Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded products and futures contracts. There was a broadly similar evolution in Europe, though there appears to have been greater restrictions (protections) for retail investors. Some vehicles also allowed investors enhanced leverage, which acts like a force multiplier. The particular spark that ignited the dry

Topics:

Marc Chandler considers the following as important: $CNY, Brexit, EUR, Featured, Fiscal, FX Trends, Germany, Italy, Japan, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application.

The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded products and futures contracts. There was a broadly similar evolution in Europe, though there appears to have been greater restrictions (protections) for retail investors. Some vehicles also allowed investors enhanced leverage, which acts like a force multiplier.

The particular spark that ignited the dry tinder of market positioning may very well have been the jump in US hourly earnings reported with the January employment data on February 2. Even though some questions have been raised about possible distortions, if it was not this spark it would have been another. There was a stretch of around 400 days without a five percent correction in the S&P 500. The longer it took, the greater the positions betting that it would continue, the larger the shock, the greater the drama.

Stability leads to instability. The long stretch of low volatility led to the historic jump in volatility as if the music of the financial instruments created an echo-chamber like a horror house.

It is not very pretty, and quite painful for many, but this is how the markets mature. In this sense, what has happened is much more like the 1987 stock market crash than the 2008-2009 brutal bear market. Then it as was “portfolio insurance” that was said to have created that echo-chamber. Going forward, this experience will likely shape debates about circuit breakers and appropriateness of products for individual investors.

The most important driver of the week ahead is whether the pre-weekend price action in the US stock market signals that we have emerged from this nail-biting echo chamber. The price action was encouraging. The market dropped to new lows before staging a strong recovery and close near the session highs which were recorded in late dealings. The S&P 500 approached the 200-day moving average, which has often provided support in this multi-year bull market after meeting the oft-used definition of a correction (-10% from peak).

If the equity markets stabilize, then it will be easier to make sense of what is happening to interest rates. The rise in hourly earnings ostensibly raised inflation risks and spurred the sell-off in bonds. Many observers are emphasizing the importance of the January CPI report due Wednesday. The base effect is strong, which means that the year-over-year pace of both the headline and core are likely to have eased.

Measures of inflation expectations are flawed for one reason or another. With that caveat in mind, using the market-based measures (like the five-year/five-year forward or the 10-year breakeven), it appears that real rates went up more than the inflation premium. An alternative narrative to the inflation-scare is the supply-scare.

Avoiding the politically-charged rhetoric like the plague, US fiscal policy is easing aggressively pro-cyclically, which is to say, while the US economy is already expanding at a pace that appears somewhat above trend. Rather than follow-up the tax cuts with spending reform, the US has now lifted the spending caps on both defense and non-defense spending by a little more than $200 bln over the next two years and provides an additional $90 bln for disaster relief. On top of these, the new infrastructure initiative is expected to be unveiled in the coming days.

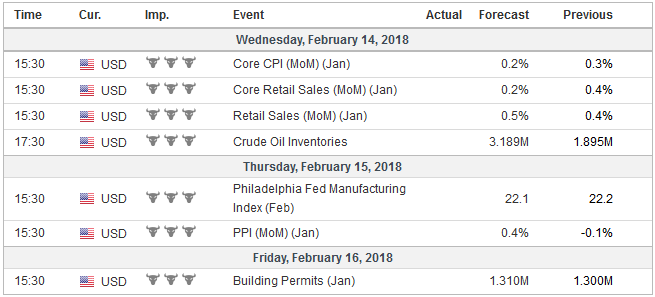

United StatesThe US Treasury issuance was set to at least double this year. One of its largest buyers, the Federal Reserve, has already announced it would be buying $420 bln less than last year. The cost of hedging and reserve management decisions may also deter other buyers, which might not be offset by demand from oil exporters. Without exaggerating the significance, last week’s quarterly refunding, which took place while emersed in the echo-chamber, saw a lukewarm reception, at best. The lifting of the debt ceiling will allow the US Treasury to issue $300-$400 bln of T-bills, replenishing what was drawn down to stay within the cap. The dollars will reduce amount sloshing around the plumbing of the international capital markets. The cross currency swap market should show the greater premium will be paid to secure dollar funding. We have anticipated that this would be a dollar-positive development in the spot market, though the relationship is not always straightforward. At the same time, investors get updates on two sectors that were particularly strong in Q4 17 consumption and industrial output. Headline retail sales may have slowed to 0.2%. Note that it rose by an average of 0.7% a month in Q4 a 0.8% average in Q3. These are unusually strong readings and simply cannot be sustained. That said, GDP-component may have slowed after averaging 0.75% in Q4 but may remain elevated near Q3’s average monthly of 0.5%. The strength of the US industrial sector is not fully appreciated. At an annualized pace, its exceed 8.5% in the last three-months of 2017. It was the best quarter in seven years. The recovery from the storm provided extra demand. It is likely to have begun normalizing with a monthly gain of around 0.2% in January. Manufacturing had eked out a modest 0.1% gain in December, which may overstate the slow. The market is looking for a 0.3% increase, which would still be a touch less than January 2017. Still, overall the US growth impulses appear to be carrying over into 2018, though important trade and inventory data are not available. The first look at February comes from the Empire and Philly Fed surveys due in the week ahead. The Atlanta Fed GDPNow sees the US economy tracking 4.0% annualized growth in Q1, while the NY Fed’s model is at 3.3%. |

