I was on Bloomberg’s Day Break with the team and guest Anne Lester from JP Morgan discussing oil and inflation. Oil prices had bounced back at the end of last week and were lifted further on news that Saudi Arabia and Russia were inclined to support extending output cuts not just until the end of the year, but through Q1 18. I make two points. First, that US yields seem to be largely decoupled from the oil prices. This...

Read More »FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

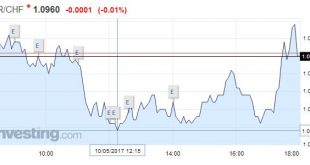

Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar...

Read More »Bi-Weekly Economic Review

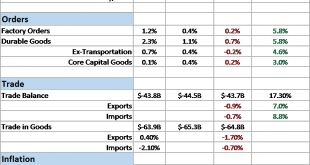

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched. I said during that entire time that while the problems in the energy...

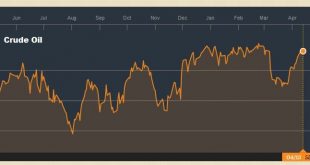

Read More »Great Graphic: Gas and Oil

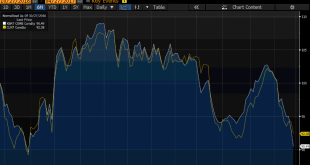

Summary: Steep falls in gasoline and oil prices. Large build in gasoline inventories and record refinery work shifted some surplus from oil to the products. OPEC is expected to roll over its output cuts, but non-OPEC may find it difficult and US output continues to rise. This Great Graphic, made on Bloomberg, shows the past six months of oil and gas prices. The white line is the June gasoline futures and the...

Read More »FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

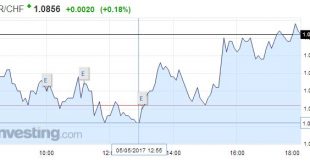

Swiss Franc EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky...

Read More »Decoupling of Oil and US Interest Rates

Summary: US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top. Rising oil prices traditionally boost inflation expectations and US interest rates. The May futures contract for light sweet crude oil is up today for the sixth consecutive...

Read More »FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

Swiss Franc EUR/CHF - Euro Swiss Franc, April 11(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc could be in for a particularly volatile with the recent developments in Syria and now North Korea. Both the Swiss Franc and US dollar generally perform very well in times of global economic and political uncertainty as their status as safe haven currencies becomes apparent once again. The...

Read More »Economics Through The Economics of Oil

The last time oil inventory grew at anywhere close to this pace was during each of the last two selloffs, the first in late 2014/early 2015 and the second following about a year after. Those events were relatively easy to explain in terms of both price and fundamentals, though the mainstream managed to screw it up anyway (“supply glut”). By and large, the massive contango of the futures curve that showed up as a result...

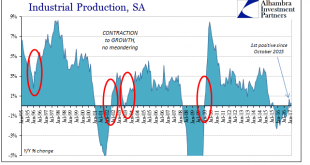

Read More »Industrial Symmetry

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking...

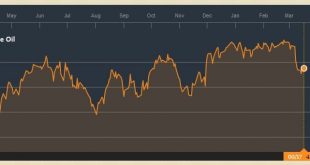

Read More »Oil Supply Remains Resilient, Prices Heavy

Summary: Nearly half of OPEC’s intended cuts are being offset by an increase in US output. The contango rewards the accumulation of inventories. The drop in oil prices probably weighs more on European reflation story than the US. Oil prices are lower for the seventh consecutive session. Light sweet crude prices had fallen 10.3% over the past two weeks, and with today’s losses are off another 1.6% already...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org