Summary: Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust. The US 10-year yield is at its highs for the year, and yet the US dollar has been struggling to gain traction.Some suggest that this means that the dollar rally is over. Charts like this one are circulating among market participants. This Great...

Read More »FX Daily, January 26: EUR/CHF collapses to 1.670

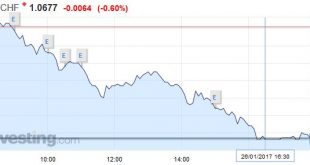

Swiss Franc The euro collapsed today, both against USD and CHF. One reason might be the new record for Swiss exports and for the Swiss trade balance. EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) - Click to enlarge Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here? The Pound has continued to climb throughout the week, after it was...

Read More »FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

Swiss Franc EUR/CHF - Euro Swiss Franc, January 25(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF The pound is higher against the Swiss Franc as we finally get some clarity over just what Brexit means. The pound was initially expected to fall but contrary to popular expectation it found favour as Theresa May finally delivered some clarity over just what Brexit means. Most...

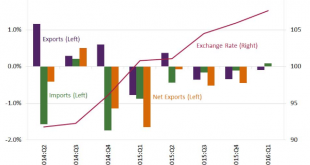

Read More »Great Graphic: How a Strong Dollar Weighs on Net Exports

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar’s appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP. It is clear that a strong dollar in this period was associated with a drag on growth from net...

Read More »FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

Swiss Franc EUR/CHF - Euro Swiss Franc, January 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration’s economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European...

Read More »FX Weekly Preview: The Challenging Week Ahead

Summary: Investors will finally be able to focus on what the new US President does rather than what he says. The UK Supreme Court decision is expected, but it may not be the driver than it may have previously seemed likely. The dollar-yen rate does not appear to be driven by domestic variable as much as US yields and equities. Prices not real sector data may be the key for the euro. United States The US...

Read More »Cool Video: Bloomberg’s Daybreak – Dollar Correction

Marc Chandler - Click to enlarge I was on Bloomberg’s Daybreak: Americas today. The issue at hand was about the dollar’s losses since the start of the year. I suggest that the correction actually began a day or so after the Federal Reserve hiked rates in mid-December. I noted that the correction was not just about the dollar but also interest rates. I suggest that interest rates are still key. The US 10-year yield...

Read More »FX Daily, January 20: Trump Day

Swiss Franc EUR/CHF - Euro Swiss Franc, January 20(see more posts on EUR/CHF, ) - Click to enlarge The Pound has recovered some its losses from early last week following the speech made by Prime Minister Theresa May which covered the Brexit issue. We could see further volatility going into next week though when the Supreme Court judgement is due to be released. Theresa May has already announced that she will...

Read More »Great Graphic: Trade and Tariffs-End of an Era?

This Great Graphic was tweeted by the Financial Time’s John Authers, who got it from @fathomcomment. The green line is the inversion of global trade (right-hand scale). The blue line is a trade-weighted average global tariff rate. What the chart shows is that since 1990, the decline in the average tariff coincided with an increase in trade (remember green line is inverted). However, the as chart illustrates, around the...

Read More »Draghi Lets Steam out of Euro

Summary: US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration. The combination of stronger US economy data and a dovish Draghi has seen the US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org