Brexit talks appear to be going the right way at the moment. The talks are progressing and it has been confirmed that the government will be allowed to vote on the final agreement prior to the triggering of Article 50. The Pound is still under huge...

Read More »Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro’s outlook and whether the US should have a strong or weak dollar.I sketch out my idea that the (upside) correction in the euro began in mid-December around following the Fed’s hike. Over the last couple weeks, I have been...

Read More »FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

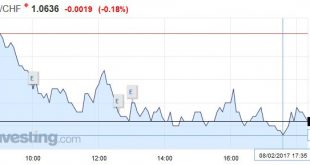

Swiss Franc EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) - Click to enlarge Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently...

Read More »Is a Strong or Weak Dollar Good for the US? The $16 trillion Question

Summary: Dollar movement helps some economic interest and hurts others. From a strategic point of view, the best thing for the US is the market-generated rate. It was an important achievement that the forex market was de-weaponized. Many observers have been crying wolf about a currency war for many years, which may have de-sensitized investors to the threat of a real one. Reports suggest that recently President...

Read More »Cool Video: Around the World with Katie Martin of the Financial Times

Katie Martin and Marc Chandler I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs. Often I...

Read More »FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by...

Read More »The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations. Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan’s consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org