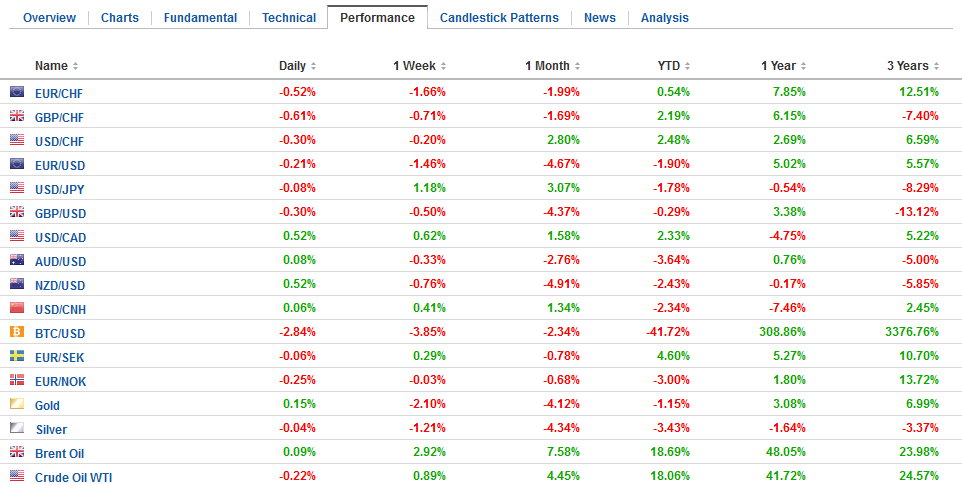

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press conference on April 26, Draghi refused to normalize monetary policy. Hence also old news and nothing that could explain the recent euro weakness. Swiss GDP growth will probably surprise to the upside. According to SECO, GDP could rise between 2 and 2.4% this year. With new sanctions against Iran, oil

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Canada, Canada consumer price index, Canada Retail Sales, EUR, EUR/CHF, Featured, Italy, Japan National Consumer Price Index, Japan National Core Consumer Price Index, JPY, newsletter, Oil, SPY, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are:

During months the SNB did not have to intervene. But in the last two weeks the central bank bought FX for 1.1 bln. CHF (see the Page on Sight Deposits). |

EUR/CHF and USD/CHF, May 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

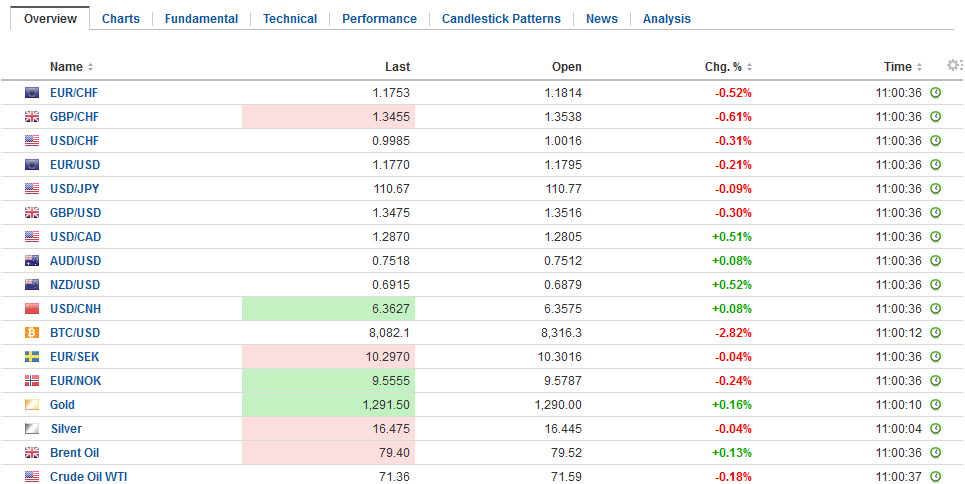

FX RatesThe US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765. It has been unable to distance itself much from the low. It has straddled the $1.18 level, where there is a 1.9 bln euro option expiring today. With this week in tow, the euro has fallen in 10 of the past 13 weeks. With the help of a softer CPI report, the yen’s declining streak is being extended. The greenback briefly traded above JPY111.00 for the first time since January 23. The dollar is higher against the yen for the fifth consecutive session, and eighth consecutive week. |

FX Daily Rates, May 18 |

| Rising Japanese equities seems like one of the strongest trends in the equity markets. The Nikkei closed higher for the eighth consecutive week and 10th week in the past 11. Over this period, it has risen by about 8.25%.