Economic Events: United States, Week February 12 |

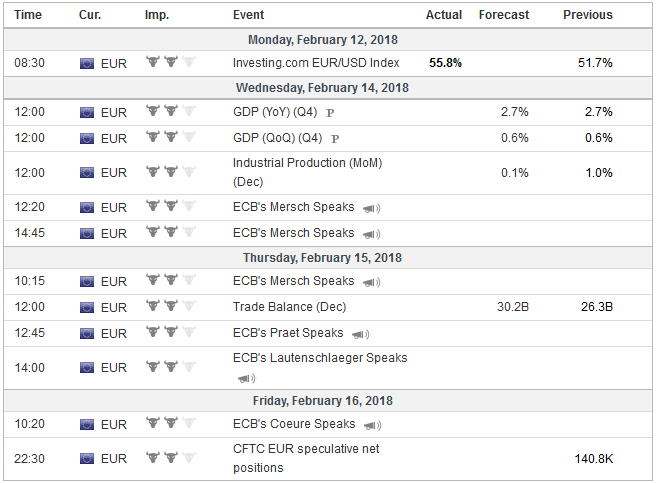

EurozoneEurope will update its preliminary Q4 GDP report and more country-level details will be available. If there is a risk it is that GDP gets revised higher from the initial estimate of a 0.6% quarterly expansion. For many investors, the near-term dynamic is about the impact of the changes in oil prices and the euro for changes in the ECB’s staff inflation forecasts in a few weeks. The decline in oil prices has brought the June Brent back to around where it was for the last staff forecasts, while the euro around four percentage points stronger on a trade-weighted basis. We detect a shift in expectations among many investors. Previously, many had seemed to believe that the ECB would end its purchases when the current program ends in September. However, now, with the encouragement of even some of the (perceived) more hawkish members, it seems that many now accept that the purchases will likely be gradually tapered than stopped cold. There is an important difference between cutting from 60 bln euros a month to 30 bln a month in purchases than going from 30 bln to none. One implication of this is there is scope for further compression of peripheral European yields and German Bunds. That said, two political risks now loom ahead. First, the one every has in their diary is the Italian election on March 4. The center-right bloc, led by Berlusconi (who cannot vote or run for office) is drawing a plurality. It is enough for the right-flank of the bloc to draw more attention to their extreme ideas, but not enough to secure a majority. Berlusconi has tried to re-invent himself as a moderate and the only political force that can stop the populists of the Five-Star Movement. His partners’ rhetoric may raise other questions. The center-left appears to be slipping into third. |

Economic Events: Eurozone, Week February 12 |

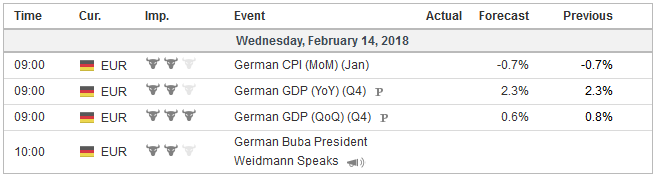

GermanyThe second is Germany. The agreement struck last week between Merkel’s CDU/CSU and the Social Democrats (SPD) needs to be ratified by SPD members in a voting process that begins on February 20. The results will be known around the time as the Italian election in early March. SPD-head Schulz reclusion as a minister in the new government may be just enough to put the odds in favor of acceptance and a rejection could unsettle markets. |

