Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

Swiss Franc The Euro is down by 0.63% to 1.1545 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Italian stocks are flat, while most European bourses are higher, with the Dow Jones Stoxx 600 up 0.5% in late morning turnover in Europe. The benchmark is lead by real estate,...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More »Oil: Supply and Demand Drivers

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more...

Read More »FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

Swiss Franc The Euro has risen by 0.18% to 1.186 CHF. EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and...

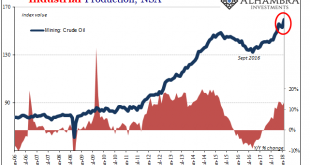

Read More »US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots. US Industrial Production, Jan 2006 - 2018(see more posts on U.S. Industrial...

Read More »FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the...

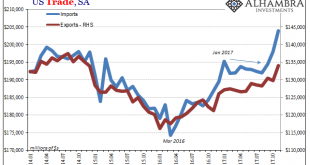

Read More »The Conspicuous Rush To Import

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007. US Trade Balance, Jan 2014 - 2018(see more posts on U.S. Trade Balance, ) - Click to...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org