- Click to enlarge Production of new banknote series is safeguarded Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange. At the same time, and at the same 90/10 split, the share capital in Landqart...

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

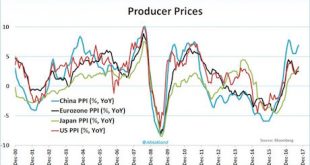

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »Swiss Perfectionism

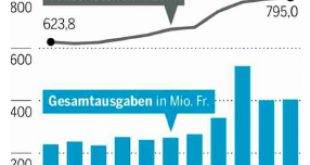

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten. Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken...

Read More »Direct Investments in 2016

Swiss direct investment abroad In 2016, companies domiciled in Switzerland invested CHF 71 billion abroad. Swiss direct investment abroad thus fell short of the CHF 90 billion recorded in 2015, due primarily to lower investment activity by finance and holding companies. All other industry categories combined actually exceeded the level of the previous year with investment abroad of CHF 62 billion (2015: CHF 46...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »News conference Swiss National Bank, Thomas Jordan

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Thomas Jordan - Click to enlarge Introductory remarks by Thomas Jordan Ladies and gentlemen It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will...

Read More »Andréa M. Maechler: Introductory remarks, news conference

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Complete text: PDF (478 KB) I will begin my remarks with a review of the situation on the financial markets, before going on to discuss the progress made in reference interest rate reform. Situation on the financial markets Let me start with developments on the financial markets....

Read More »News conference Swiss National Bank 2017, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Fritz Zurbrugg - Click to enlarge Introductory remarks by Fritz Zurbrügg In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically...

Read More »SNB Monetary policy assessment of 14 December 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org