Economic Events: Germany, Week February 12 |

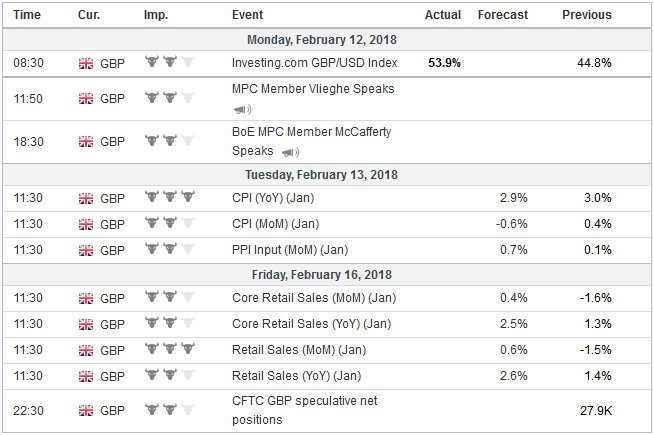

United KingdomBrexit remains a chronic issue and is not going away anytime soon. The hawkishness of the BOE ensured no dissents but was predicated on not Brexit shocks. You could barely say “bangers and mash” three times before the market sold sterling as it pushed above $1.40 and the euro approached the lower end of its five-month range against sterling (~GBP0.8700). Sterling weakened despite the market upgrading the chances of a May hike from a little less than a 50/50 proposition to a nearly 2/3 favorite. Within 24 hours or so of Governor Carney’s press conference, the EU’s chief negotiator Barnier suggested that talks were going so poorly that perhaps a transition period would not be agreed up. Investors had already been informed that an agreement by the March summit was “ambitious.” The EU continues to show a united front and firm positions, while the UK does not quite seem to know what to do, or what it wants. The risk of a policy mistake, even if only knowable in hindsight, appears high. Like the US, the UK will also report January inflation and retail sales figures. The UK’s headline CPI is expected to fall 0.6%, but this is mostly seasonal. The year-over-year rate may have slipped to 2.9% from 3.0%. CPIH, the new preferred measure for statistical purposes, may have actually risen to 2.8% from 2.7%. Retail sales are likely to have improved from the Scrooge-like 1.6% decline in retail sales in December, excluding auto fuel. A modest increase coupled with the base effect (January 2017 retail sales fell 0.5%) will lift the year-over-year pace. Retail sales gradually slowed last year and the average year-over-year pace was about 2%, though in Q4 17 it slowed to 1%. |

Economic Events: United Kingdom, Week February 12 |

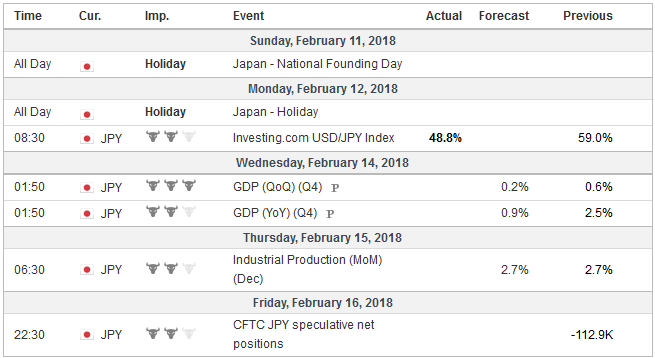

JapanJapan offers its first estimate of Q4 17 GDP. While the expansion continued, it is expected to have slowed from 0.6% in Q3 to 0.2% in Q4. After annualized growth of 2.9% and 2.5% respectively in Q2 and Q3, the pace is forecast to slow to 1.0%, the slowest since Q3 16. While consumption appears to have improved in the quarter, residential and public investment may have softened. Although the core CPI has risen this year, the GDP deflator is expected to be flat. New reports before the weekend claimed that BOJ Govorner Kuroda will be reappointed for a second term. It was understood as a close call, and the tradition is for only one term. However, it is understandable that Prime Minister Abe desires continuity. Indeed, there is a new Chair of the Fed, and PBOC Zhou is thought to be stepping down in the coming months, while Draghi and Carney are due to step down next year. The terms of the two deputy governors of the BOJ end in the middle of next month, a few weeks before Kuroda’s term. The appointment of the deputies will likely underscore the commitment to the current policy thrust. Amamiya, understood as a key architect to the current monetary policy, is rumored to likely be promoted from an Executive Director of the BOJ to Deputy Governor. Honda, the advisor to Abe who is now the ambassador to Switzerland, is thought to be a promising candidate for the other Deputy Governor position. |

Economic Events: Japan, Week February 12 |

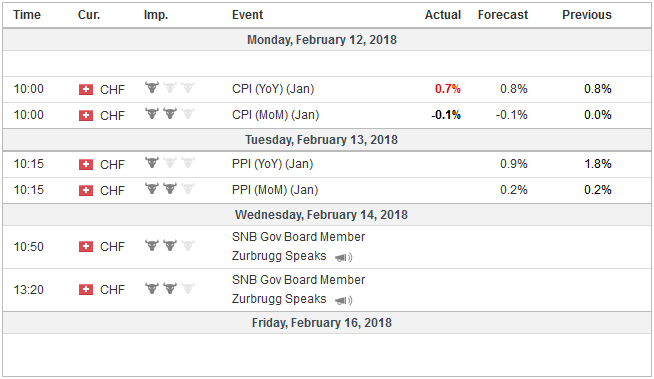

Switzerland |

Economic Events: Switzerland, Week February 12 |

Tags: #USD,$CNY,$EUR,Brexit,Featured,Fiscal,Germany,Italy,Japan,newsletter