If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

Read More »US Trade Skews

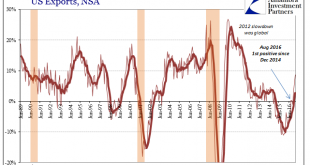

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it. Exports in the latter half of 2015 and for that first month of 2016 were contracting at double digit rates, the base effects of the...

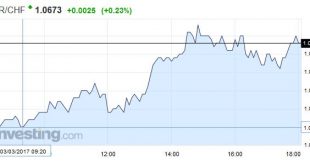

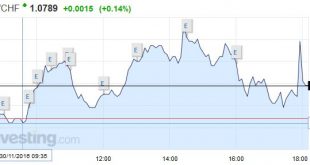

Read More »FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

Swiss Franc EUR/CHF - Euro Swiss Franc March 03(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF Prime Minister Theresa May is still committed to triggering Article 50 before the end of the month in spite of what happened this week with the House of Lords’ decision to challenge the Brexit bill. The House of Lords are primarily concerned with keeping the rights of EU citizens living...

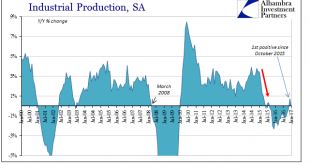

Read More »No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry. After suffering through a more than...

Read More »Why Aren’t Oil Prices $50 Ahead?

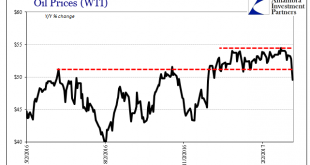

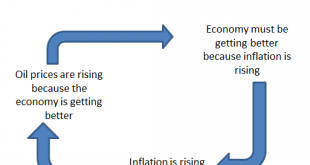

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

Read More »Saudis Cut More than Commitment, Lifts Prices

Summary: US refinery demand for oil is near a 30-year high. Demand growth will help catch up to supply. Saudi Arabia (and Kuwait) appear to have cut more output than promised. - Click to enlarge Oil prices rallied yesterday following the EIA weekly data and are up further today. Despite the rise in US inventories (4.1 mln barrels) more than four times greater than expected, participants focused on other details. ...

Read More »FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

Swiss Franc EURCHF - Euro Swiss Franc December 21(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge The pound has tailed off from its recent high against the Swiss Franc over the last couple of weeks with rates for GBP CHF sitting at 1.27 for this pair. The pound seems to have climbed as far as it can against most of the major currencies with the current economic and political factors at...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More »Short Summary on US Thanksgiving

Summary: Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey’s central bank surprised with a 50 bp hike in the repo rate. While US markets were closed for the celebration of Thanksgiving, the underlying trends remained intact. Here is a summary of several developments. The euro edged to a new low, a little below...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org