Swiss Franc The Euro has fallen by 0.09% to 1.1427 CHF. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea’s missile over Japan subsided. The US response was seen as measured and tempered. North Korea...

Read More »Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index...

Read More »Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding. Many investors were looking for policy clues, but these were not forthcoming. The December Fed funds futures contract was unchanged,...

Read More »FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

Swiss Franc The Euro has fallen by 0.57% to 1.1374 CHF. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend’s test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea...

Read More »Structural Business Statistics 2015: Employment grows again thanks to the tertiary sector

Neuchâtel, 24.08.2017 (FSO) – There were 597,000 enterprises in Switzerland in 2015, i.e. an increase of 3578 entities (+0.6%) in one year. The number of jobs, measured in full-time equivalents, also saw similar growth (+0.5%). These changes were mainly due to the dynamism of very small and very large units in the tertiary sector, according to the latest findings of the structural business statistics (STATENT) from the...

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

- Click to enlarge By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent – which often, not always, go hand in hand together – where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren’t for the fact it’s so damn far from the beach I could actually live here. It’s really quite lovely....

Read More »Power company Alpiq decides not to sell Swiss hydro assets

Alpiq’s hydropower portfolio includes the Grand Dixence, the tallest gravity dam in the world (Keystone) Swiss energy concern Alpiq has changed its mind about selling up to 49% of its hydropower portfolio due to a tough market environment. In March 2016, Alpiq declared that it was planning to sell a large share of its hydropower assets to investors, provoking strong reactions in the power sector and media. Hydropower is...

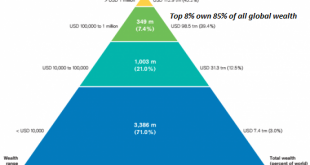

Read More »The 5 Steps to World Domination

You don’t need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income. World Domination–it has a nice ring, doesn’t it? Here’s how to achieve it in 5 steps: 1. Turn everything into a commodity that can be traded on the global market:land, leases on land, options to purchase land, houses, buildings, rooms in slums, labor, tools, robots,...

Read More »Que reste-t-il de la BNS? Liliane Held-Khawam

Nous alertons sur ce blog depuis des années sur le fait que la BNS, qui a récupéré grâce à la « réforme » de 2003 une levée des restrictions sur sa politique monétaire, mène une stratégie complaisante vis-à-vis du marché financier, et plus précisément américain. Nous avons osé affirmé que la BNS utilisait nos fonds de trafic de paiement pour gonfler de manière totalement illégitime (mais légalisée de fait) son bilan....

Read More »FX Daily, August 24: Greenback Firmer in Becalmed Markets

Swiss Franc The Euro has fallen by 0.24% to 1.1366 CHF. EUR/CHF and USD/CHF, August 24(see more posts on #USD, $CHF, EUR/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump’s threat...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org