The Dow Jones Stoxx 600 is off by about 0.25%, but this is not enough to turn the week negative. This European benchmark is still up about 0.5% on the week. Provided the session’s losses do not accelerate after the session open, it will be the eighth consecutive weekly advance; during which time it has risen by almost 7.9%. Another trend has been US yields. The US 10-year yield has risen for the past five sessions, coming into today. It has risen for 11 of the past 14 sessions and five of the past seven weeks. The 10-year yield finished last week near 2.97%. It reached almost 3.12% earlier today, before pulling back a little. It is straddling the 3.10% area now. |

FX Performance, May 18 |

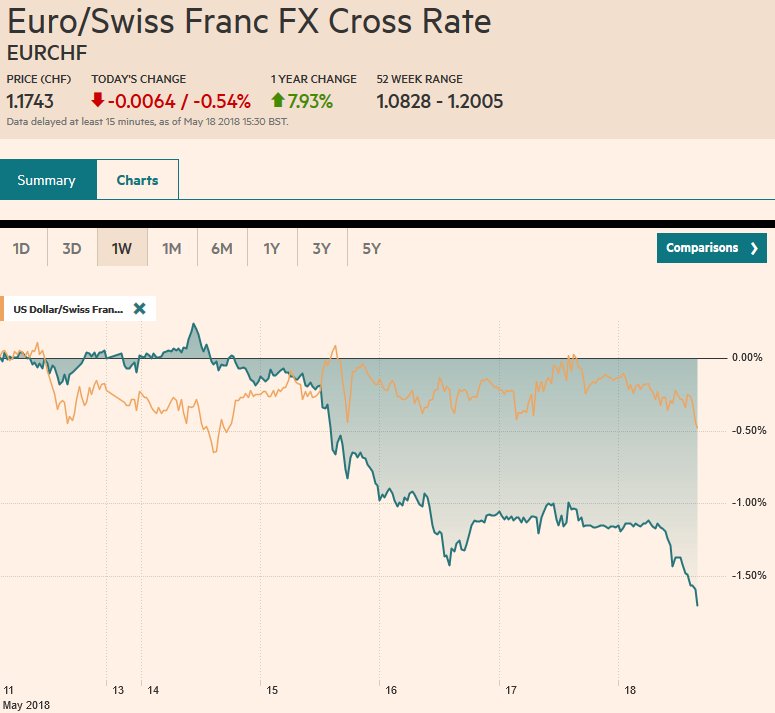

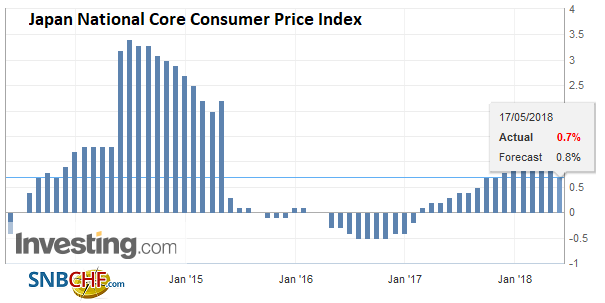

JapanThere are four main macro talking points today, two in Asia and two in Europe. In Asia, Japan’s disappointing CPI report follows the poor (contracting) Q1 GDP report earlier this week. This combination can only serve to keep the BOJ cautious about even contemplating an exit from its extraordinary monetary policy. Headline CPI slowed to 0.6% in April from 1.1% in March. It is the first back-to-back decline in Japanese CPI since March-April 2016. Energy and mobile phone services were the main culprits. The pace is the slowest since last November. |

Japan National Consumer Price Index (CPI) YoY, May 2013 - 2018(see more posts on Japan National CPI, ) Source: Investing.com - Click to enlarge |

| The core rate, which excludes fresh food, and is the measure the BOJ targets, slipped to 0.7% from 0.9%, and incidentally matches EMU core rate, though it is measured quite differently. |

Japan National Core Consumer Price Index (CPI) YoY, May 2013 -2018(see more posts on Japan National Core CPI, ) Source: Investing.com - Click to enlarge |

