Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

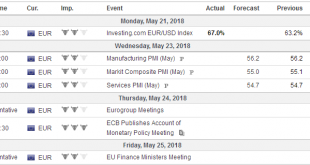

Read More »FX Daily, May 23: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »FX Daily, May 24: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »FX Weekly Preview: Dollar Power

There are several trends in the capital markets at a high-level. The euro and yen’s decline has coincided with sustained rallies in European and Japanese equity benchmarks. Emerging market equities and currencies have been trending lower. There are two other trends that arguably are reinforcing if not causing the other trends. Both oil prices and U0S interest rates have been trending higher. It is unusual but not...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More »FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

Swiss Franc The Euro has risen by 0.02% to 1.1821 CHF. GBP and CHF The Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in...

Read More »FX Daily, May 16: US Yields Soften After Yesterday’s Surge

Swiss Franc The Euro has fallen by 0.40% to 1.1804 CHF. EUR/CHF and USD/CHF, May 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It...

Read More »FX Daily, May 14: US Dollar Slips in Quiet Turnover

Swiss Franc The Euro has fallen by 0.10% to 1.1939 CHF. EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today’s mild losses, Dollar Index is off for a...

Read More »FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro’s losses. The euro...

Read More »Look Past Disappointing Jobs Data, Luke

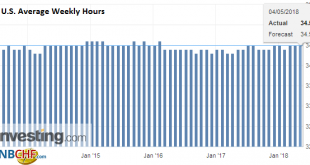

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org