The launch of futures on Bitcoins was rushed so quickly through the regulatory channels that the anticipation was short-lived. And as the recent price action amply demonstrates, the existence of a derivative market has not tamed the digital token’s volatility. It is still the early days, but Bitcoin futures do not look likely to change the world. On the other hand, any day now China is expected to launch a futures...

Read More »The Economy Likes Its IP Less Lumpy

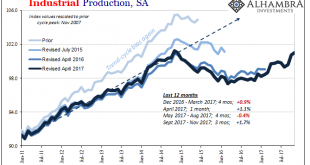

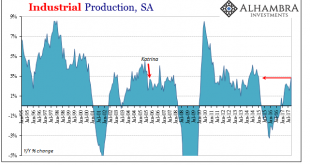

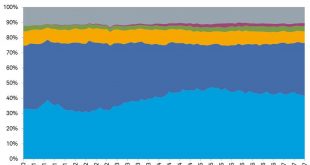

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months. Combining April 2017 with October, IP advanced by 2.2% leaving the other 10 to...

Read More »FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

Swiss Franc The Euro has fallen by 0.15% to 1.1651 CHF. EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden’s inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining...

Read More »Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. US Industrial Production, Jan 1995 - Nov 2017(see more posts on U.S. Industrial Production, ) - Click to enlarge That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will...

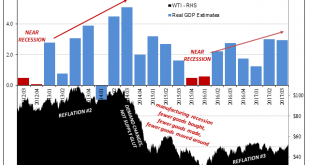

Read More »Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

Read More »FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

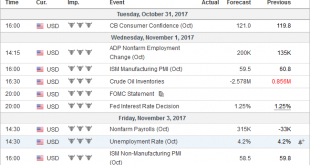

Summary Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain. The week ahead will be among the busiest in Q4. In this note, we provide a brief sketch of the different events and data points that will shape the investment climate. Given the importance of initial conditions, we will begin with an overview of the...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

Read More »FX Daily, October 05: Sterling and Aussie Weakness Featured in the Otherwise Becalmed FX Market

Swiss Franc The Euro has fallen by 0.03% to 1.1461 CHF. EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly little changed as the broad consolidation that has emerged this week continues. The two powerful forces that have emerged–expectation of a Fed hike at the end of the year and European political challenges–appear to...

Read More »FX Daily, September 26: Weekend Election and North Korea Rhetoric Helps Greenback Remain Firm

Swiss Franc The Euro has fallen by 0.01% to 1.1446 CHF. EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most major currencies today. The implications the Jamaica coalition in Germany is understood to be less likely to support a new vision for Europe in the aftermath of Brexit and the Great Financial Crisis....

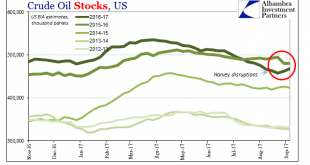

Read More »Harvey’s Muted (Price) Impact On Oil

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices. According to the US Department of Energy, as of August 31, 10 refineries had been shut down with a combined capacity of 3.01...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org