It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Swiss Balance of Payments and International Investment Position: Q2 2017

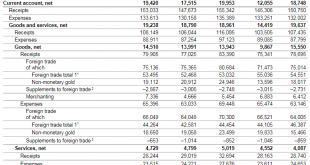

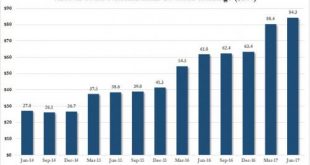

Q2/2017 Change vs. Q2/2016 Changein % Current Account +18.7 bn. +19.4 bn. -3.7% of which Goods Trade net +19.6 bn. +19.2 bn. +2.0% of which Services Trade net +4.1 bn. +4.7 bn. -14.6% of which Investment Income net +7.4 bn. +9.6 bn. -29.7% Financial Account +12.5 bn. +6.0 bn. +52% of which Direct Investments net -63.0 bn. +6.4 bn. -89.8% of which Portfolio Investments net +26.5 bn. -0.5 bn. +98.1% of...

Read More »Is The Swiss National Bank A Fraud?

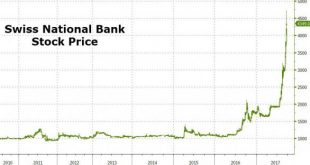

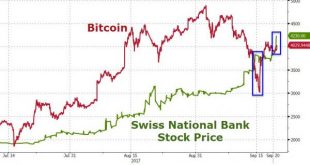

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »Swiss National Bank Bubble Regains Lead Over Bitcoin

A week ago we tweeted… Dear @SNB_BNS_en – you are the next bitcoin: congratulations pic.twitter.com/cld4YNbNLb — zerohedge (@zerohedge) September 14, 2017 But as Bitcoin rebounded from its China challenges, it overtook The SNB once again as bubbliest bubble. However, a 13% spike in the share price of The Swiss National Bank today has put an end to that leaving the central bank back in first place among the...

Read More »Digital-Currency Milestone: Somebody Just Bought A House With Bitcoin

A day after Bridgewater Associates Founder Ray Dalio claimed that bitcoin was “definitely in a bubble” partly because he said the digital currency was too difficult to spend, CoinTelegraph is reporting that the first-ever bitcoin-only real-estate transaction has been completed in Texas. The transaction “illustrates crypto’s potential to transform how financial transactions are conducted,” according to Futurism.com. The...

Read More »SNB Monetary Policy Assessment September 2017 and Comments

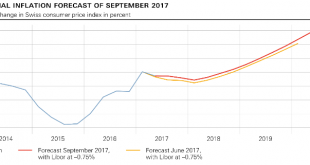

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »Dommage que Monnaie pleine ait omis de prévoir des mesures pour brider les risques que fait porter la BNS sur le contribuable.

Site de l’initiative Monnaie pleine: http://www.initiative-monnaie-pleine.ch/texte-de-linitiative/ Le peuple suisse va voter sur une initiative qui porte le nom de « monnaie pleine ». Cette initiative est partie du constat que les banques émettent de la monnaie scripturale dite monnaie-dette ou monnaie bancaire, et souhaite rendre la BNS seule responsable de la création monétaire, comme c’est d’ailleurs prévue par...

Read More »Les réserves de la BNS au service des investisseurs étrangers

M Cedric Tille, professeur d’Economie (Cédric tille bns) vient de publier une étude fort intéressante qui gagne à être découverte. Elle cartographie la position économique de la Suisse par rapport au reste du monde. Il démontre à quel point la structure qui compose le moteur économique, financier et monétaire de la Suisse dans ses relations avec l’étranger avait changé en dix ans. Grâce à lui, nous voyons que la BNS se...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org