In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More »FX Daily, August 09: North Korea lets EUR/CHF Collapse

Swiss Franc The euro has depreciated by 1.16% to 1.1316CHF. EUR/CHF and USD/CHF, August 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is decidedly mixed. The Swiss franc, not the yen is the strongest of the major currencies. It is up nearly 1.1%. If sustained, it could be the biggest single day dollar loss against the franc this year, edging out more than...

Read More »FX Daily, August 01: The Most the Dollar Can Hope for on Turn Around Tuesday is Consolidation

Swiss Franc The Euro has fallen by 0.41% to 1.14 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific...

Read More »Progress in St. Petersburg

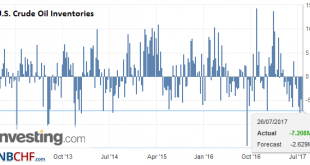

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further. Ecuador announced it would no longer participate in the output restraint. Hopes that...

Read More »FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

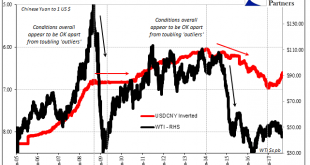

Read More »Oil Update

Summary: OPEC meets on July 24. Nigeria and Libya may be pressured to cap output although they were exempt from quotas. US exports and refining appear to be the driving force behind the 13.8 mln barrel decline in inventories. Mexico has reportedly made two large oil finds. It may not be on your economic calendar, but on July 24 OPEC meets in St. Petersburg, and there is a reasonably good chance that efforts to...

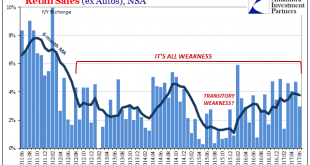

Read More »Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not...

Read More »Wholesale: No Acceleration, No Liquidation

In the same way as durable goods orders and US imports, wholesale sales in May 2017 were up somewhat unadjusted but down for the third straight month according the seasonally-adjusted series. As with those other two, the difference is one of timing. In other words, combining the two sets, seasonal and not, we are left to interpret a possible recent slowing in activity. There are gains year-over-year to be sure, but it...

Read More »FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

Swiss Franc The euro has depreciated by 0.24% to 1.0868 CHF. EUR/CHF - Euro Swiss Franc, June 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord...

Read More »Great Graphic: OIl and the S&P 500

The first Great Graphic (created on Bloomberg) here shows the rolling 60-day correlation of the level of the S&P and the level of oil since the beginning of last year. In early 2016, the correlation was almost perfect, but steadily fell and spend a good part of the second half of the year negatively correlated. Late in the year, the correlation began recovering, and February reached almost 0.8. However, a month...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org