As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting...

Read More »Oil market: supply disruption is here

The risk that similar attacks to the ones seen this weekend in Saudi Arabia could disrupt oil supplies, but it does not fundamentally change our medium-term scenario. We still forecast USD50 per barrel for Brent in 2020.After this weekend’s drone attack on the world’s most important crude oil facility, the Saudi Arabian authorities have announced that 5.7 million barrels per day (mbd), half of its daily oil production and 5% of the world total, will be taken off-line. Iran-aligned Houthi...

Read More »The Path Clear For More Rate Cuts, If You Like That Sort of Thing

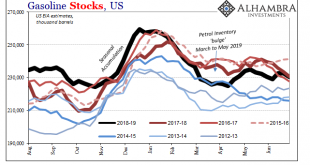

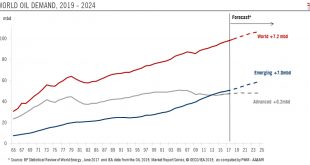

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months. That wasn’t all, as the EIA’s report focused in on some more sobering aspects...

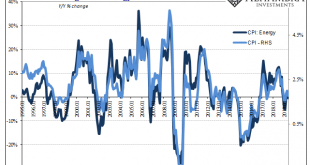

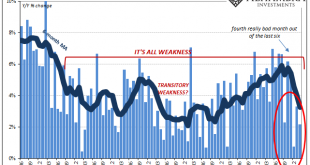

Read More »When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

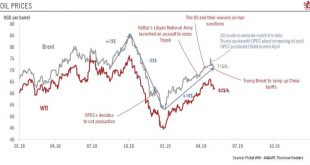

Read More »Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts. The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession. Business sentiment has been...

Read More »Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.Business sentiment has been deteriorating for some time. By May, the world Purchasing Manager Index for...

Read More »Oil prices decline despite the end of Iran waivers

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could...

Read More »Green Shoot or Domestic Stall?

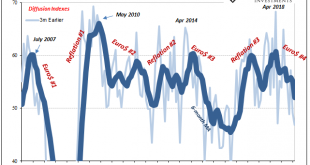

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

Read More »Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics. After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018. The recent release of the International...

Read More »Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org