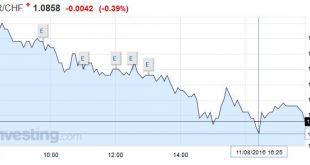

Swiss Franc Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. Click to enlarge. FX Rates The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone. After closing the North American session...

Read More »No Big Thoughts, but Several Smaller Observations

Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »Oil and Economy Pull the Canadian Dollar Lower

Summary: The decline in oil prices is a factor weighing on the Canadian dollar. US premium over Canada is rising, and may continue as the economies diverge. The general risk appetite is supportive for the Canadian dollar. Our informal and simple model for the Canadian dollar has three variables. Oil, interest rates, and general risk environment. Over time, the coefficient of the variables can and do change....

Read More »Great Graphic: OIl Breaks Down Further

Summary: With today’s losses the Sept contract has retraced 50% of this year’s rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row. Oil Future Today’s 2.5% fall in the September light sweet crude oil futures contract extends the decline that began on June 9. It is the third consecutive loss and the fifth loss in the past six...

Read More »Oil: The Great Rebalancing

On June 8, the price of Brent crude ticked above $50 a barrel for the first time since August 2015. But the new $50-plus era came to an end two days later, amid a broader selloff that affected multiple asset classes. Energy analysts with Credit Suisse’s Global Markets team point out, however, that both supply (which is shrinking) and demand (which is growing steadily) point to firming oil prices ahead. Indeed, the bank’s analysts think that after two years of oversupply, the crude oil market...

Read More »FX Daily, June 15: Key Data and FOMC

Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today,...

Read More »Great Graphic: Oil Flirts with Four-Month Uptrend

Oil prices reached their highest level in eleven months in the middle of last week. The front-month futures contract did not post a key reversal on June 9, but the continuation contract did. Since reaching almost $51.70 then, prices have pushed lower, with lower highs and lower lows. As this Great Graphic created on Bloomberg shows, a trendline drawn off the mid-February cyclical low, and hitting the early and...

Read More »Can OPEC Surprise?

OPEC ministers meet in Vienna tomorrow. Expectations could hardly be lower. Attempts to agree on an output freeze were stymied by the Saudi’s insistence that is rival Iran participates as well. Iran cannot agree to limit its production yet, or it would have sacrificed (or postponed) it nuclear program for nought. Many observers have announced the death of OPEC. The Saudi’s refusal in 2014 to continue to act as the swing producer, coupled with the rise of non-OPEC production,...

Read More »FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political considerations made it unlikely that Saudi Arabia would be willing to sacrifice market share to its rival Iran. We also understood why Iran could not accept a freeze on...

Read More »Oil prices should rise gradually

Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017. On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%. In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org