Swiss Franc The Euro has fallen by 0.24% to 1.1609 CHF. EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve’s independence. Trump’s comments and tweets...

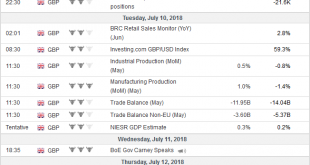

Read More »FX Daily, July 18: Greenback Extends Gains-For Now

Swiss Franc The Euro has fallen by 0.21% to 1.1635 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is at its best level here in July against the Canadian dollar. The CAD1.3265 area corresponds to a 61.8% retracement of the leg down in late June from almost CAD1.3390 to the recent low near CAD1.3065. The Australian dollar has...

Read More »FX Daily, July 13: Trump Trips Sterling, but Greenback Enjoys Broad Gains

Swiss Franc The Euro has risen by 0.01% to 1.1698 CHF. EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling’s 0.6% loss (@ ~$1.3120) is co-leading the downside in the firm US dollar environment, having to share that role with the New Zealand dollar today, where a weaker manufacturing PMI (52.8 from 54.4) is taking a toll. Both sterling and...

Read More »FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

Swiss Franc The Euro has fallen by 0.06% to 1.1639 CHF. EUR/CHF and USD/CHF, July 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new...

Read More »FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

Swiss Franc The Euro has fallen by 0.13% to 1.1632 CHF. EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro was already trading with a heavier bias, having been turned back after approaching the $1.18 level yesterday. The disappointing Geman survey data encouraged some late longs to be cut, driving the euro to the session low near $1.1715,...

Read More »FX Weekly Preview: Macro Considerations for the Capital Markets

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes. The president of the country with the strongest military might and largest...

Read More »FX Daily, July 03: Markets Trying to Stabilize

Swss Franc The Euro has risen by 0.03% to 1.1565 CHF. EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth...

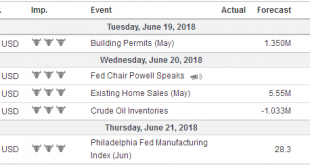

Read More »FX Daily, June 19: America First Clashes With Made in China 2025

Swiss Franc The Euro has fallen by 0.60% to 1.1495 CHF. EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady...

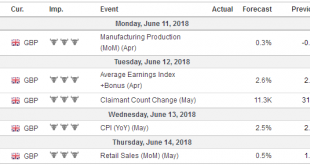

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More »FX Weekly Preview: Busy Week Ahead

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org