“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies. Discussed in this interview: 01:31 A looming global recession ahead? 06:47 Money printing by central banks at its...

Read More »“We don’t have to behead the king if we can just ignore him” – Claudio Grass

“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies. Discussed in this interview: 01:31 A looming global recession ahead? 06:47 Money printing by central banks at its...

Read More »“Our prosperity is temporary and illusory. “ – Jeff Deist

As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue to...

Read More »“Our prosperity is temporary and illusory. “ – Jeff Deist

As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue...

Read More »Is it platinum’s time to shine?

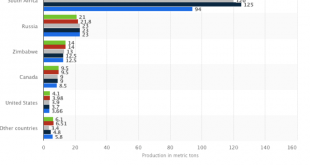

Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy. Although it might not...

Read More »Is it platinum’s time to shine?

Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy. Although it might not share gold’s illustrious...

Read More »Is it platinum’s time to shine?

Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy. Although it might not share gold’s...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

Read More »The Fed’s Capitulation: What It Means For Gold Investors

“Perhaps they think that they will exercise power for the general good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org