The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets. The Dollar Index’s first weekly advance since the middle of last December amid...

Read More »FX Daily, February 02: A Note Ahead of US Jobs Report

Swiss Franc The Euro unchanged at 1.1585 CHF. EUR/CHF and USD/CHF, February 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in...

Read More »FX Daily, February 01: Fed’s Hawkish Hold Keeps Dollar Consolidation Intact

Swiss Franc The Euro has risen by 0.10% to 1.1578 CHF. EUR/CHF and USD/CHF, February 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of...

Read More »FX Daily, January 29: A Brief Word

Swiss Franc The Euro has fallen by 0.33% to 1.1559 CHF. EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest...

Read More »FX Weekly Preview: Market Confusion and New Inputs

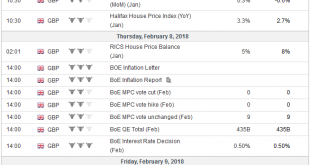

Many investors are confused, and the official communication only fanned the confusion. Before turning to next week’s key events and data, let’s first spend some time, working through some of the confusion. There was no change in policy last week. The US did not suddenly become protectionist. It did put tariffs on solar panels and washing machines. At the end of last week, unexpectedly the US International Trade...

Read More »Initial Thoughts on Draghi

ECB President Draghi was unable to arrest the US dollar’s slide and euro’s surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar’s slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy. The economy is the strongest it has been in more than a decade, but the US is no slouch. The US reports the...

Read More »Did Mnuchin Signal a Policy Shift Today?

Did US Treasury Secretary Mnuchin signal a change in the US dollar policy? Probably not. As Mnuchin and President Trump have done before, a distinction was drawn between short- and longer-term perspectives. In the short-term, a weaker dollar says Mnuchin, is good for US trade and “other opportunities”. In the longer-term, Mnuchin explicitly acknowledged, “the strength of the dollar is a reflection of the strength of the...

Read More »FX Daily, January 26: Trump-Inspired Dollar Short Squeeze Fades Quickly

Swiss Franc The Euro has fallen by 0.33% to 1.1624 CHF. EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It was dramatic. Following the BOJ and ECB’s rather mild rebuke of dollar’s depreciation, US President Trump cautioned that his Treasury Secretary comments were taken out of context, and in ant event, he, the President ultimately favored...

Read More »FX Daily, January 25: And Now, a Word from Draghi

Swiss Franc The Euro has fallen by 0.59% to 1.1656 CHF. EUR/CHF and USD/CHF, January 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events...

Read More »FX Daily, January 23: Dollar Stabilizes Near Recent Lows

Swiss Franc The Euro has fallen by 0.14% to 1.1773 CHF. EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org