Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth...

Read More »House View, November 2017

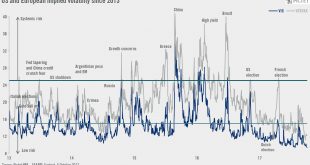

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain constructive on equities, which are being underpinned in particular by robust earnings growth.However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.US tax cuts could...

Read More »House View, October 2017

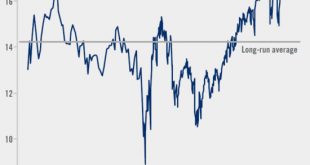

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains...

Read More »House View, September 2017

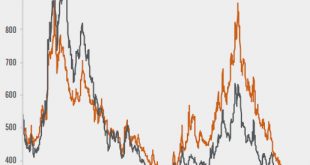

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationThere are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.Low correlations...

Read More »Monthly Investment Strategy Highlights, August 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved...

Read More »Monthly Investment Strategy Highlights, July 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the...

Read More »Monthly Investment Strategy Highlights, June 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationMarkets have continued to rally on strong fundamentals. It has been important to stay invested, and we continue to favour DM equities. However, markets appear unduly complacent, and we have taken advantage of current low volatility to scale back our risk exposure.We reduced our equity overweight in June by selling part of our Global Defensives equities, and also cut most of our US high yield position. We...

Read More »Monthly Investment Strategy Highlights, May 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset AllocationMarkets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.We expect core...

Read More »Monthly Investment Strategy Highlights, April 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset allocationThe first quarter was exceptionally strong for risk assets, and the outlook remains good for developed market (DM) equities.We remain comfortable with our overweight in developed market equities, but it would be wise not to take too much risk in the coming quarter.EM assets may offer attractive opportunities on a tactical basis.CurrenciesThe US dollar probably has only limited further upside, absent a...

Read More »Monthly Investment Strategy Highlights, March 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain comfortable with our overweight position in developed-market (DM) equities and believe there are good reasons to be positive on Japanese equities,With volatility low and risks looming in the short term, this is a good time to add protection to portfolios. We have bought derivative protection on EUR high yield bonds and a call option on gold.Expecting yields on core sovereign bonds to rise further...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org