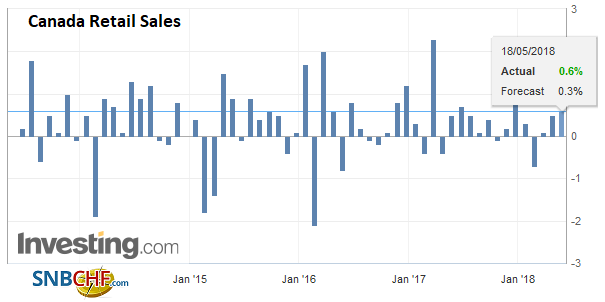

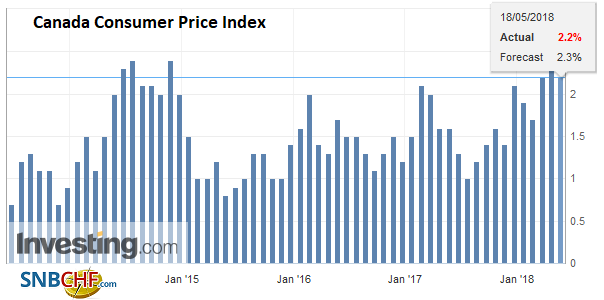

CanadaThe highlight of the North American session today comes from the retail sales and CPI reports from Canada. Retail sales are expected to rise 0.3% in April after a 0.4% rise in March. However, the composition has changed. March was sales were driven by autos. Excluding autos, Canadian retail sales were flat in March. In April, retail sales are expected to have risen by 0.5% excluding auto sales. Meanwhile, inflation is expected to be steady. |

Canada Retail Sales, May 2013 - 2018(see more posts on Canada Retail Sales, ) Source: Investing.com - Click to enlarge |

| A 0.3% rise in April’s CPI will keep the year-over-year rate at 2.3%. The underlying measures are also expected to be flat. |

Canada Consumer Price Index (CPI) YoY, Jun 2013 - May 2018(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Oil has also been streaking. Light sweet crude for June delivery is edging higher for the fifth consecutive session. Despite the steady advance, the gains have been modest and with today’s small gain, the rise on the week is less than a dollar. Still, it is the fifth weekly gain in six weeks.

The other Asian talking point is the conflicting press reports about US-China trade talks. Yesterday, President Trump seemed to downplay the likelihood of successful talks because China was “spoiled” (as is Europe). A newswire reported earlier today that China was offering to meet the US demand to reduce the bilateral trade deficit by $200 bln by boosting imports. This seemed incredulous to us; first, because it is a huge concession seemingly without getting anything in return, and second it is not immediately evident that the US has the equivalent of 1% of GDP to ship to China. In any event, China’s state media and at least one official has now denied the report.

In Europe, the Five Star Movement and the (Northern) League have reportedly finalized their agreement, though the prime minister candidate has not been announced. The M5S will hold an electronic referendum of its members today, according to reports. Investors do not like what they have seen and heard this week. After being fairly calm in the aftermath of the early March election, the combination of populist and nativist forces, coupled with what appears to be an expensive program for one of the most indebted countries is spooking investors.

The yield on Italy’s 10-year benchmark bond is up six basis points today and 19 for the week. It stands at 2.17% now. The premium over Germany has risen by almost 27 bp this week. Italian equities are off 1.1% today, which brings the loss on the week to 2.6%. Many media reports have been quite negative Italy, and not without reason.

However, it is hardly mentioned in most of these write-ups that Italy has a stable current account surplus of around 2.7% of GDP, and its budget deficit has been among the smallest in Europe and was projected to fall to 1.8% of GDP this year. Nor do most of the accounts that discuss the bad loan problem among Italian banks identify 1) the provisions already made, 2) the residual value and 3) the progress being made in selling and divesting of the bad loans. Many of Italy’s problems stem from poor growth and give the Stability and Growth Pact mandate of capping fiscal deficits at 3% of GDP, there is scope for some stimulus.

A combination of tax cuts and spending increases that the M5S and the League are proposing is at the worst about 1% of GDP. This coupled with challenging the EU’s stance on refugees, which places the burden on the front-line countries, giving the wealthier Northern Europeans a freer-ride is not an unreasonable program. The refugee problem in Italy is a source of both economic and political stress and has facilitated the rise of both populist and nativist forces.

The other development in Europe is the resistance what EU President Tusk called the “capricious assertiveness” by the US. The US decision to pull out of the Iran accord has escalated the already elevated tensions with Europe. The EU is considering a blocking statute, which would, in essence, make it illegal for European companies to adhere to the US sanctions on Iran.

This is a powerful card to play and one that prompted the Clinton Administration to back down in the mid-1990s (over sanctions on Cuba, Libya, and Iran). Separately, the EU has announced that it will retaliate against the US steel and aluminum tariffs by putting a 25% tariff on 2.8 bln euros ($3.3 bln) of US exports to Europe, effective June 20.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,$JPY,$TLT,Canada,Canada Consumer Price Index,Canada Retail Sales,EUR/CHF,Featured,Italy,Japan National Consumer Price Index,Japan National Core Consumer Price Index,newsletter,OIL,SPY,USD/CHF