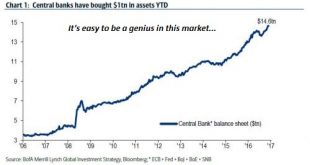

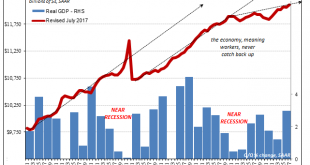

Yes, this time it’s different: all the foundations of a healthy economy are crumbling into quicksand. The rallying cry of Permanent Bulls is this time it’s different. That’s absolutely true, but it isn’t bullish–it’s terrifically, terribly bearish. Why is this time it’s different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy “fixes” have...

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More »Bitcoin: Tragedy of the Speculations

A tragedy… get the hankies out! ? [PT] The Instability Problem Bitcoin is often promoted as the antidote to the madness of fiat irredeemable currencies. It is also promoted as their replacement. Bitcoin is promoted not only as money, but the future money, and our monetary future. In fact, it is not. Why not? To answer, let us start with a look at the incentives offered by bitcoin. We saw a comment this week, which is...

Read More »FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

(The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue) Swiss Franc The Euro has fallen by 0.14% to 1.147 CHF. EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling’s losses...

Read More »Fewer planes carry more passengers

Some 52 million passengers took off, landed or transited via Swiss airports last year. But while the number of passengers continues to soar, there are fewer planes in operation than in 2000. There are now fewer planes in circulation, but they have much bigger capacities, like this Airbus A380 taking off from Zurich Airport (Keystone) - Click to enlarge In 2016, Switzerland’s national airports in Zurich, Geneva...

Read More »Buy Gold for Long Term as “Fiat Money Is Doomed”

– Buy gold for long term as fiat money is doomed warns Frisby– Gold’s “winning streak” will continue in long term– September is traditionally a good month for gold, as we head into the Indian wedding season– “It’s just a matter of time before gold comes good again…”by Dominic Frisby, Money Week Today folks, by popular demand, we’re talking gold. It’s had a nice summer run. What now? Gold Daily, Jul 2010 - Oct 2017(see...

Read More »US Export/Import: ‘Something’ Is Still Out There

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013. In May and June of...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe) Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in...

Read More »Red Cross launches new bond to tap private money

The ICRC is the world's largest provider of physical rehabilitation services in developing countries. (Keystone) - Click to enlarge The Swiss-run International Committee of the Red Cross (ICRC) has launched the world’s first ‘Humanitarian Impact Bond’, which encourages private sector investment in humanitarian programmes. The innovative “payment-by-results” model centres on a five-year private placement programme...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org