Swiss Franc The Euro has fallen by 0.09% to 1.1531 CHF. EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September’s...

Read More »FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

Swiss Franc The Euro has fallen by 0.11% to 1.1505 CHF. EUR/CHf and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The most important development today has been the stability in the equity markets after last week’s meltdown. The recovery from new lows in the US before the weekend set the tone for today’s moves. Tokyo markets were on holiday, and the...

Read More »FX Weekly Preview: Recovering from Too Much of a Good Thing?

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded...

Read More »FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

Swiss Franc The Euro has risen by 0.38% to 1.1502 CHF. EUR/CHF and USD/CHF, February 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude...

Read More »Great Graphic: FX Vol Elevated, but Still Modest

Summary: FX implied vol bottomed before the VIX took off. FX vol is at the highs for the year, but euro and yen vol is lower than last September. Sterling vol has risen the most. With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be...

Read More »FX Daily, February 08: Dollar Firms, While Equities Search for Stability

Swiss Franc The Euro has fallen by 0.43% to 1.152 CHF. EUR/CHF and USD/CHF, February 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the...

Read More »FX Daily, February 07: Guns and Butter May Resolve US Legislative Logjam

Swiss Franc The Euro has risen by 0.18% to 1.1602 CHF. EUR/CHF and USD/CHF, February 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a volatile session in North America, the major equity indices closed higher. In fact, the 1.75% rise in the S&P 500 was the best since November 2016. Asian equities stabilized, and the MSCI Asia Pacific Index was able to eke out...

Read More »Cool Video: Bloomberg Double Feature–BOE Meeting and the Yield Curve

- Click to enlarge The Bank of England meets tomorrow. Although no one expects a move, it has little to do with the recent market volatility. The FTSE 100 is poised to snap a six-day 7%+ slide. The FTSE 250 fell for seven consecutive sessions through yesterday, shedding 5.75% in the process. The UK’s 2-year yield slipped about seven basis points from last week’s close to58 bp before recovering to 63 bp today,...

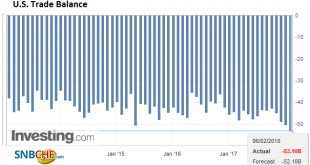

Read More »US Trade Balance is Deteriorating, Despite Record Exports

Summary: The U.S. 2017 trade deficit was the largest since 2008. U.S. goods exports hit a record. There has been substantial improvement in the U.S. oil trade balance. The US trade deficit swelled in December, and the $53.1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of $566 bln, the largest...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org