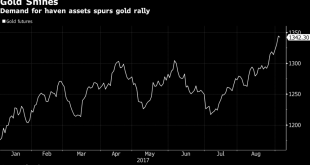

– Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response– Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’– North Korea prepares for possible ICBM launch says S. Korea– U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

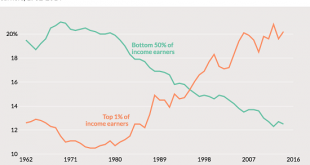

Read More »The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don’t keep pace with...

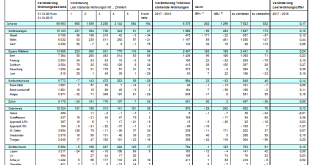

Read More »Swiss Real Estate: The Empty Dwellings Rate Continues to Increase

The Swiss Real Estate Bubble and Rents The number of empty dwellings is an important indicator for the Swiss real estate bubble. Prices of Swiss real estate had risen by 5%-8% per year between 2009 and 2014, while rents for existing contracts are regulated and have not followed this path yet. Landlords can only introduce higher prices levels for new buildings or new contracts. The reader should bear in mind that the...

Read More »“Things Have Been Going Up For Too Long” – Goldman CEO

– “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch– Bubbles are everywhere including London property– $14 trillion of monetary stimulus has pushed investors to take more risks– We are now in a new era of bigger booms and bigger busts – BAML– “Seeing signs of bubbles in more and...

Read More »Chiasso accepts tax payments in bitcoin

Chiasso is establishing itself as a rival to Zug's Crypto Valley for fintech start-ups (Keystone) - Click to enlarge Switzerland ramped up its bid to become a global hub for financial technology (fintech) and cryptocurrency start-ups with the decision by a town on the Italian border to accept tax payments in bitcoin. Chiasso announced that it would take bitcoin to settle up to CHF250 ($265) of tax bills from the...

Read More »FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

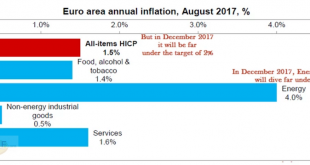

EUR/CHF The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach. Strangely the EUR/CHF reacted with losses only on Friday. Where will Euro...

Read More »Switzerland’s home ownership illusion

© Tomasz Markowski | Dreamstime - Click to enlarge When 10-year mortgage interest rates fall to 1%, home ownership becomes a very attractive alternative to renting. A recent report on home ownership shows why home ownership remains out of reach of the average Swiss household despite very low interest rates. The report, by Credit Suisse, says that despite the strong desire for people to own their own home, fewer and...

Read More »FX Weekly Review, August 28 – September 02: The end of big euro rise?

EUR/CHF Let us remember why the euro has risen from 1.08 to 1.14 between June and August: Hopes that the French president Macron will help the French economy, similarly to the Trump reflation trade. Hopes that the ECB will finish their bond buying program earlier combined with quite good economic data. We are of the opinion that both points may be illusionary. The euro should not rise further. Politicians cannot...

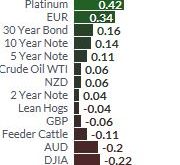

Read More »FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

Swiss Franc The Euro has risen by 0.04% to 1.1418 CHF. EUR/CHF and USD/CHF, September 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback’s gains yesterday. Manufacturing PMIs from China, EMU,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org