Swiss Franc After touching 1.08, which apparently the “new floor”, the SNB moved the EUR/CHF upwards yesterday and Monday. Today’s EUR recovery against USD, let also the EUR/CHF rise. EUR/CHF - Euro Swiss Franc, October 26(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar’s upside momentum reversed in North America yesterday and has been sold in Asia and Europe. This seems like mostly...

Read More »Is Oil about to Rollover?

Summary: Oil has rallied 20% since mid-September. Market may be getting ahead of itself. US rig count has risen by more than 100 in less than 4-months and inventories, seasonally adjusted are at record highs. The price of oil has risen more than 20% over the past month. It is being driven by ideas that OPEC (and Russia) may implement a freeze or an output cut at the end of next month. At the same time, US...

Read More »Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

With the strong ISM non-manufacturing PMI last week, long positions on the dollar are increasing, while speculators increase their euro and Swiss Franc shorts. CHF net shorts increased to 9.4 K positions. That the euro has depreciated against CHF, is possibly caused by real, non-speculative money into CHF, i.e. money in the form of cash and stock purchases. We will get more information tomorrow when the SNB sight...

Read More »FX Weekly Preview: The Week Ahead: It’s Not about the Data

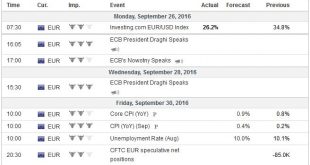

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead. The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations. A November rate Fed move was never very likely. The September employment report needed to be amazingly strong to boost the chances, and it was...

Read More »Canadian Dollar: A Little Less About Oil, a Little More about Rates

Summary: The Canadian dollar’s link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly. Of the majors, only sterling was weaker than the Canadian dollar in Q3. Sterling’s drop was a function of its decision to leave the EU and ease monetary policy. The Canadian dollar fell 1.6% compared with sterling’s 2.6% fall. The other dollar-bloc currencies...

Read More »FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

Swiss Franc The EUR/CHF has fallen to 1.0862, the downwards tendency since one day before the SNB monetary assessment meeting has continued. Click to enlarge. FX Rates The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen’s weakness. While the majors are mostly off marginally and now...

Read More »FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s...

Read More »FX Weekly Preview: Capital Markets in the Week Ahead

Summary: Global bonds and global stocks ended last week on a weak note and this will likely carry into this week’s activity. The Bank of England meets, but the data may be more important. Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week. The week ahead will likely be shaped by a combination of...

Read More »A Rig-Driven Rally for Oilfield Services

Does the recent stabilization in oil prices portend better times ahead for energy companies? Investors in oilfield services companies (OFS), which provide equipment and support to exploration and production companies, certainly think so, as evidenced by the fact that the stocks of several such companies up by double-digit percentages this year. Can the rally continue? Equity strategists from Credit Suisse’s Global Markets team think so. Why? The answer lies in a single number:...

Read More »Weekly Speculative Positions: Switch to Small Net Long CHF

Speculative position adjustments in the currency futures continued at a low pace in the Commitment of Traders report for the week ending August 9. There were though two distinct patterns: Speculators reduced their exposure in EUR, CHF and peso. Speculator increased their exposure in JPY, GBP, CAD and NZD. Euro, Swiss Franc, Peso: Lower Exposures The first pattern is found in the euro, Swiss franc,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org