Climate will be a big debating point for October’s parliamentary elections. (© Keystone / Peter Klaunzer) Analysis of survey questions filled out by Swiss politicians in 2015 and 2019 shows a marked turnaround in attitudes towards the introduction of a carbon tax on fuel. The Smartvote online platformexternal link asks politicians various attitudinal questions in an effort to help voters make up their minds in the lead...

Read More »EU court rejects Swiss union criticism

Criticism of the Court of Justice of the European Union (CJEU) by Swiss unions intensified in 2007 after the Court ruled against workers in the Laval case in Sweden. © Paulgrecaud | Dreamstime.comLatvian workers were being paid less than the minimum wage on a construction site in Sweden. In protest, local workers blockaded the site. However, the CJEU ruled against the blockade on the grounds that it prevented the free movement of services. Swiss unions viewed the ruling as a failure...

Read More »Drug addicts entitled to welfare, rules Switzerland’s highest court

Until recently, Swiss case law placed the responsibility for drug addiction on the drug user. © Tomas Nevesely | Dreamstime.comDrug addicts only qualified for disability welfare if their addiction was connected with an illness or accident. A recent ruling on a case by the Federal Tribunal, Switzerland’s highest court, changes this. The case involved a man in Zurich dependent on opioids and benzodiazepines, a type of drug sometimes used to alleviate the symptoms of alcohol...

Read More »“THE BIGGEST PROBLEM IS THE DEBT PROBLEM” – INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN (PART II)

“Like medieval alchemy that failed to turn lead into gold, today’s easy-money folly of central banks and governments will lead to crisis, not economic growth and prosperity.” – H.S.H. Prince Michael of Liechsteinstein Claudio Grass (CG): Despite its formidable tradition and the “Old-World” heritage that Liechtenstein was founded upon, the tiny principality has been incredibly agile and efficient in embracing and fostering entrepreneurship, innovation and new technologies, the most...

Read More »“THE BIGGEST PROBLEM IS THE DEBT PROBLEM” – INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN (PART I)

“In fact, it is easier for governments to control the spending of people in debt than those with savings. A person with financial resources is free, while debtors are hostage to their creditors.”H.S.H. Prince Michael of Liechtenstein The rare resilience and the economic and strategic prowess of the Principality of Liechtenstein have elevated the small alpine nation to a bright example internationally in terms of prudent governance. It offers countless lessons in long-term planning, in...

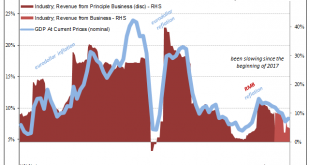

Read More »China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter. Even if that was the case, the Soviet system...

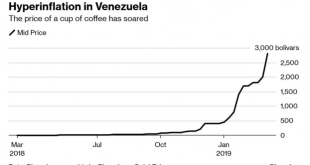

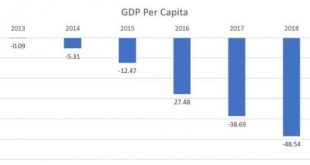

Read More »THE ROAD TO SERFDOM – BY THE EXAMPLE OF VENEZUELA – PART II

“Inflationism, however, is not an isolated phenomenon. It is only one piece in the total framework of politico-economic and socio-philosophical ideas of our time. Just as the sound money policy of gold standard advocates went hand in hand with liberalism, free trade, capitalism and peace, so is inflationism part and parcel of imperialism, militarism, protectionism, statism and socialism.” Ludwig von Mises, On the Manipulation of Money and Credit, p. 48 Claudio Grass (CG): We have all...

Read More »The Road to Serfdom – by the example of Venezuela – Part I

“Venezuela is the current poster child of interventionist failure” When looking at the quality of the media coverage of Venezuela’s crisis and the interpretations of the factors that caused it, the superficiality of most analyses quickly becomes apparent. The explanations offered by many “experts” and commentators largely ignore the country’s history and fail to take into account the pre-existing political and economic dynamics that heavily contributed to, if not predetermined,...

Read More »Switzerland could lose billions in global corporate tax reform push

Novartis only generated 2% of its revenue in Switzerland but paid 39% of its tax bill there. Switzerland stands to lose up to CHF10 billion ($10.2 billion) as a consequence of attempts by other countries to change how multinationals are taxed. Countries belonging to the G20 and OECDexternal link are pushing for changes in corporate taxation rules to capture a larger share of taxes of multinationals based in tax-friendly...

Read More »Retirement age to rise for women in Switzerland

© motortion | Dreamstime.com The Swiss government has been looking at measures to shore up the finances of Switzerland’s pension system for some time. The difference between the official retirement age for women (64) and men (65) is an obvious target. Recently, the Federal Council, Switzerland’s executive, said it would include increasing the retirement age of women from 64 to 65 in a package of reforms aimed at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org